- Italy

- /

- Oil and Gas

- /

- BIT:ENI

European Dividend Stocks To Consider In March 2025

Reviewed by Simply Wall St

As European markets face uncertainty due to U.S. trade policies and economic growth concerns, the pan-European STOXX Europe 600 Index has seen a slight decline, although increased spending plans in Germany and the EU have helped mitigate losses. In such a climate, dividend stocks can offer stability and income potential for investors seeking to navigate these turbulent times.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.28% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.17% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.86% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.81% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.64% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.14% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.44% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.27% | ★★★★★★ |

| VERBUND (WBAG:VER) | 5.96% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.56% | ★★★★★★ |

Click here to see the full list of 228 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

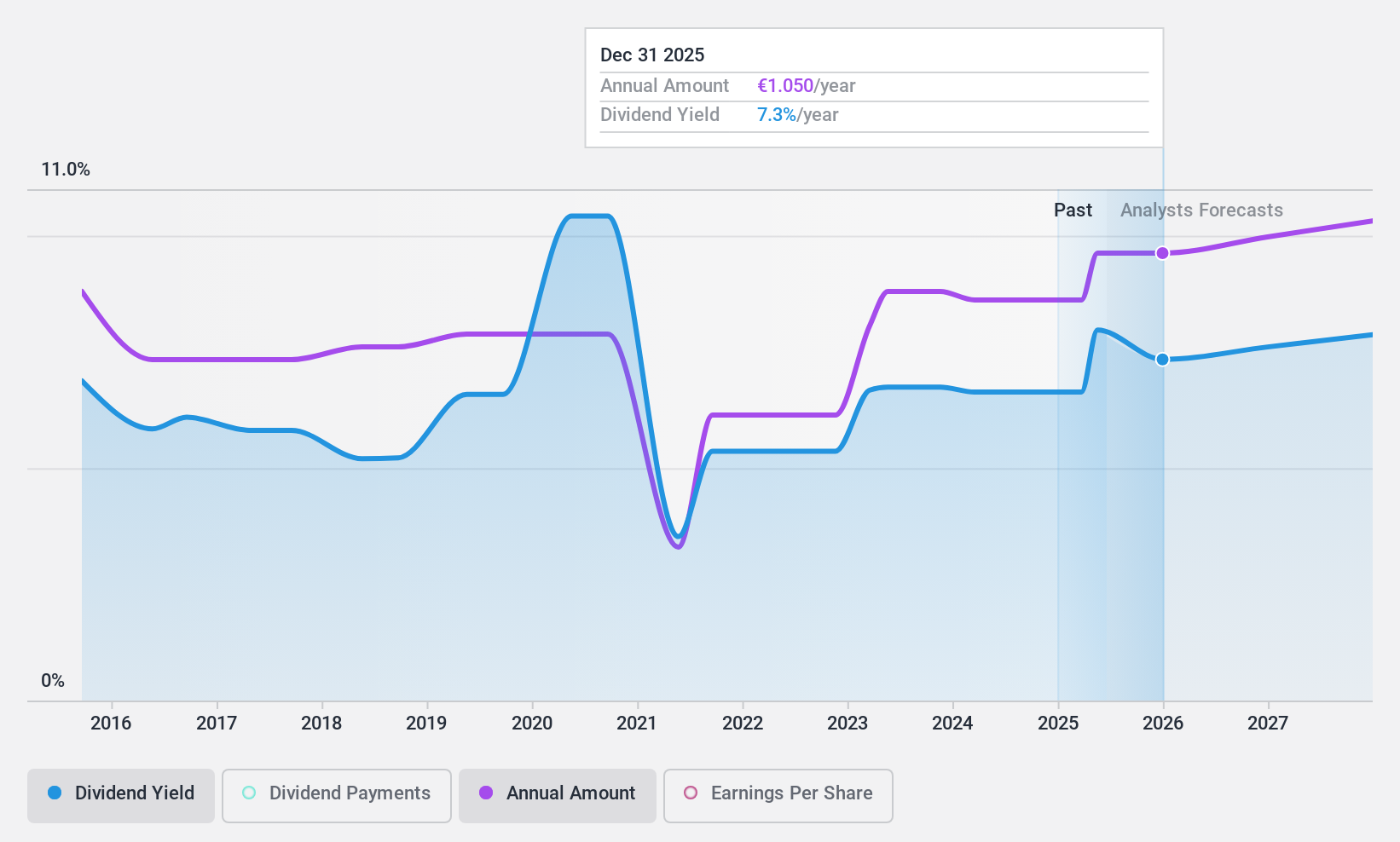

Eni (BIT:ENI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eni S.p.A. is an integrated energy company with global operations and a market capitalization of approximately €42.04 billion.

Operations: Eni S.p.A.'s revenue is primarily derived from its Exploration & Production segment (€54.44 billion), followed by Enilive and Plenitude (€31.30 billion), Refining, Chemicals and Power (€21.21 billion), and Global Gas & LNG Portfolio (€18.88 billion).

Dividend Yield: 6.9%

Eni's dividend yield is among the top 25% in Italy, with a payout ratio of 29.9%, indicating coverage by earnings. Despite recent financial challenges, including a drop in net income to €2.64 billion for 2024, dividends remain covered by cash flows (62.6%). However, Eni's dividend history has been volatile over the last decade and profit margins have decreased from 4.9% to 2.9%. Recent fixed-income offerings totaling €1.49 billion may support future stability.

- Dive into the specifics of Eni here with our thorough dividend report.

- According our valuation report, there's an indication that Eni's share price might be on the expensive side.

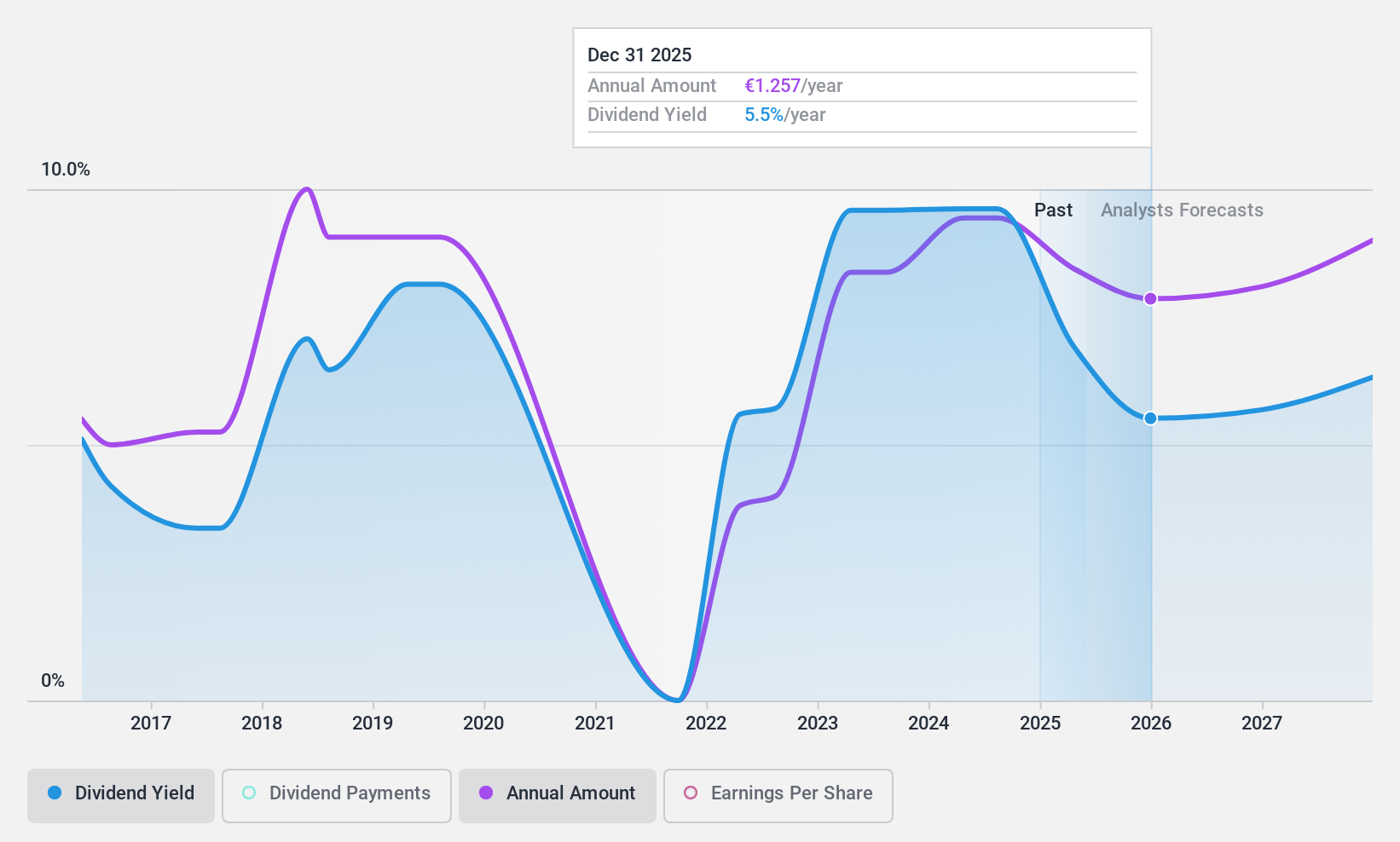

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and internationally, with a market cap of €15.98 billion.

Operations: ABN AMRO Bank N.V. generates revenue through its diverse offerings of banking products and financial services tailored to retail, private, and business clients across domestic and international markets.

Dividend Yield: 7.0%

ABN AMRO Bank's dividend yield ranks in the top 25% of the Dutch market, supported by a payout ratio of 72.8%, indicating coverage by earnings. Despite this, its dividend history is unstable and has been unreliable over nine years. Recent financials show a decline in net income to €397 million for Q4 2024. Fixed-income offerings totaling over €4 billion could bolster financial stability amid forecasts of declining earnings and a reduced final dividend proposal for 2024.

- Take a closer look at ABN AMRO Bank's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that ABN AMRO Bank is trading behind its estimated value.

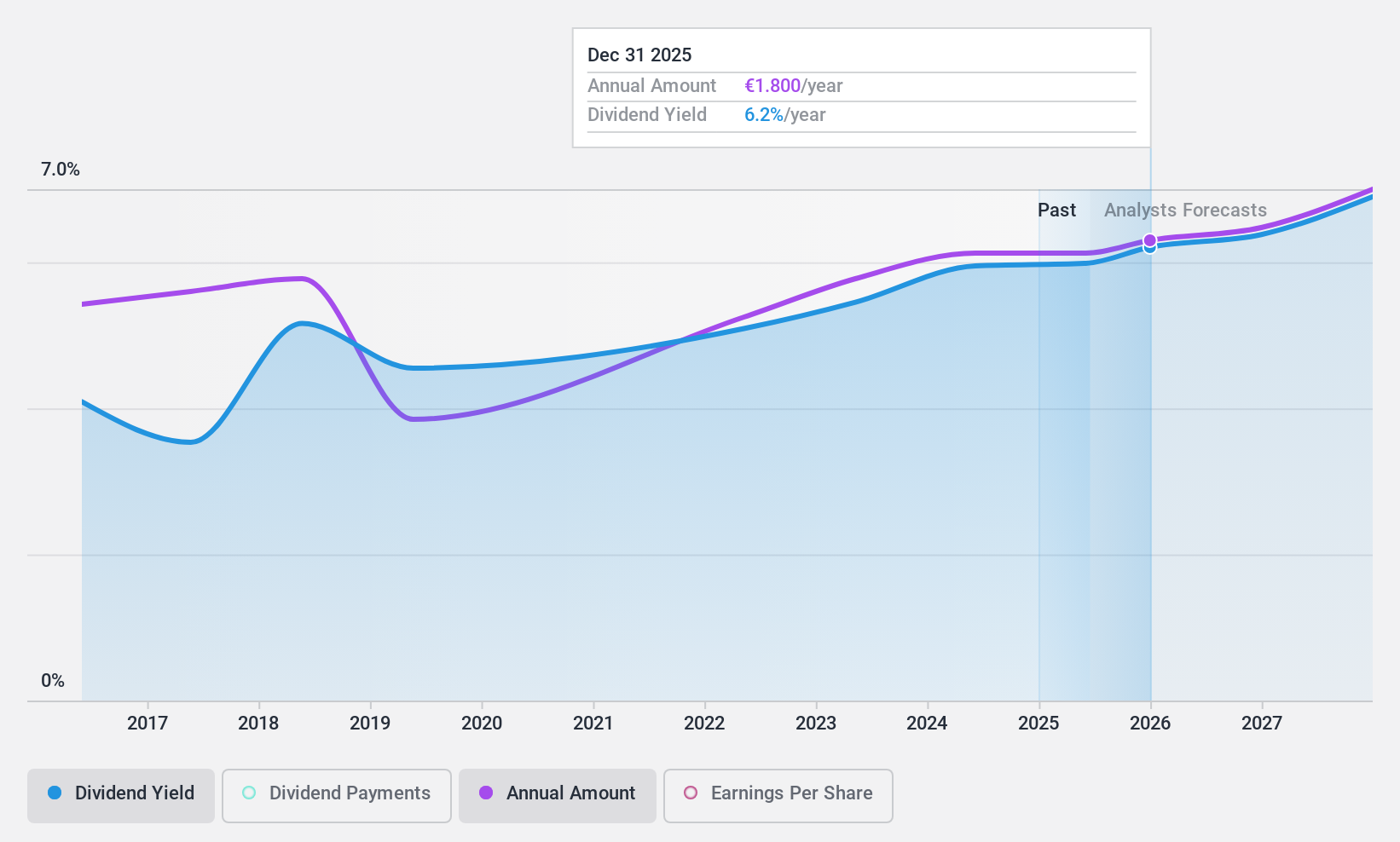

PWO (XTRA:PWO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PWO AG manufactures and sells lightweight construction aluminum sheet components made of steel for the mobility industry across several countries, including Germany and China, with a market cap of €93.13 million.

Operations: PWO AG generates revenue primarily from its Auto Parts & Accessories segment, which amounts to €560.07 million.

Dividend Yield: 5.9%

PWO's dividend yield is among the top 25% in Germany, with a payout ratio of 42.5%, indicating strong coverage by earnings and cash flows. However, its dividend payments have been volatile and unreliable over the past decade, with significant annual drops. Despite trading at a significant discount to its estimated fair value, PWO faces challenges as interest payments are not well covered by earnings, raising concerns about financial stability.

- Navigate through the intricacies of PWO with our comprehensive dividend report here.

- According our valuation report, there's an indication that PWO's share price might be on the cheaper side.

Summing It All Up

- Reveal the 228 hidden gems among our Top European Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eni might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ENI

Eni

Operates as an integrated energy company in Italy, Other European Union, Rest of Europe, the United States, Asia, Africa, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives