- Switzerland

- /

- Software

- /

- SWX:TEMN

3 Stocks Estimated To Be Trading At Discounts Of Up To 43.4%

Reviewed by Simply Wall St

As global markets navigate a landscape of fluctuating interest rates and economic data, investors are keenly observing the performance of major indices, with the Nasdaq Composite recently reaching a record high amidst mixed results across other U.S. indexes. In this environment, identifying undervalued stocks can be particularly appealing as they may offer potential opportunities for growth when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥26.21 | CN¥52.08 | 49.7% |

| UMB Financial (NasdaqGS:UMBF) | US$122.18 | US$244.23 | 50% |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.9% |

| GlobalData (AIM:DATA) | £1.88 | £3.73 | 49.6% |

| Equity Bancshares (NYSE:EQBK) | US$46.49 | US$92.69 | 49.8% |

| Wetteri Oyj (HLSE:WETTERI) | €0.298 | €0.59 | 49.7% |

| Ingenia Communities Group (ASX:INA) | A$4.60 | A$9.14 | 49.7% |

| Equifax (NYSE:EFX) | US$265.81 | US$530.33 | 49.9% |

| QD Laser (TSE:6613) | ¥297.00 | ¥591.10 | 49.8% |

| Cellnex Telecom (BME:CLNX) | €32.32 | €64.59 | 50% |

Let's review some notable picks from our screened stocks.

Temenos (SWX:TEMN)

Overview: Temenos AG develops, markets, and sells integrated banking software systems to financial institutions globally, with a market cap of CHF4.83 billion.

Operations: Temenos generates its revenue from integrated banking software systems provided to financial institutions around the world.

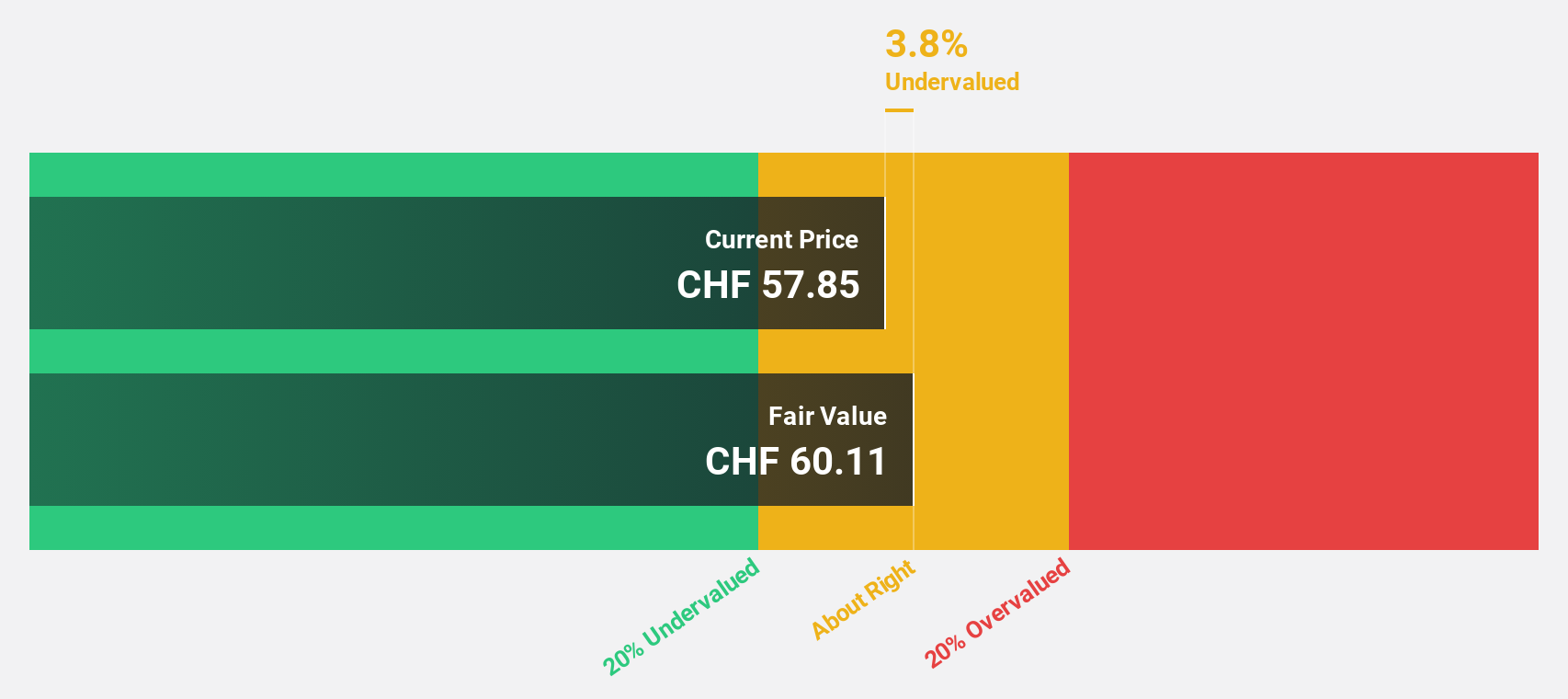

Estimated Discount To Fair Value: 38.6%

Temenos is trading at CHF66.25, significantly below its estimated fair value of CHF107.84, highlighting its potential undervaluation based on cash flows. Recent earnings show growth with revenue reaching US$246.92 million and net income rising to US$30.85 million for Q3 2024. The company is enhancing digital offerings with strategic partnerships and AI integration, although it carries a high debt level which investors should consider when evaluating financial health and future growth prospects.

- Our growth report here indicates Temenos may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Temenos stock in this financial health report.

Avant Group (TSE:3836)

Overview: Avant Group Corporation, with a market cap of ¥77.02 billion, operates through its subsidiaries to offer accounting, business intelligence, and outsourcing services.

Operations: The company's revenue is derived from three primary segments: Group Governance Business with ¥7.88 billion, Management Solutions Business generating ¥8.96 billion, and Digital Transformation Promotion Business contributing ¥9.16 billion.

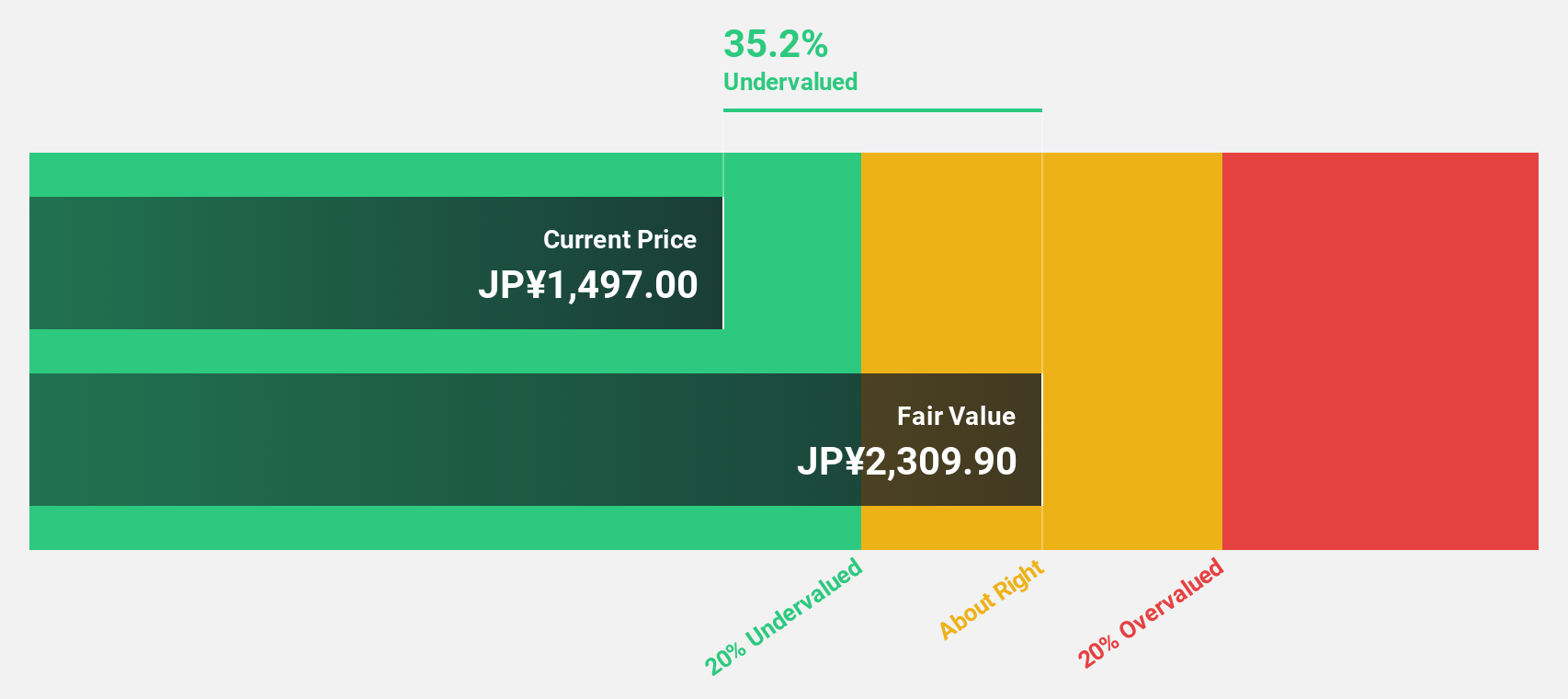

Estimated Discount To Fair Value: 43.4%

Avant Group is trading at ¥2115, significantly below its estimated fair value of ¥3736.92, indicating potential undervaluation based on cash flows. The company has demonstrated robust earnings growth of 35.2% over the past year and forecasts suggest continued strong performance with annual profit growth expected to outpace the JP market. However, recent share price volatility may concern some investors despite a completed share buyback program totaling ¥828.93 million for 1.67% of shares outstanding.

- In light of our recent growth report, it seems possible that Avant Group's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Avant Group.

Hensoldt (XTRA:5UH)

Overview: HENSOLDT AG, along with its subsidiaries, offers defense and security electronic sensor solutions globally and has a market capitalization of €4.08 billion.

Operations: The company's revenue segments consist of Sensors (€1.80 billion) and Optronics (€303 million).

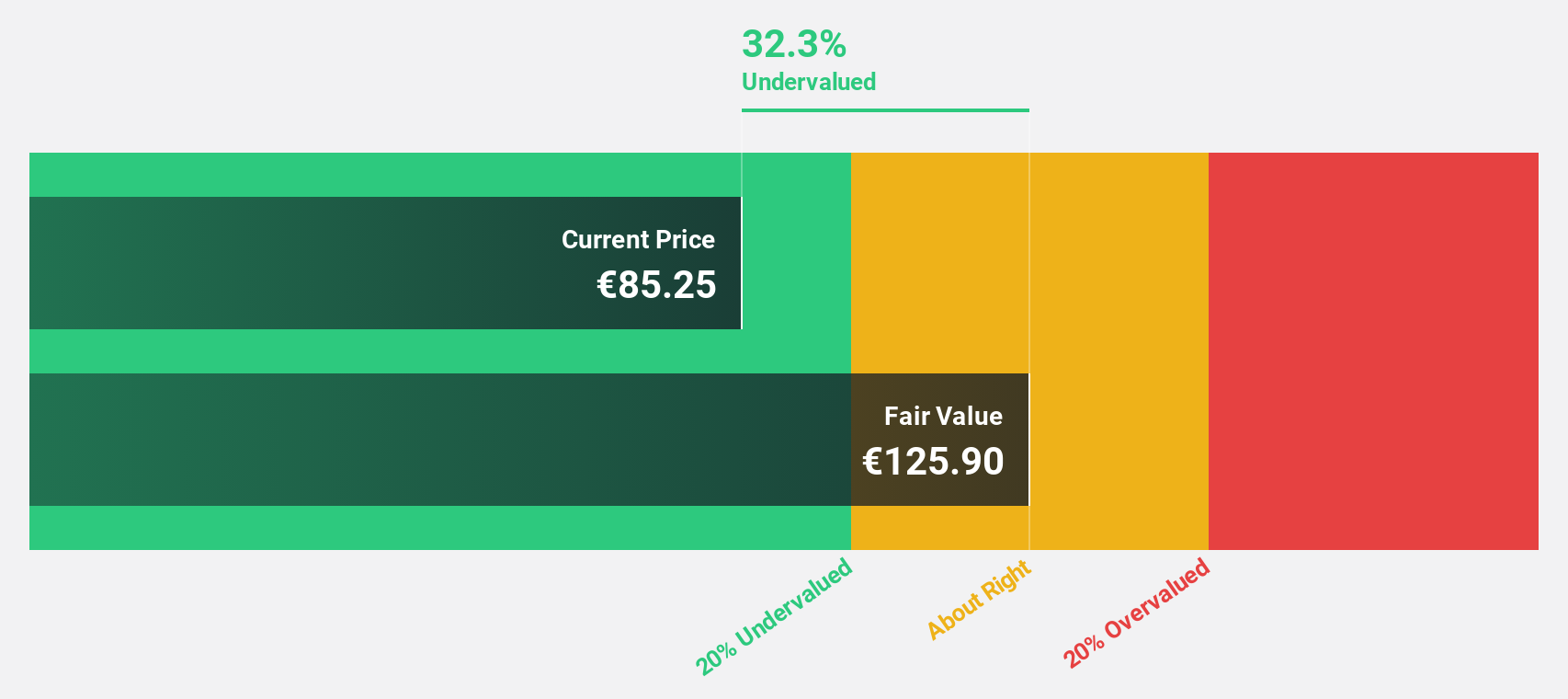

Estimated Discount To Fair Value: 20.9%

Hensoldt is trading at €35.3, over 20% below its estimated fair value of €44.63, highlighting potential undervaluation based on cash flows. Despite reporting a net loss of €46 million for the first nine months of 2024, earnings are forecast to grow significantly by 63.1% annually over the next three years, outpacing the German market's growth rate. The PEGASUS project milestone further underscores Hensoldt's strategic advancements in defense technology integration.

- Our comprehensive growth report raises the possibility that Hensoldt is poised for substantial financial growth.

- Take a closer look at Hensoldt's balance sheet health here in our report.

Make It Happen

- Access the full spectrum of 909 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Temenos might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TEMN

Temenos

Develops, markets, and sells integrated banking software systems to banking and other financial services institutions.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives