- Germany

- /

- Auto Components

- /

- XTRA:PGN

paragon GmbH & Co. KGaA's (ETR:PGN) Business Is Trailing The Industry But Its Shares Aren't

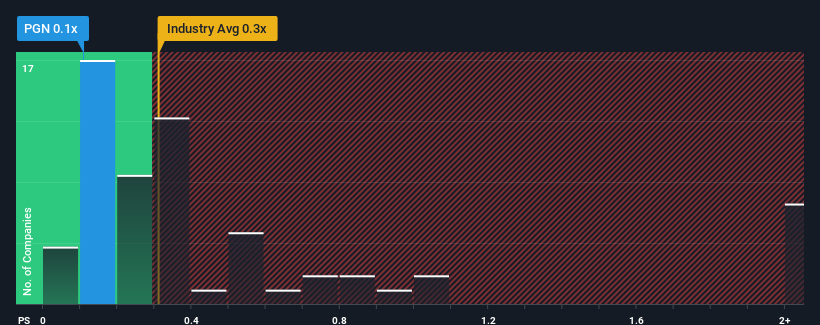

There wouldn't be many who think paragon GmbH & Co. KGaA's (ETR:PGN) price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S for the Auto Components industry in Germany is similar at about 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for paragon GmbH KGaA

What Does paragon GmbH KGaA's P/S Mean For Shareholders?

There hasn't been much to differentiate paragon GmbH KGaA's and the industry's revenue growth lately. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Want the full picture on analyst estimates for the company? Then our free report on paragon GmbH KGaA will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, paragon GmbH KGaA would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 13% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 1.6% over the next year. Meanwhile, the rest of the industry is forecast to expand by 4.2%, which is noticeably more attractive.

With this in mind, we find it intriguing that paragon GmbH KGaA's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From paragon GmbH KGaA's P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that paragon GmbH KGaA's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

You should always think about risks. Case in point, we've spotted 2 warning signs for paragon GmbH KGaA you should be aware of, and 1 of them is a bit concerning.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:PGN

paragon GmbH KGaA

Develops, produces, and distributes automotive electronics, body kinematics, and e-mobility solutions for the automotive industry in Germany, European Union, and internationally.

Good value with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026