- Saudi Arabia

- /

- Basic Materials

- /

- SASE:3003

Undiscovered Gems with Promising Potential for December 2024

Reviewed by Simply Wall St

As we approach December 2024, global markets are witnessing a divergence in performance, with major indexes like the S&P 500 and Nasdaq Composite reaching record highs while small-cap indices such as the Russell 2000 face declines. Amidst this backdrop of mixed market sentiment and economic indicators showing a rebound in job growth, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking to uncover undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Miwon Chemicals | 0.08% | 11.70% | 14.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Bank Ganesha | NA | 25.03% | 70.72% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| Forth Smart Service | 60.55% | -7.89% | -14.33% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

City Cement (SASE:3003)

Simply Wall St Value Rating: ★★★★★★

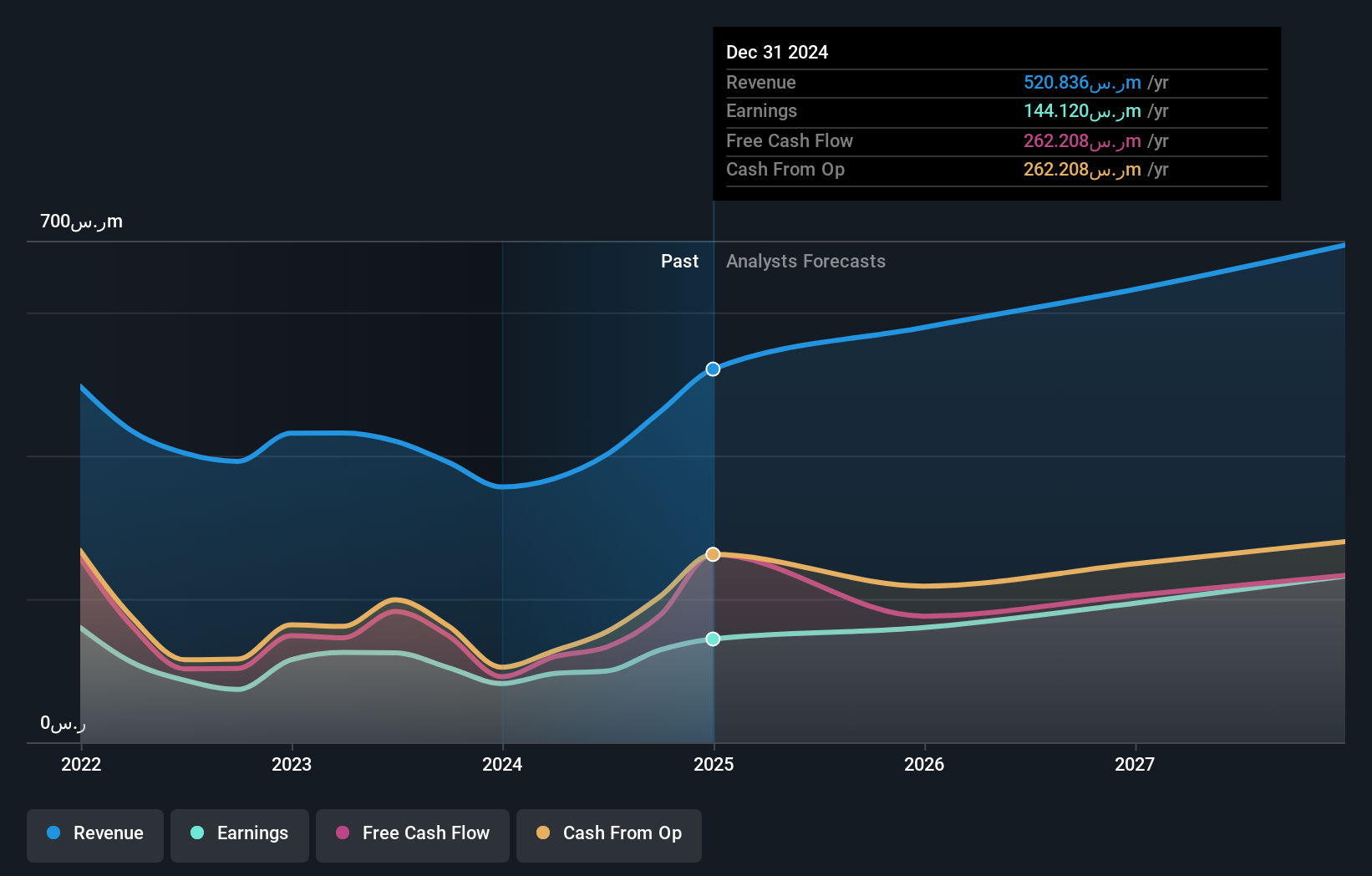

Overview: City Cement Company manufactures and sells cement in the Kingdom of Saudi Arabia, with a market capitalization of SAR2.54 billion.

Operations: City Cement's primary revenue stream is from cement sales, generating SAR460.97 million, while environmental services contribute SAR2.35 million.

City Cement, a promising player in the cement industry, has shown impressive growth with earnings rising 23.7% over the past year, outpacing the Basic Materials sector's 12.1%. The company reported third-quarter sales of SAR 130.11 million, nearly doubling from SAR 70.68 million last year, and net income surged to SAR 33.66 million from SAR 4.42 million previously. With no debt on its books for five years and trading at a value estimated to be 13% below fair value, City Cement seems well-positioned for future growth amid strong financial health and high-quality earnings.

- Click here to discover the nuances of City Cement with our detailed analytical health report.

Review our historical performance report to gain insights into City Cement's's past performance.

Mao Geping Cosmetics (SEHK:1318)

Simply Wall St Value Rating: ★★★★★★

Overview: Mao Geping Cosmetics Co., Ltd. operates in China, offering color cosmetics and skincare products under the MAOGEPING and Love Keeps brands, with a market cap of CN¥12.33 billion.

Operations: The company's revenue is primarily derived from personal products, totaling CN¥2.89 billion.

Mao Geping Cosmetics recently completed an IPO, raising HKD 2.34 billion, with shares priced at HKD 29.8 each. The company has demonstrated impressive earnings growth of 88% over the past year, surpassing the Personal Products industry's 59%. Despite its illiquid shares, it trades at a substantial discount of 53.7% below estimated fair value and remains debt-free for five years now, eliminating concerns about interest coverage. This combination of rapid earnings growth and undervaluation positions Mao Geping as a compelling prospect in the cosmetics sector despite liquidity challenges in its stock trading.

- Get an in-depth perspective on Mao Geping Cosmetics' performance by reading our health report here.

Understand Mao Geping Cosmetics' track record by examining our Past report.

Inkeverse Group (SEHK:3700)

Simply Wall St Value Rating: ★★★★★★

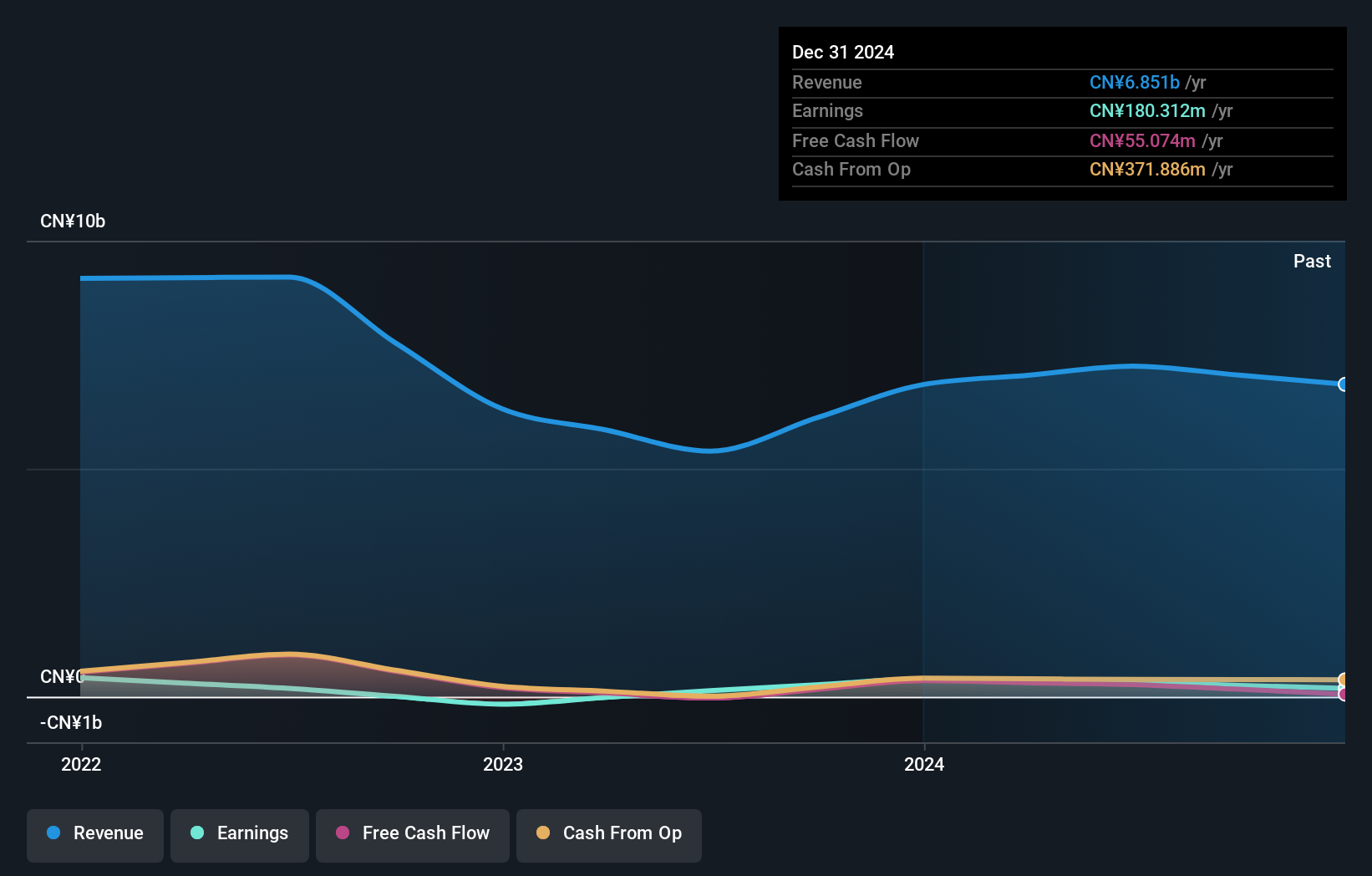

Overview: Inkeverse Group Limited is an investment holding company that operates mobile live streaming platforms in the People’s Republic of China, with a market capitalization of HK$3.78 billion.

Operations: The primary revenue stream for Inkeverse Group comes from its live streaming business, generating CN¥7.25 billion. The company's financial performance reflects a focus on this segment as a major source of income.

Inkeverse Group, a tech-driven entity, showcases impressive earnings growth of 136% over the past year, outpacing the industry average of 5.8%. Its price-to-earnings ratio stands at 11.4x, slightly below the sector's average of 12.2x, suggesting potential undervaluation. The company operates without debt for five years now and boasts high-quality earnings with free cash flow positivity. Recent board changes introduce Ms. Zheng Congnan as an independent director with a strong track record in tech innovation and management from Silicon Valley firms like Robinhood and Coursera, likely enhancing Inkeverse's strategic direction in technology development and user experience enhancement.

- Click here and access our complete health analysis report to understand the dynamics of Inkeverse Group.

Gain insights into Inkeverse Group's past trends and performance with our Past report.

Where To Now?

- Explore the 4644 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:3003

City Cement

City Cement Company with its subsidiaries manufactures and sells cement in the Kingdom of Saudi Arabia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives