It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Traton (ETR:8TRA). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Traton

Traton's Improving Profits

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. Which is why EPS growth is looked upon so favourably. It's an outstanding feat for Traton to have grown EPS from €0.90 to €4.85 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Traton is growing revenues, and EBIT margins improved by 7.1 percentage points to 9.3%, over the last year. Both of which are great metrics to check off for potential growth.

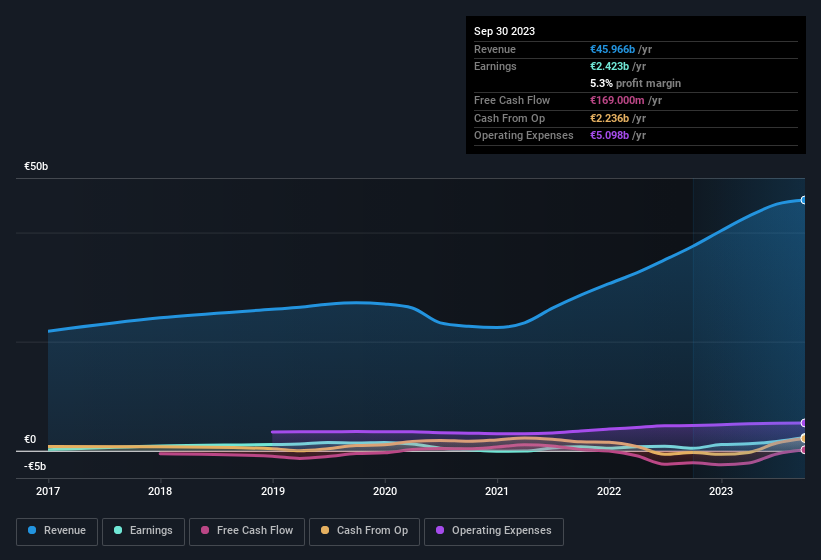

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Traton's forecast profits?

Are Traton Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. Our analysis has discovered that the median total compensation for the CEOs of companies like Traton, with market caps over €7.4b, is about €4.2m.

The CEO of Traton only received €1.9m in total compensation for the year ending December 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Traton Deserve A Spot On Your Watchlist?

Traton's earnings have taken off in quite an impressive fashion. This appreciable increase in earnings could be a sign of an upward trajectory for the company. Meanwhile, the very reasonable CEO pay is a great reassurance, since it points to an absence of wasteful spending habits. So faced with these facts, it seems that researching this stock a little more may lead you to discover an investment opportunity that meets your quality standards. You should always think about risks though. Case in point, we've spotted 2 warning signs for Traton you should be aware of, and 1 of them is potentially serious.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in DE with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Traton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:8TRA

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives