- Germany

- /

- Auto Components

- /

- XTRA:CON

Continental’s Sharp Q3 Loss Might Change The Case For Investing In Continental (XTRA:CON)

Reviewed by Sasha Jovanovic

- Continental reported its third quarter 2025 results, showing sales of €4.95 billion and a net loss of €756 million, compared to a net income of €486 million a year earlier.

- This marks a significant reversal in the company’s financial performance, with continued losses over the nine months reinforcing concerns around profitability and operating challenges.

- We'll examine how the shift from profit to a substantial net loss shapes Continental's investment narrative moving forward.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Continental Investment Narrative Recap

To be a shareholder in Continental today, you need conviction in the company's ability to overcome significant operational and market headwinds, particularly given the latest Q3 net loss. The recent results reinforce the near-term pressure on profitability, making margin recovery and cost discipline the most important catalyst, while ongoing exposure to depressed sales volumes remains the principal risk for the business. If this trend persists, the investment narrative may shift further toward turnaround potential rather than steady growth.

Among recent announcements, the June 2025 revision to full-year earnings guidance directly connects to this quarter’s performance, highlighting that sales expectations have been narrowed in the ContiTech segment. In light of ongoing volume challenges flagged in the results, this realignment signals management’s focus on cost structure and operational efficiency as central themes to watch in upcoming quarters.

By contrast, investors should be conscious that recurring restructuring and spin-off costs, not just operating losses, continue to...

Read the full narrative on Continental (it's free!)

Continental's outlook anticipates €41.4 billion in revenue and €2.1 billion in earnings by 2028. This scenario is based on analysts forecasting 1.5% annual revenue growth and an earnings increase of €1.0 billion from €1.1 billion today.

Uncover how Continental's forecasts yield a €68.79 fair value, a 6% upside to its current price.

Exploring Other Perspectives

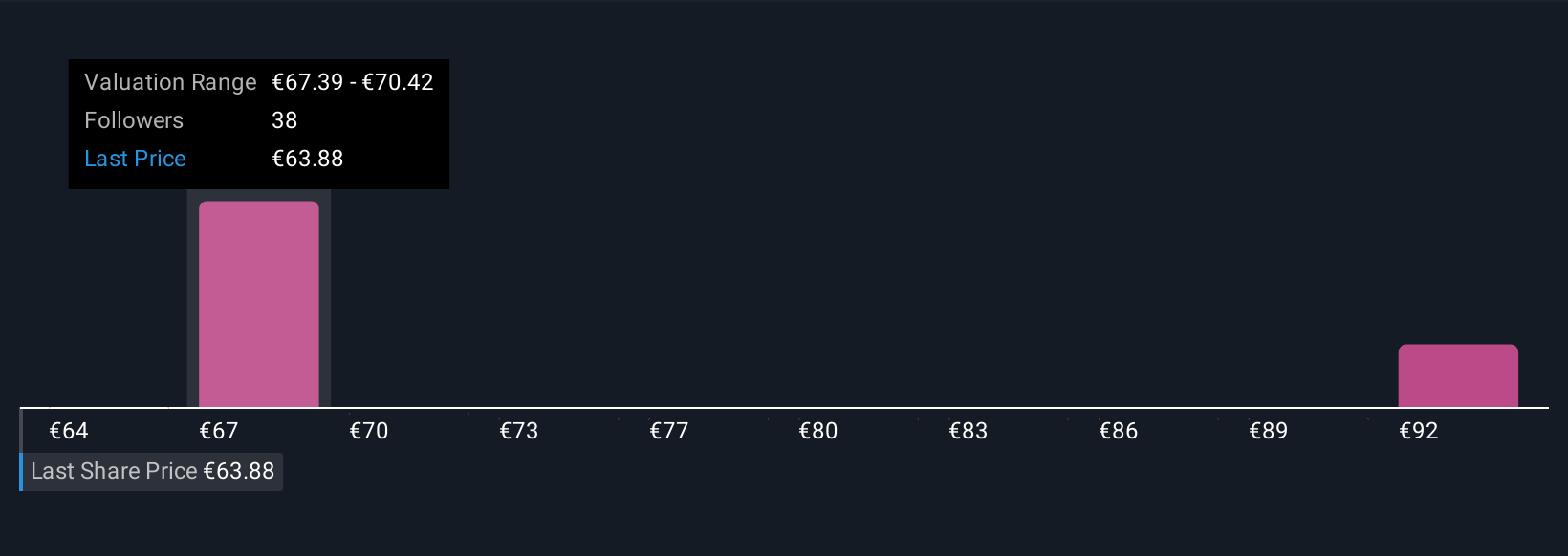

Five individual fair value estimates from the Simply Wall St Community range from €64.35 to €93.45 per share. While margin pressures remain at the forefront after recent quarterly losses, these diverse views show just how differently market participants may assess future prospects, explore several viewpoints to see which resonates most with your outlook.

Explore 5 other fair value estimates on Continental - why the stock might be worth just €64.35!

Build Your Own Continental Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Continental research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Continental research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Continental's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CON

Continental

Manufactures tire and develops and produces solutions for automotive manufacturers, industrial, and end customers worldwide.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives