How Volkswagen’s (XTRA:VOW3) Expanded AI Partnership Could Shape Its Long-Term Competitive Edge

Reviewed by Simply Wall St

- On August 25, 2025, Cerence Inc. announced an expanded collaboration with the Volkswagen Group to launch an upgraded IDA in-car assistant across multiple Volkswagen brands, delivering more natural, multi-turn conversational AI features powered by Cerence Chat Pro.

- This rollout signifies Volkswagen's commitment to integrating advanced digital assistants into its vehicles, aiming to improve user experience and maintain its position as a leader in intelligent mobility solutions worldwide.

- We'll examine how the introduction of enhanced conversational AI technology may influence Volkswagen's long-term investment narrative and competitive positioning.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Volkswagen Investment Narrative Recap

Volkswagen’s investment appeal centers on its ability to balance rapid digital and electrification transformation with disciplined cost management and global scale. The latest upgraded digital assistant partnership with Cerence highlights the company’s focus on in-car experience, but does not materially shift the near-term catalyst: operational execution on battery electric vehicles in key markets, nor does it reduce the largest immediate risk, which is intensifying competition and margin dilution from BEV ramp-up, especially in China and Europe.

The most relevant recent announcement is Volkswagen’s expanded partnership with Rivian, which is directly tied to accelerating advanced EV technology rollout and managing development costs. While the Cerence collaboration shows progress in digital services, investor attention will likely remain on execution of capital allocation and efficiency as the group faces persistently lower net margins due to heavy BEV investment and market pressures.

However, despite innovation in digitalization, persistent margin erosion from BEV growth means investors should be aware of ...

Read the full narrative on Volkswagen (it's free!)

Volkswagen's narrative projects €352.0 billion in revenue and €15.8 billion in earnings by 2028. This requires 2.8% yearly revenue growth and a €7.4 billion earnings increase from current earnings of €8.4 billion.

Uncover how Volkswagen's forecasts yield a €113.55 fair value, a 14% upside to its current price.

Exploring Other Perspectives

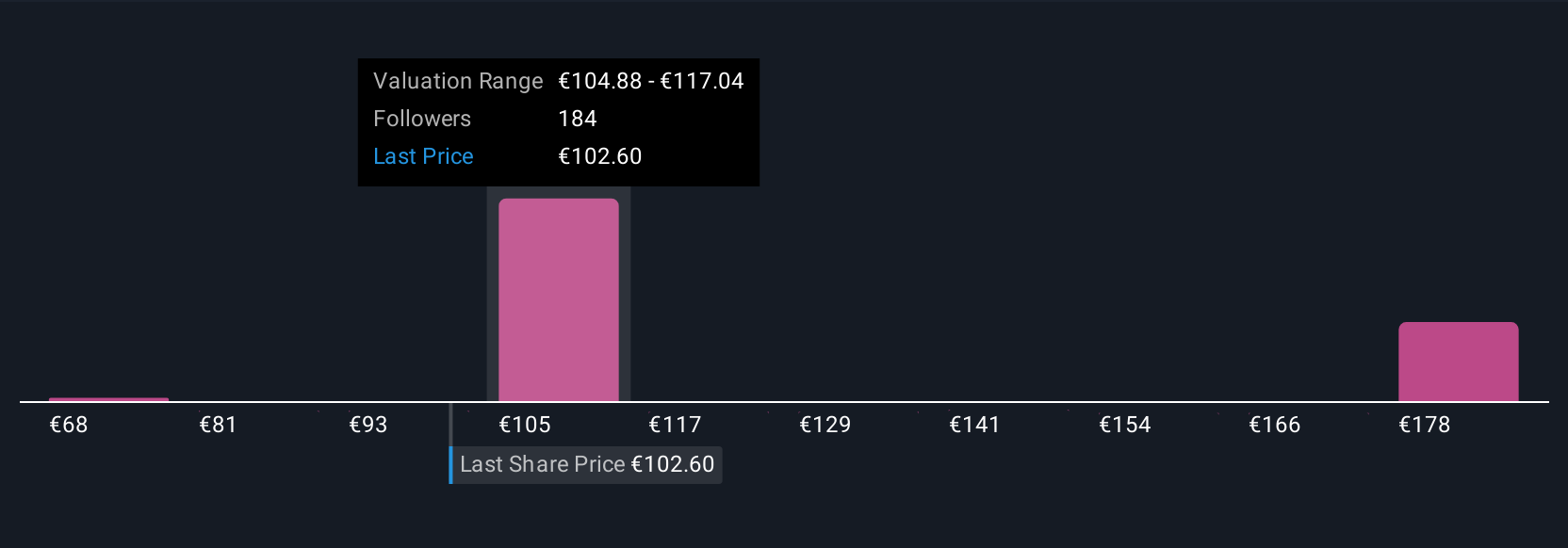

Fair value targets from 11 Simply Wall St Community members range from €68.40 to €190.01, a spread that spans Volkswagen’s current price by a wide margin. Some see the potential in electrified vehicle expansion but you should always examine how fast-growing BEV volumes might strain profitability and limit capital returns over time, other viewpoints may surprise you.

Explore 11 other fair value estimates on Volkswagen - why the stock might be worth as much as 90% more than the current price!

Build Your Own Volkswagen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Volkswagen research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Volkswagen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Volkswagen's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VOW3

Volkswagen

Manufactures and sells automobiles in Germany, other European countries, North America, South America, the Asia-Pacific, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives