Slowing Rates Of Return At Daimler Truck Holding (ETR:DTG) Leave Little Room For Excitement

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Having said that, from a first glance at Daimler Truck Holding (ETR:DTG) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

What Is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. Analysts use this formula to calculate it for Daimler Truck Holding:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

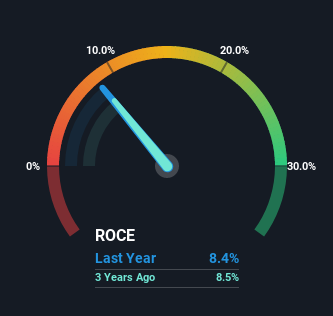

0.084 = €3.6b ÷ (€64b - €21b) (Based on the trailing twelve months to December 2022).

So, Daimler Truck Holding has an ROCE of 8.4%. In absolute terms, that's a low return but it's around the Machinery industry average of 9.8%.

Check out our latest analysis for Daimler Truck Holding

In the above chart we have measured Daimler Truck Holding's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Daimler Truck Holding here for free.

What Can We Tell From Daimler Truck Holding's ROCE Trend?

In terms of Daimler Truck Holding's historical ROCE trend, it doesn't exactly demand attention. The company has employed 46% more capital in the last four years, and the returns on that capital have remained stable at 8.4%. This poor ROCE doesn't inspire confidence right now, and with the increase in capital employed, it's evident that the business isn't deploying the funds into high return investments.

The Key Takeaway

As we've seen above, Daimler Truck Holding's returns on capital haven't increased but it is reinvesting in the business. Since the stock has gained an impressive 27% over the last year, investors must think there's better things to come. Ultimately, if the underlying trends persist, we wouldn't hold our breath on it being a multi-bagger going forward.

One more thing: We've identified 2 warning signs with Daimler Truck Holding (at least 1 which is a bit unpleasant) , and understanding them would certainly be useful.

While Daimler Truck Holding isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:DTG

Daimler Truck Holding

Manufactures and sells light, medium- and heavy-duty trucks and buses in Europe, North America, Asia, Latin America, and internationally.

Very undervalued with adequate balance sheet.