German Stocks Estimated To Be Trading Below Fair Value In October 2024

Reviewed by Simply Wall St

As geopolitical tensions in the Middle East escalate, European markets have shown caution, with Germany's DAX index experiencing a notable decline. Amidst these uncertainties and potential shifts in monetary policy by the European Central Bank, investors are increasingly interested in identifying stocks that may be trading below their intrinsic value. In such a market environment, finding undervalued stocks involves assessing companies with solid fundamentals and growth potential that have not been fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| technotrans (XTRA:TTR1) | €17.45 | €31.16 | 44% |

| init innovation in traffic systems (XTRA:IXX) | €35.40 | €52.23 | 32.2% |

| Formycon (XTRA:FYB) | €52.30 | €81.72 | 36% |

| Gerresheimer (XTRA:GXI) | €77.85 | €111.81 | 30.4% |

| SAP (XTRA:SAP) | €205.00 | €275.82 | 25.7% |

| Schweizer Electronic (XTRA:SCE) | €3.78 | €7.19 | 47.5% |

| MTU Aero Engines (XTRA:MTX) | €285.20 | €567.64 | 49.8% |

| LPKF Laser & Electronics (XTRA:LPK) | €8.93 | €12.45 | 28.3% |

| Basler (XTRA:BSL) | €9.33 | €14.01 | 33.4% |

| EQS Group (DB:EQS) | €39.40 | €51.69 | 23.8% |

We'll examine a selection from our screener results.

init innovation in traffic systems (XTRA:IXX)

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally and has a market cap of €349.62 million.

Operations: The company's revenue segment is primarily derived from Wireless Communications Equipment, amounting to €235.67 million.

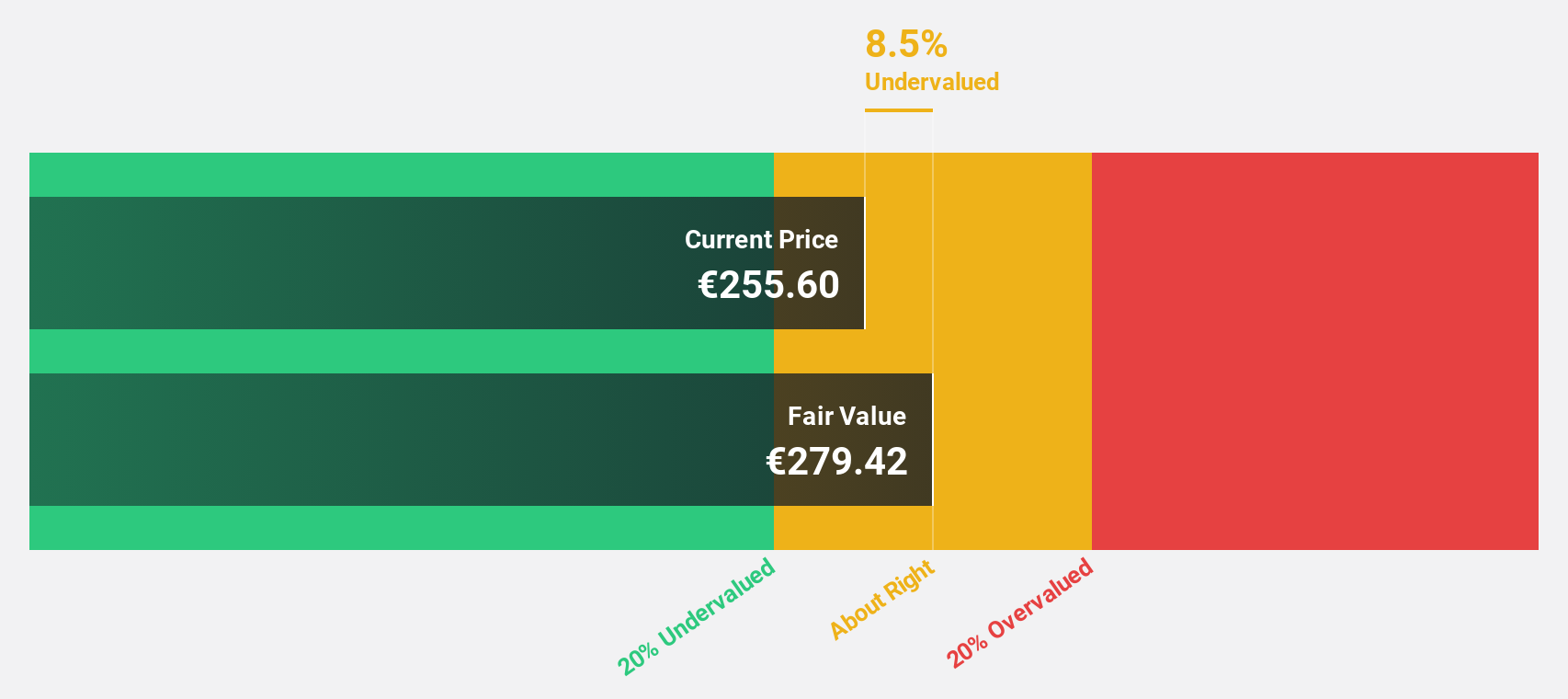

Estimated Discount To Fair Value: 32.2%

init innovation in traffic systems SE is trading at a significant discount to its estimated fair value of €52.23, with current prices around €35.4, suggesting undervaluation based on discounted cash flow analysis. Despite a recent dip in quarterly net income to €2.42 million, the company has demonstrated strong revenue growth and improved earnings over six months, with revenues increasing from €89.63 million to €114.49 million year-on-year, indicating robust operational performance amidst market challenges.

- Our earnings growth report unveils the potential for significant increases in init innovation in traffic systems' future results.

- Click here and access our complete balance sheet health report to understand the dynamics of init innovation in traffic systems.

SAP (XTRA:SAP)

Overview: SAP SE, along with its subsidiaries, offers applications, technology, and services on a global scale and has a market capitalization of approximately €238.49 billion.

Operations: SAP SE generates revenue primarily from its Applications, Technology & Services segment, which amounts to €32.54 billion.

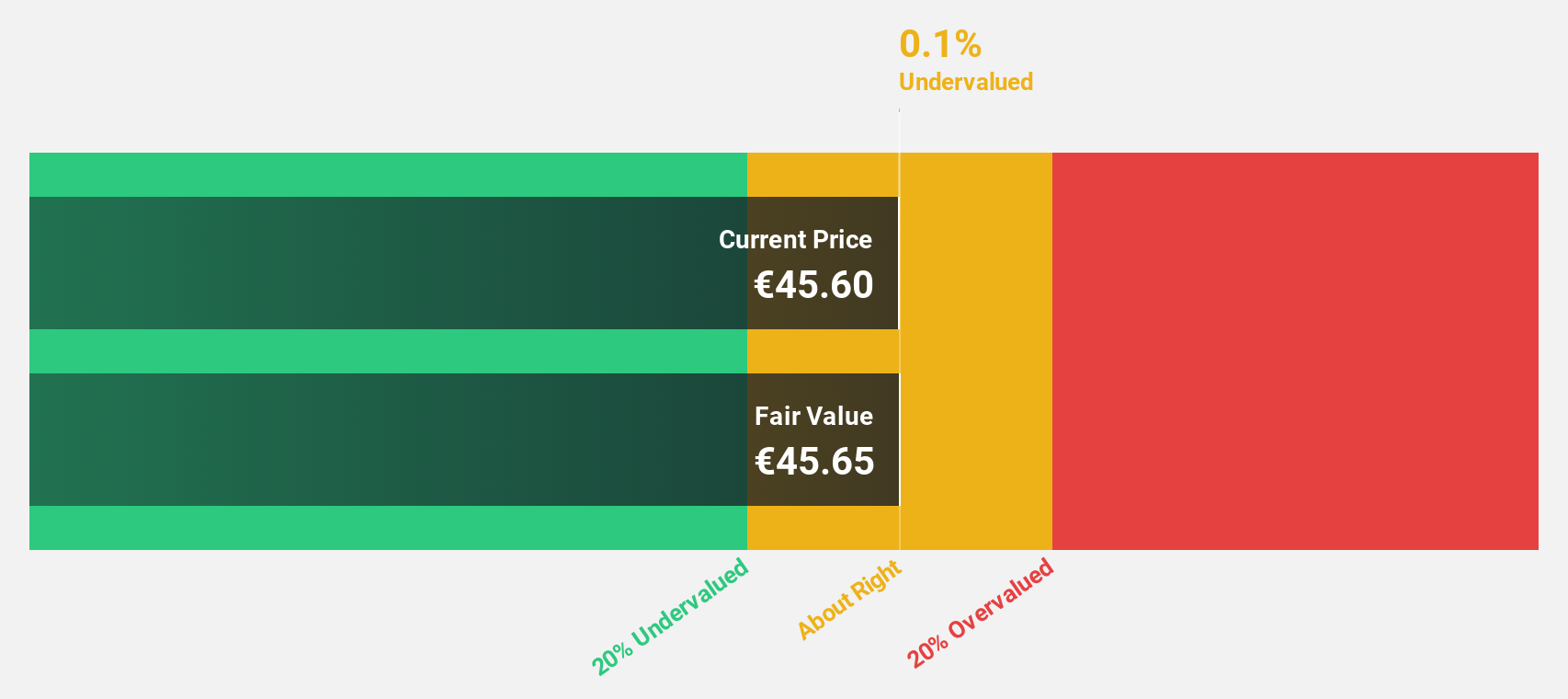

Estimated Discount To Fair Value: 25.7%

SAP is trading at a significant discount to its estimated fair value of €275.82, with current prices around €205, highlighting potential undervaluation based on cash flows. Despite a forecasted low return on equity, SAP's earnings are expected to grow significantly over the next three years. Recent AI innovations, including Joule and collaborative AI agents, aim to enhance productivity and streamline business processes, potentially driving future growth and operational efficiency.

- Upon reviewing our latest growth report, SAP's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in SAP's balance sheet health report.

Schaeffler (XTRA:SHA0)

Overview: Schaeffler AG, along with its subsidiaries, develops, manufactures, and sells components and systems for industrial applications across Europe, the Americas, China, and the Asia Pacific; it has a market cap of €2.45 billion.

Operations: The company's revenue segments are composed of €9.80 billion from Automotive Technologies, €2.43 billion from Vehicle Lifetime Solutions, and €4.10 billion from Bearings & Industrial Solutions.

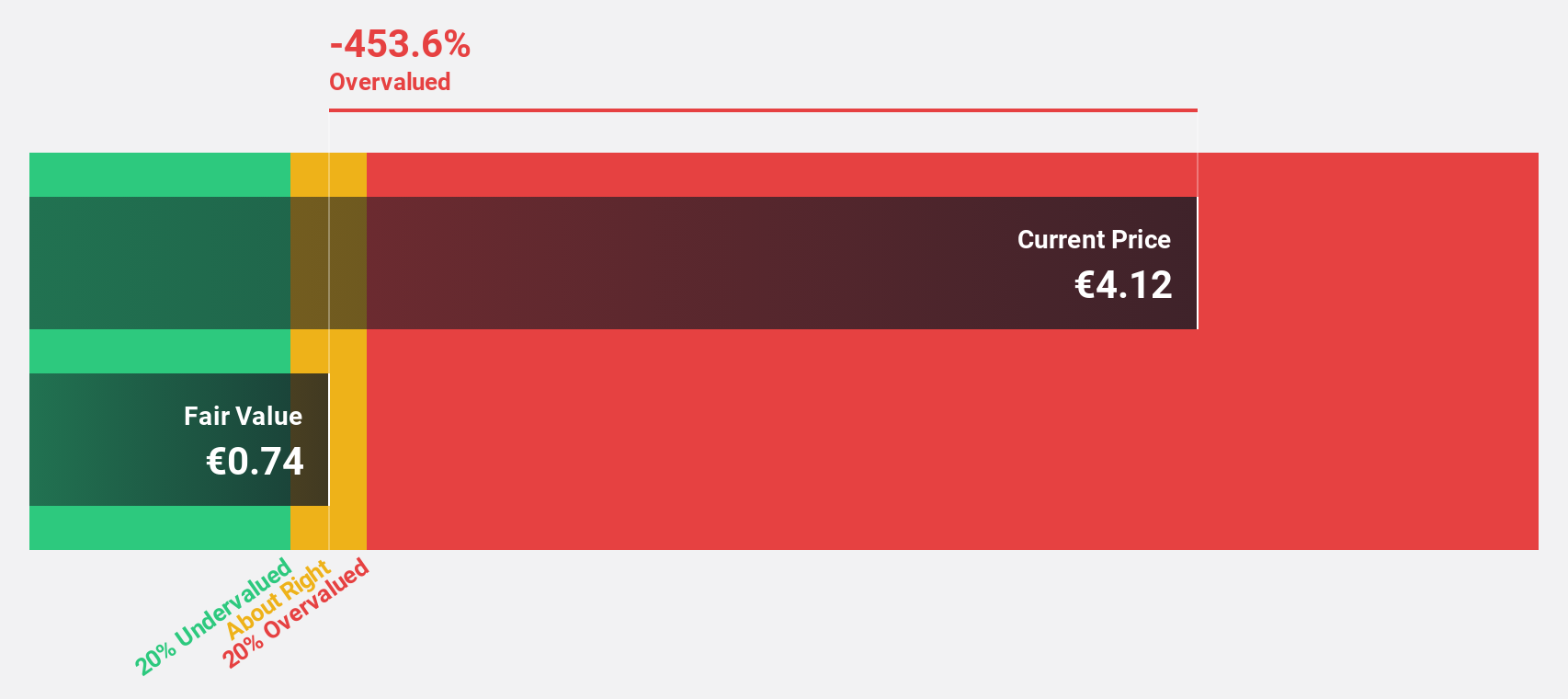

Estimated Discount To Fair Value: 14.6%

Schaeffler is trading below its estimated fair value of €5.74, with current prices at €4.9, suggesting potential undervaluation based on cash flows. Despite recent shareholder dilution and lower profit margins compared to last year, earnings are forecast to grow significantly at 38.1% annually over the next three years, outpacing the German market. However, interest payments are not well covered by earnings, and shares remain highly illiquid following executive changes in financial leadership.

- According our earnings growth report, there's an indication that Schaeffler might be ready to expand.

- Take a closer look at Schaeffler's balance sheet health here in our report.

Summing It All Up

- Investigate our full lineup of 16 Undervalued German Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives