Porsche SE (XTRA:PAH3): Assessing Valuation After Electric Model Delays, Profit Guidance Cut, and Share Price Drop

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 19.4% Undervalued

According to a widely followed narrative, Porsche Automobil Holding’s share price trades at a notable discount to fair value. This is seen as suggesting substantial upside potential if the company can stabilize its fundamentals. The narrative applies a discount rate of 9.93%.

"PAH3 appears undervalued at current levels, but traditional DCF valuation is challenging due to its holding company structure. The discount to NAV and analyst targets suggest potential upside. However, risks around VW's performance and debt levels remain key concerns."

Curious about the bold assumptions powering this undervaluation call? The secret mix involves projected turnaround in earnings and a future profit multiple more common to growth stocks. Want to understand what sets the fair value so much higher than today’s price? Take a closer look at the financial forecasts behind this narrative’s target range.

Result: Fair Value of €40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, the narrative could shift if Volkswagen's performance further weakens or if impairment charges rise faster than projected. This could impact Porsche’s valuation outlook.

Find out about the key risks to this Porsche Automobil Holding narrative.Another View: Discounted Cash Flow Signals Deeper Value

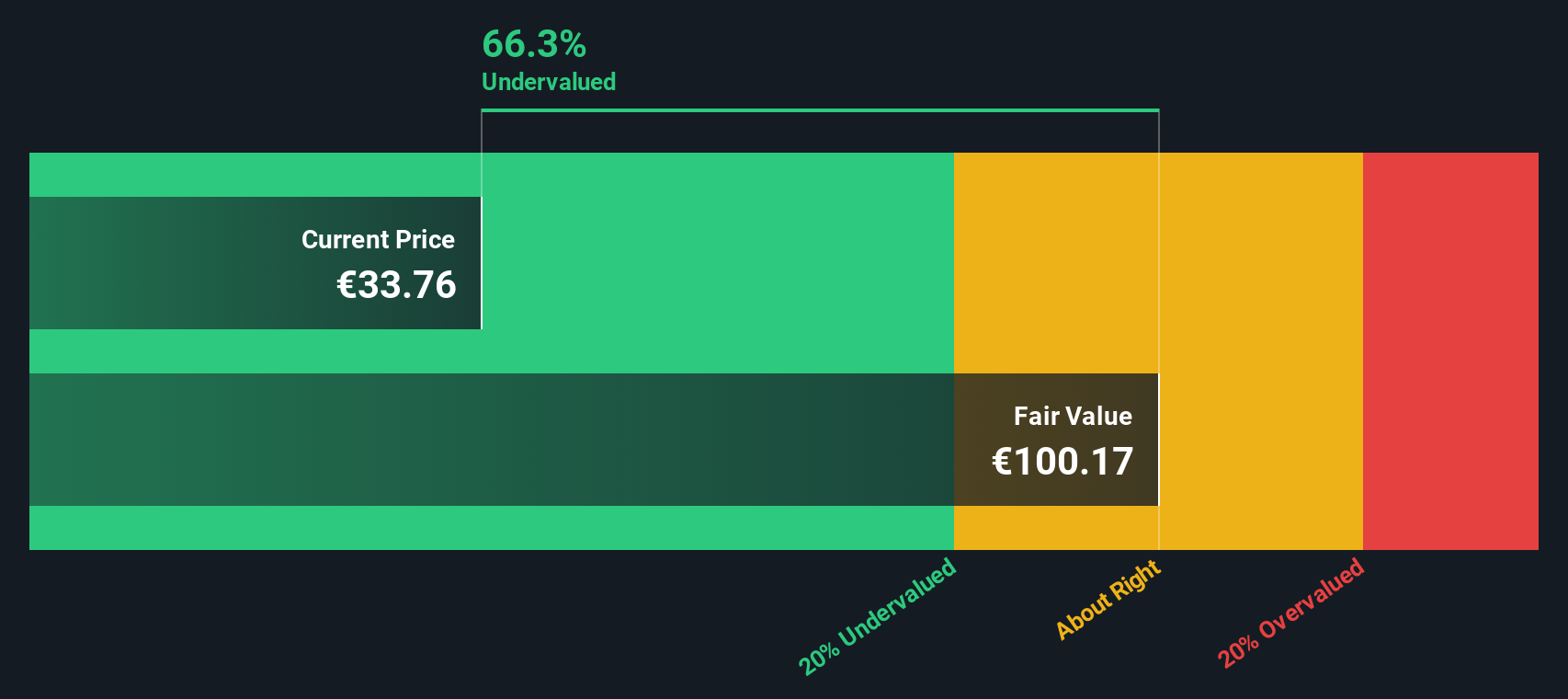

Looking from a different angle, our DCF model points to even more significant undervaluation for Porsche Automobil Holding. This method calculates fair value using future cash flows rather than market-based multiples. Does the gap hint at hidden upside or risks that are easy to overlook?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Porsche Automobil Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Porsche Automobil Holding Narrative

If these stories do not fit your outlook, there is always the option to dig into the numbers yourself and shape a fresh perspective in just a few minutes. Do it your way.

A great starting point for your Porsche Automobil Holding research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Uncover even more opportunities that fit your goals by tapping into fresh angles and market trends. If you are focused on growth, dividends, or future-focused sectors, now is the perfect time to broaden your research beyond just Porsche Automobil Holding.

- Tap into tomorrow's returns by tracking companies with a track record of rewarding shareholders. Use our link to spot dividend stocks with yields > 3%.

- Get ahead of the AI curve by evaluating promising businesses transforming industries with artificial intelligence. Start your search with AI penny stocks.

- Unleash value strategies and target stocks trading below their intrinsic worth by accessing our handpicked list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PAH3

Porsche Automobil Holding

Through its subsidiaries, operates as an automobile manufacturer worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives