The German market has shown resilience, with the DAX gaining 1.35% recently, despite mixed earnings reports in technology and luxury goods sectors. This positive sentiment provides a fertile ground for investors to explore lesser-known opportunities within the country's small-cap segment. In this article, we will uncover three undiscovered gems in Germany that exhibit strong potential. A good stock in today's market often combines solid fundamentals with growth prospects that are not yet fully recognized by the broader investment community.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.44% | -1.40% | -8.94% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| Eisen- und Hüttenwerke | NA | -14.56% | 7.71% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Südwestdeutsche Salzwerke | 0.66% | 4.03% | 11.36% | ★★★★★☆ |

| HOMAG Group | NA | -27.42% | 22.33% | ★★★★★☆ |

| BAVARIA Industries Group | 3.19% | 0.18% | 28.18% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Baader Bank | 45.72% | 12.72% | -6.93% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Energiekontor (XTRA:EKT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Energiekontor AG is a project developer involved in the planning, construction, and operation of wind and solar parks in Germany, Portugal, and the United States with a market cap of €917.33 million.

Operations: Energiekontor AG generates revenue primarily from Project Development and Sales (€157.77 million) and Power Generation in Group-Owned Wind and Solar Parks (€79.06 million). The company also earns a smaller portion from Operation Development, Innovation, and Others (€7.86 million).

Energiekontor, a small cap in Germany's renewable energy sector, has shown impressive growth with earnings increasing by 87.1% over the past year and outperforming the Electrical industry’s 13.9%. The company trades at a favorable P/E ratio of 11x compared to the German market’s 17.8x. Despite its high net debt to equity ratio of 72.9%, EKT's interest payments are well covered by EBIT (6.1x). Additionally, EKT has reduced its debt to equity from 325.1% to 167.2% over five years and remains free cash flow positive.

- Delve into the full analysis health report here for a deeper understanding of Energiekontor.

Explore historical data to track Energiekontor's performance over time in our Past section.

Mensch und Maschine Software (XTRA:MUM)

Simply Wall St Value Rating: ★★★★★★

Overview: Mensch und Maschine Software SE offers CAD/CAM/CAE, product data management, and building information modeling/management solutions in Germany and internationally, with a market cap of €1.02 billion.

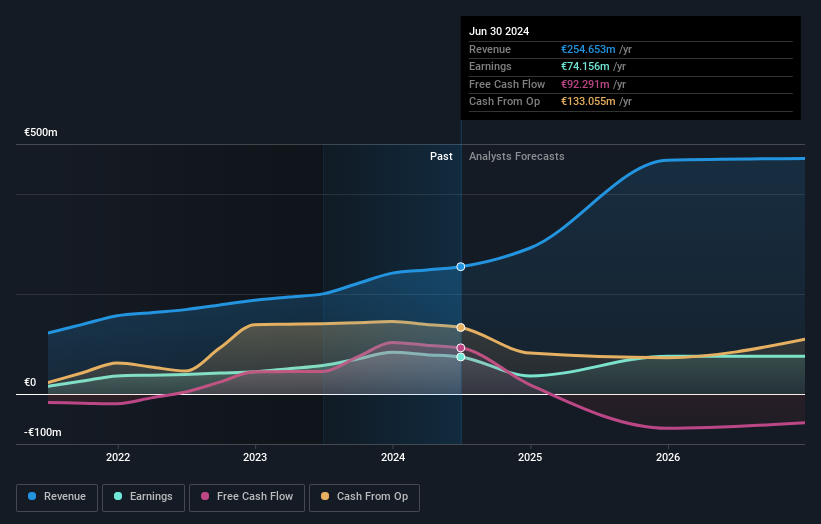

Operations: Mensch und Maschine Software SE generates revenue primarily from two segments: M+M Software (€107.71 million) and M+M Digitization (€216.19 million). The company has a market cap of €1.02 billion.

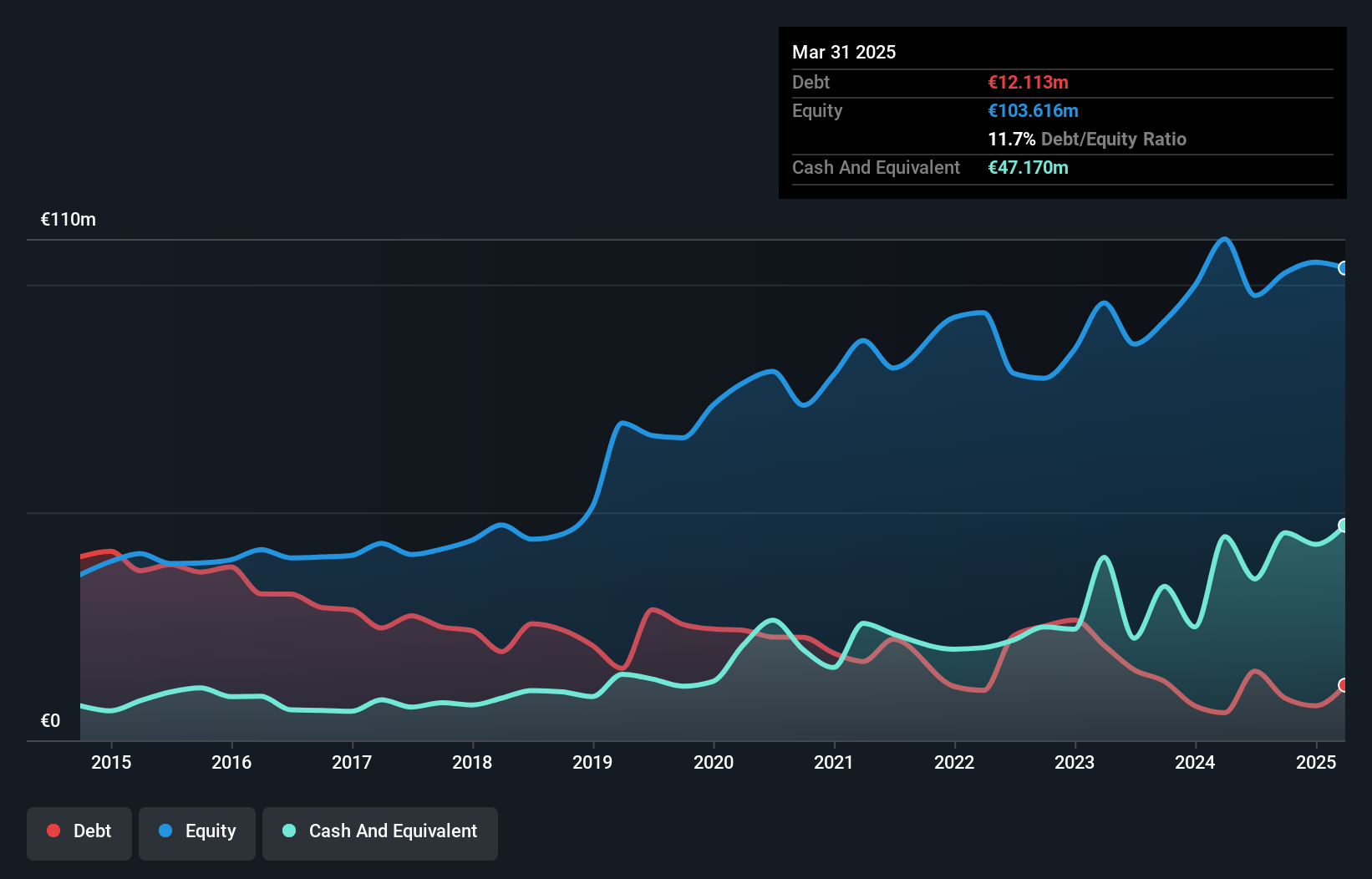

Mensch und Maschine Software (MuM) reported Q2 2024 sales of €75.1 million, up from €71.32 million last year, with net income at €7.34 million compared to €6.58 million previously. Over the past year, earnings grew by 7.6%, outpacing the software industry's -16.2%. Trading at 29% below estimated fair value and reducing its debt-to-equity ratio from 42.8% to 15.5% over five years, MuM's financial health appears robust with high-quality earnings and strong interest coverage (247x EBIT).

- Click here to discover the nuances of Mensch und Maschine Software with our detailed analytical health report.

Gain insights into Mensch und Maschine Software's past trends and performance with our Past report.

ProCredit Holding (XTRA:PCZ)

Simply Wall St Value Rating: ★★★★★☆

Overview: ProCredit Holding AG, with a market cap of €501.82 million, offers commercial banking services to small and medium enterprises and private customers across Europe, South America, and Germany through its subsidiaries.

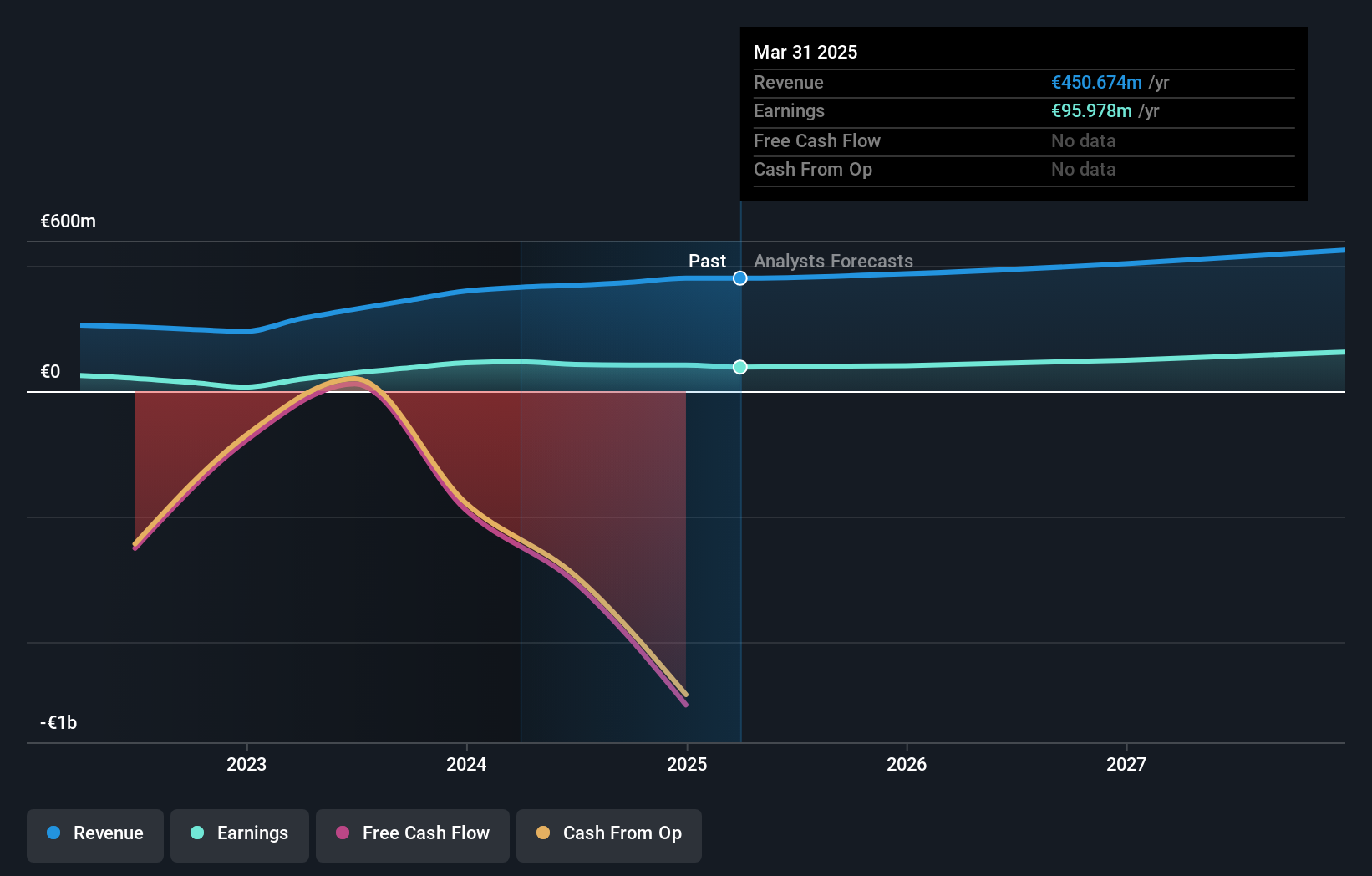

Operations: ProCredit Holding AG generated €414.42 million in revenue from its banking services segment. The company focuses on commercial banking for SMEs and private customers across multiple regions.

ProCredit Holding, with total assets of €10B and equity of €1B, demonstrates robust financial health. It has total deposits amounting to €7.5B and loans at €6.7B, earning a net interest margin of 3.6%. The company maintains a sufficient allowance for bad loans at 2.4% of total loans and enjoys primarily low-risk funding sources comprising 83% customer deposits. Notably, ProCredit's earnings surged by 146.4% in the past year, significantly outpacing the industry growth rate of 20.5%.

Make It Happen

- Click this link to deep-dive into the 41 companies within our German Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MUM

Mensch und Maschine Software

Provides computer aided design, manufacturing, and engineering (CAD/CAM/CAE), product data management, and building information modeling/management solutions in Germany and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives