Is Mercedes-Benz a Bargain After Exiting Its Nissan Stake in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Mercedes-Benz Group stock? You are definitely not alone. It is no secret that auto stocks have seen their fair share of ups and downs lately, but Mercedes stands out with its mix of tradition and evolving strategy. If you have held this stock through the last few years, you are probably well aware that the long-term trend has been solidly in your favor. It has gained a whopping 79.0% over five years and 25.0% over the last three. Shorter-term moves, though, have been more of a rollercoaster. Just last week, the shares dipped by 4.0%, even as they nudged up 2.5% over the past month and stayed nearly flat year-to-date.

What is moving the price right now? Beyond the usual market forces, recent headlines have made investors reconsider the risk and opportunity tied to global tariffs, with talk in Washington hinting at possible relief for U.S. carmakers. Meanwhile, Mercedes’ decision to exit its Nissan stake points to a sharper focus on its own business. All of this comes amid broader industry changes, from Amazon’s push for electric delivery vehicles to fierce competition in international markets.

So where does that leave Mercedes-Benz Group on value? According to a six-point valuation checklist, Mercedes checks the “undervalued” box in five out of six categories, scoring a strong 5. The big question, of course, is which methods matter most and how you can use these insights to make the smartest call on this well-known name. Let us dive into the major valuation approaches, then stick around for a perspective on how to judge value that goes even deeper.

Approach 1: Mercedes-Benz Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental valuation approach that estimates a company's true worth by projecting its future cash flows and discounting them back to the present. In short, it is a method for determining what the business is really worth today based on expected future performance.

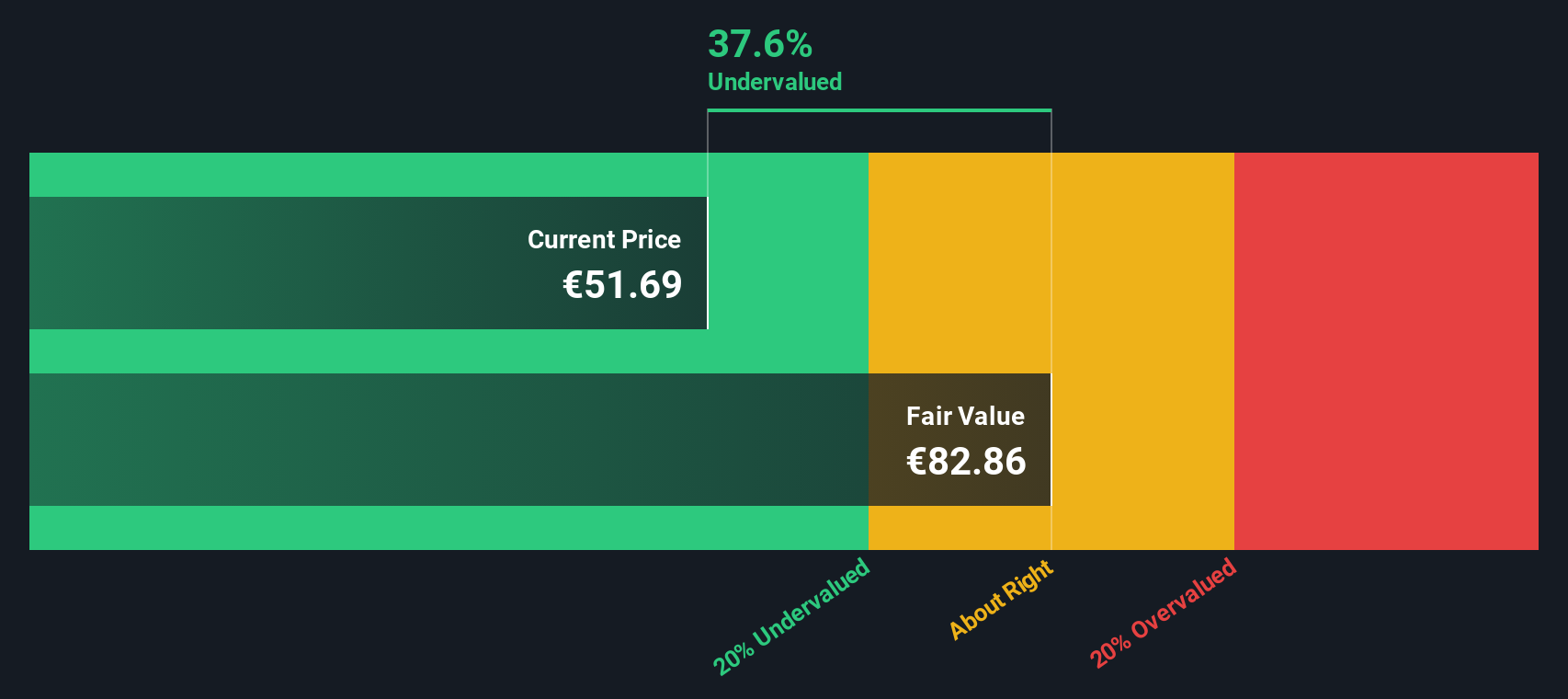

For Mercedes-Benz Group, the DCF model uses the two-stage Free Cash Flow to Equity framework. Currently, the company is generating approximately €13.26 billion in trailing twelve-month Free Cash Flow, a robust figure for any automotive company. Analyst projections cover the next five years, with Free Cash Flow expected to reach about €6.34 billion by 2029. Beyond that, forecasts from Simply Wall St extrapolate further, showing steady but modest growth into the next decade.

Based on these projections, the model calculates an intrinsic fair value of €81.38 per share. With Mercedes-Benz Group’s current share price trading around 34.6% below this intrinsic value, the DCF model suggests the stock is meaningfully undervalued at today's prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mercedes-Benz Group is undervalued by 34.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Mercedes-Benz Group Price vs Earnings

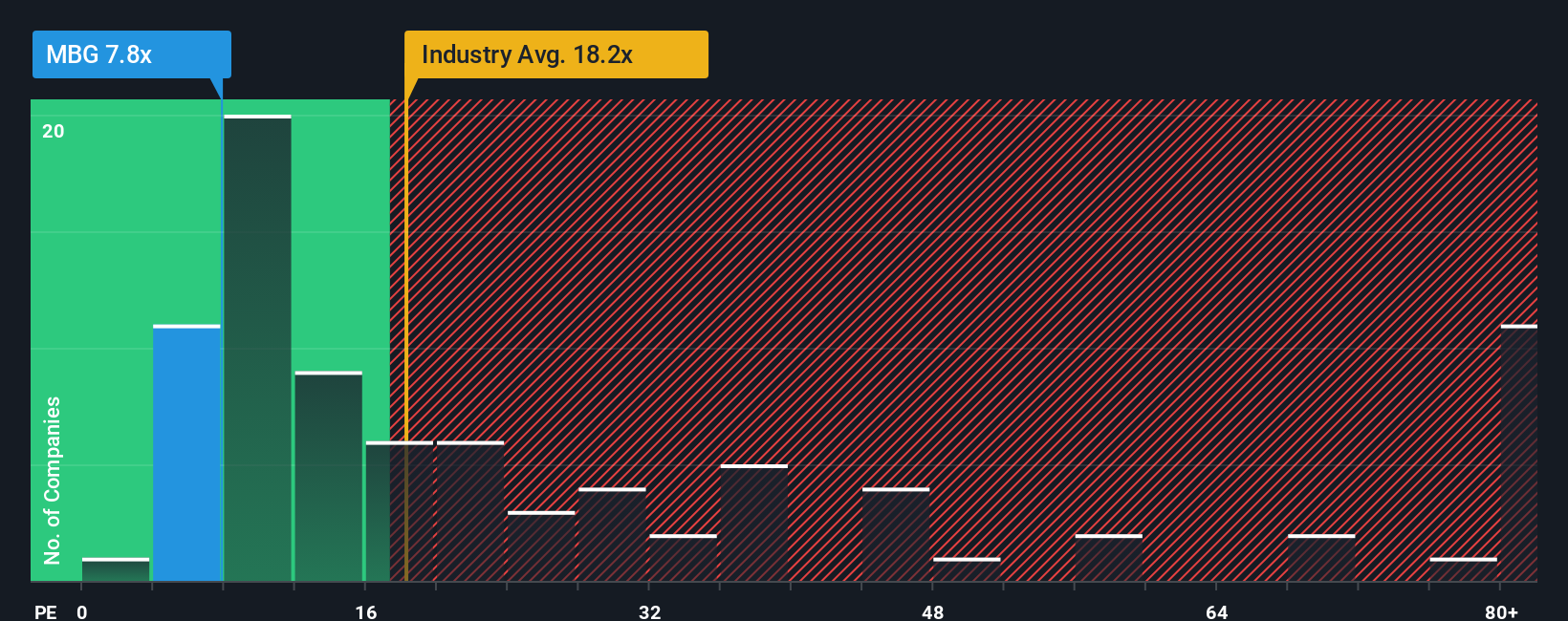

The Price-to-Earnings (PE) ratio is the go-to metric for valuing profitable companies like Mercedes-Benz Group. It is favored by investors because it connects a company’s current share price with its bottom-line earnings, giving a quick sense of how much investors are willing to pay for each euro of profit.

What makes a “normal” or “fair” PE ratio? That depends on expectations for growth and the perceived risks in the business. Higher growth prospects often justify higher PE ratios, while increased risk typically pulls the ratio down. For context, the average PE ratio for auto industry stocks is currently 19.0x, with Mercedes-Benz's selected peers averaging 10.3x.

Right now, Mercedes-Benz Group trades at just 7.5x earnings. That is well below both the industry average and its peer group. However, numbers alone do not tell the whole story. Simply Wall St’s Fair Ratio offers a more tailored benchmark, adjusting for factors like Mercedes’ future earnings growth, profit margins, market cap, and the specific risks and dynamics of its sector. For Mercedes-Benz, the Fair Ratio comes in at 10.4x, suggesting that, given all the fundamentals, investors would normally pay more for these earnings than the current market price reflects.

The upshot is that Mercedes-Benz’s PE ratio is comfortably below its Fair Ratio, pointing to a potentially attractive entry point for investors looking for value.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mercedes-Benz Group Narrative

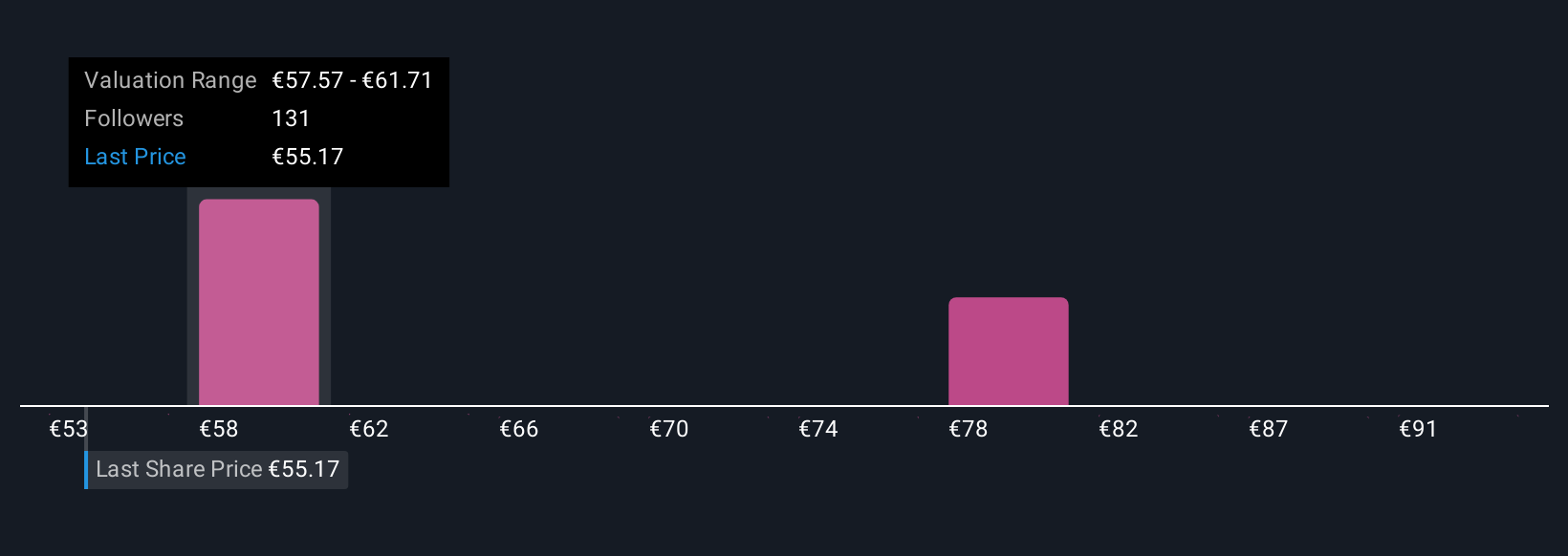

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an innovative approach to investing that combines your view of Mercedes-Benz Group’s story with financial forecasts and a sense of fair value. A Narrative is your investment perspective made practical; it allows you to explain why you think the company will succeed or struggle, link this outlook to your future estimates for revenue, profit, and margins, and see what fair value emerges from your assumptions.

Narratives make the numbers personal and interactive, available right within the Simply Wall St Community page, used by millions of investors, so anyone can create and compare perspectives in just a few clicks. With Narratives, you can quickly test your thinking, see if you believe it is time to buy or sell (by comparing Fair Value to the latest share price), and stay up to date as new information, like results or major news, instantly updates these stories and values.

For example, one Narrative on Mercedes-Benz Group forecasts bold earnings growth and long-term EV leadership, driving a high fair value near €83, while another, more cautious view reflects tough China sales and margin pressure, resulting in a fair value closer to €40. Narratives let you pick which story you believe and act with confidence.

Do you think there's more to the story for Mercedes-Benz Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MBG

Mercedes-Benz Group

Operates as an automotive company in Germany and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives