- Saudi Arabia

- /

- Banks

- /

- SASE:1030

3 Dividend Powerhouses Offering Yields Up To 9.4%

Reviewed by Simply Wall St

Amidst a backdrop of mixed performance in major stock indexes and geopolitical tensions, global markets have shown resilience with growth stocks leading the charge. As investors navigate these uncertain times, dividend stocks can offer stability and income potential, making them an attractive option for those seeking reliable returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.13% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.21% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.91% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

Click here to see the full list of 1933 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

CFM Indosuez Wealth Management (ENXTPA:MLCFM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CFM Indosuez Wealth Management SA, with a market cap of €658.95 million, provides banking and financial solutions to private investors, businesses, institutions, and professionals in Monaco and internationally through its subsidiaries.

Operations: CFM Indosuez Wealth Management SA generates its revenue primarily from its Wealth Management segment, which accounts for €196.38 million.

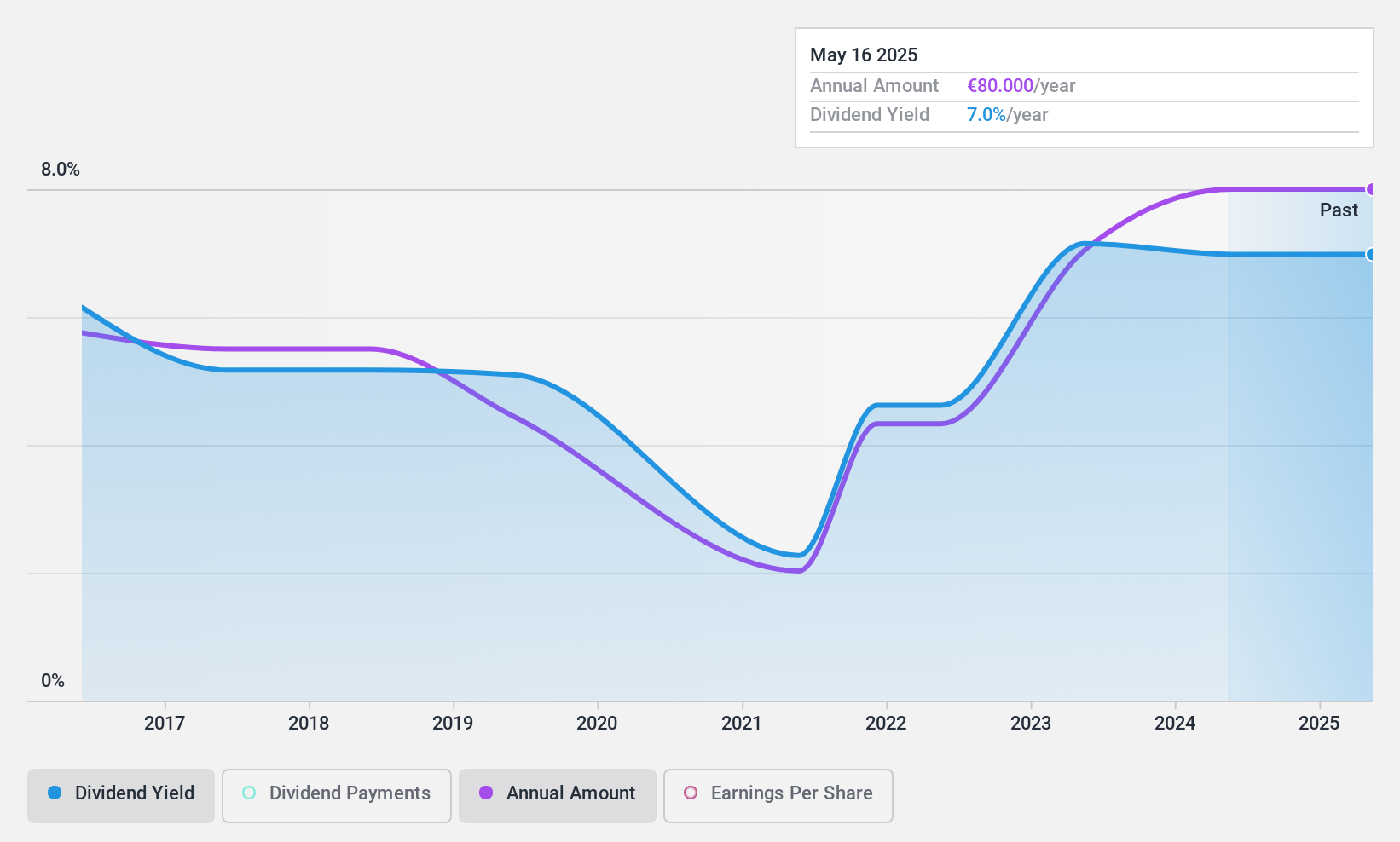

Dividend Yield: 7.0%

CFM Indosuez Wealth Management's dividend yield of 6.96% ranks in the top 25% of French market payers, yet its dividends have been volatile and unreliable over the past decade. Despite a reasonable payout ratio of 70.8%, historical volatility raises concerns about sustainability. Earnings growth at 40.1% last year suggests potential for future stability, but outdated financial reports limit current analysis accuracy, and there's insufficient data to ensure long-term coverage or predictability.

- Dive into the specifics of CFM Indosuez Wealth Management here with our thorough dividend report.

- Our valuation report unveils the possibility CFM Indosuez Wealth Management's shares may be trading at a premium.

Saudi Investment Bank (SASE:1030)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Saudi Investment Bank offers commercial and retail banking services to individuals, small to medium-sized businesses, and corporate and institutional clients in Saudi Arabia, with a market cap of SAR18.53 billion.

Operations: The Saudi Investment Bank's revenue is primarily derived from its Corporate Banking segment at SAR1.34 billion, followed by Treasury and Investments at SAR1.27 billion, Retail Banking at SAR1.23 billion, and Asset Management and Brokerage services contributing SAR217.32 million.

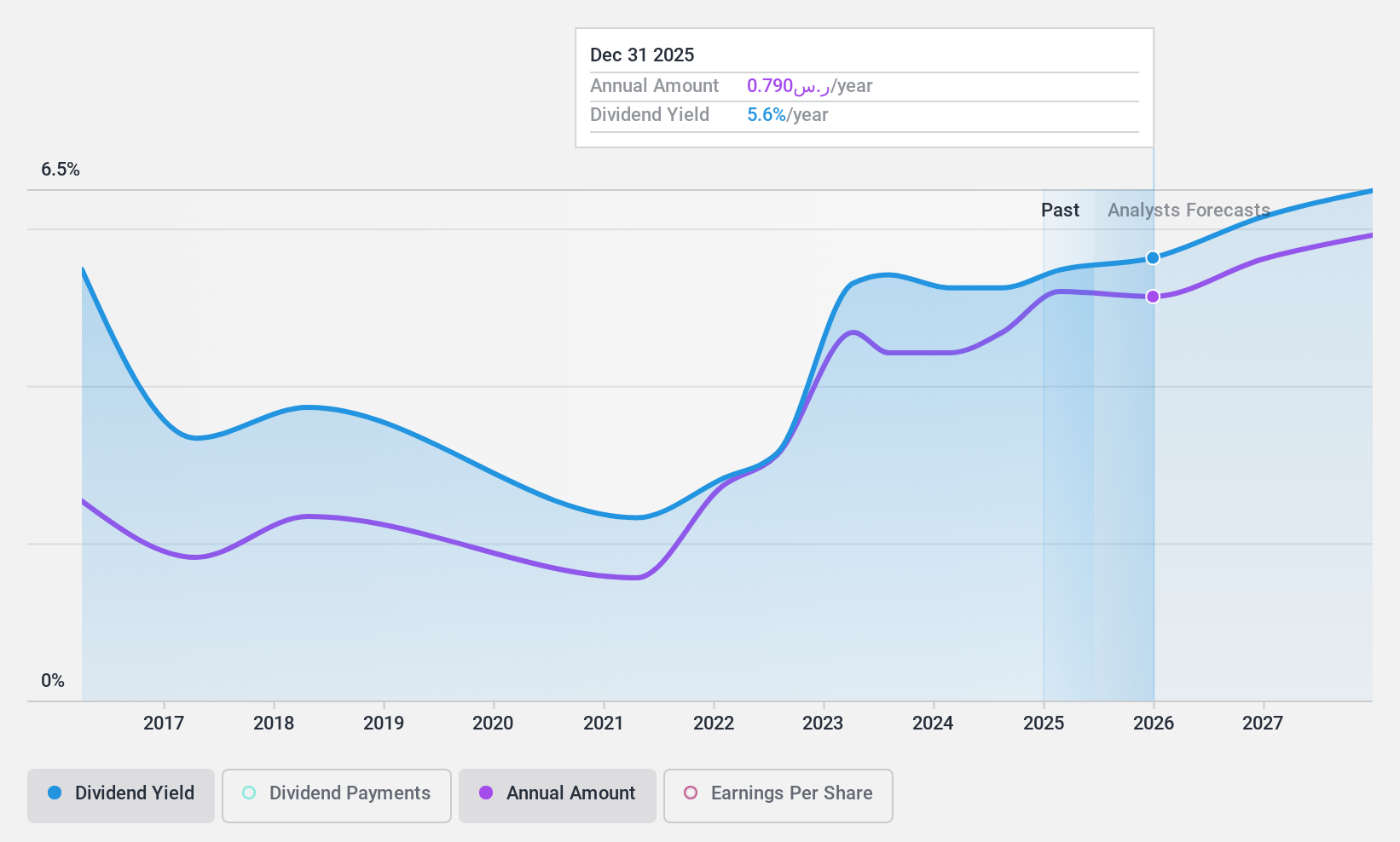

Dividend Yield: 4.9%

Saudi Investment Bank's dividend yield of 4.86% is among the top 25% in the Saudi Arabian market, supported by a reasonable payout ratio of 52%. Despite earnings growth of 16.7% over the past year and forecasts suggesting continued coverage, its dividend history has been volatile and unreliable over the last decade. The recent $750 million fixed-income offering could enhance financial stability, but caution is warranted given past dividend inconsistencies.

- Click here and access our complete dividend analysis report to understand the dynamics of Saudi Investment Bank.

- In light of our recent valuation report, it seems possible that Saudi Investment Bank is trading beyond its estimated value.

Mercedes-Benz Group (XTRA:MBG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mercedes-Benz Group AG is a global automotive company based in Germany, with operations spanning internationally and a market cap of approximately €53.38 billion.

Operations: Mercedes-Benz Group AG generates revenue from its key segments: Mercedes-Benz Cars (€108.05 billion), Mercedes-Benz Vans (€19.94 billion), and Mercedes-Benz Mobility (€26.99 billion).

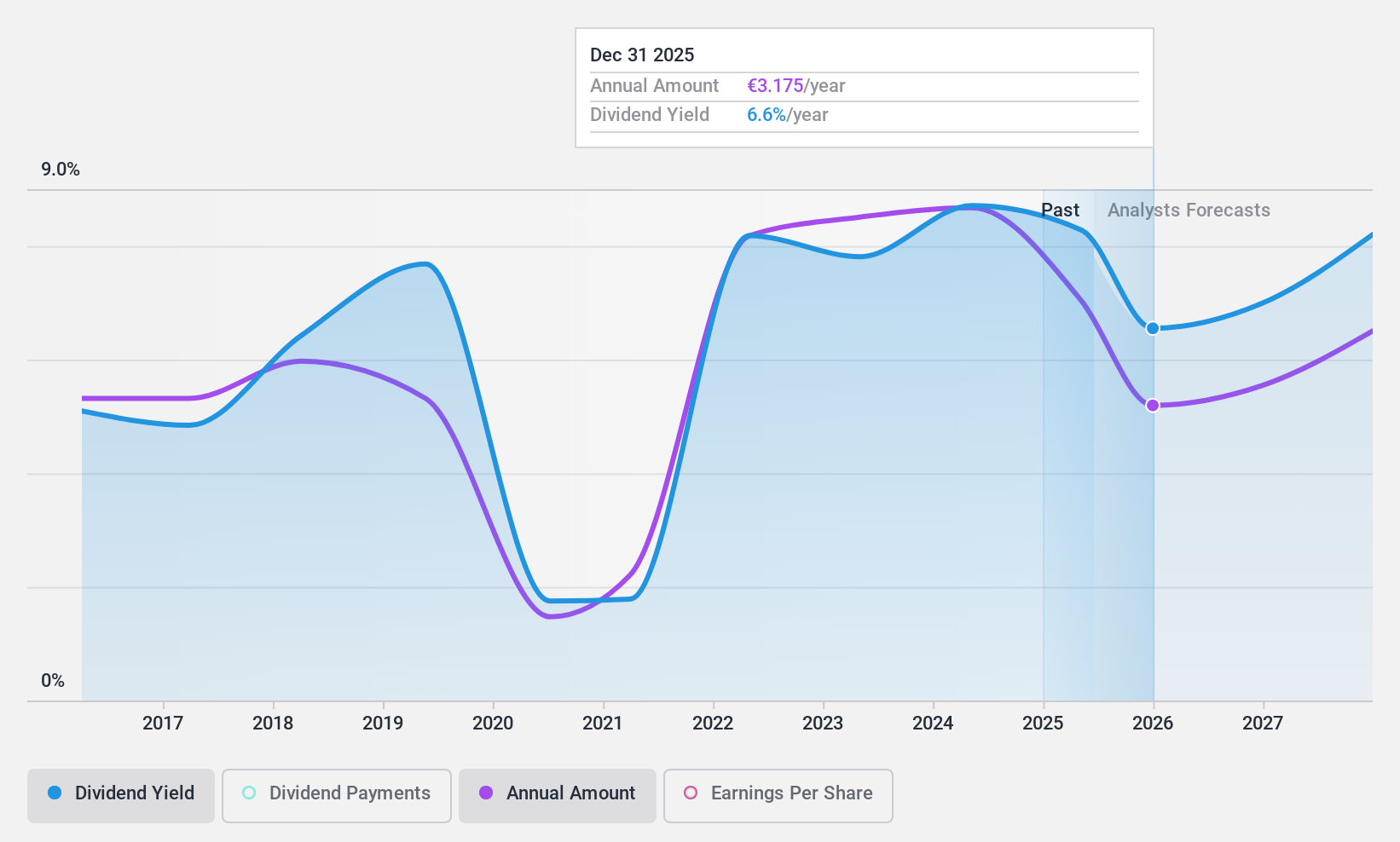

Dividend Yield: 9.5%

Mercedes-Benz Group's dividend yield of 9.45% ranks in the top 25% of German market payers, with a payout ratio of 50%, indicating solid earnings coverage. Despite recent earnings declines and a history of volatile dividends, its cash flow covers dividends at a 67.4% cash payout ratio. Trading at good value relative to peers and industry, the company's extensive share buyback program could support future dividend stability amidst ongoing financial challenges.

- Unlock comprehensive insights into our analysis of Mercedes-Benz Group stock in this dividend report.

- Upon reviewing our latest valuation report, Mercedes-Benz Group's share price might be too pessimistic.

Next Steps

- Embark on your investment journey to our 1933 Top Dividend Stocks selection here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1030

Saudi Investment Bank

Provides commercial and retail banking services to individuals and small to medium-sized businesses, and corporate and institutional customers in the Kingdom of Saudi Arabia.

Flawless balance sheet established dividend payer.