We Think That There Are More Issues For DEUTZ (ETR:DEZ) Than Just Sluggish Earnings

Despite DEUTZ Aktiengesellschaft's (ETR:DEZ) recent earnings report having lackluster headline numbers, the market responded positively. We think that shareholders might be missing some concerning factors that our analysis found.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, DEUTZ issued 10.0% more new shares over the last year. Therefore, each share now receives a smaller portion of profit. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. Check out DEUTZ's historical EPS growth by clicking on this link.

A Look At The Impact Of DEUTZ's Dilution On Its Earnings Per Share (EPS)

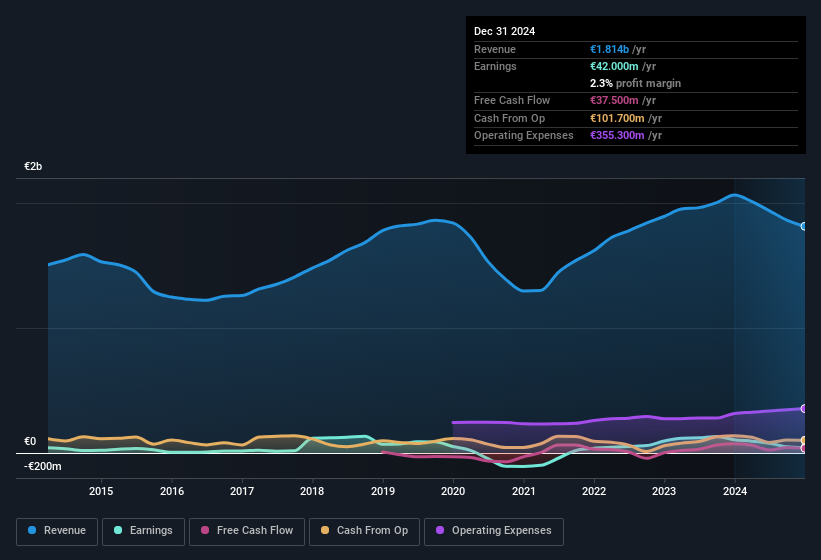

As you can see above, DEUTZ has been growing its net income over the last few years, with an annualized gain of 9.9% over three years. Net income was down 61% over the last twelve months. Unfortunately for shareholders, though, the earnings per share result was even worse, declining 63%. Therefore, the dilution is having a noteworthy influence on shareholder returns.

If DEUTZ's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On DEUTZ's Profit Performance

Over the last year DEUTZ issued new shares and so, there's a noteworthy divergence between EPS and net income growth. Therefore, it seems possible to us that DEUTZ's true underlying earnings power is actually less than its statutory profit. In further bad news, its earnings per share decreased in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. At Simply Wall St, we found 3 warning signs for DEUTZ and we think they deserve your attention.

This note has only looked at a single factor that sheds light on the nature of DEUTZ's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:DEZ

DEUTZ

Develops, manufactures, and sells diesel and gas engines in Germany, Rest of Europe, the Middle East, Africa, the Asia Pacific, and the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives