The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, CEZ, a. s. (SEP:CEZ) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for CEZ a. s

What Is CEZ a. s's Debt?

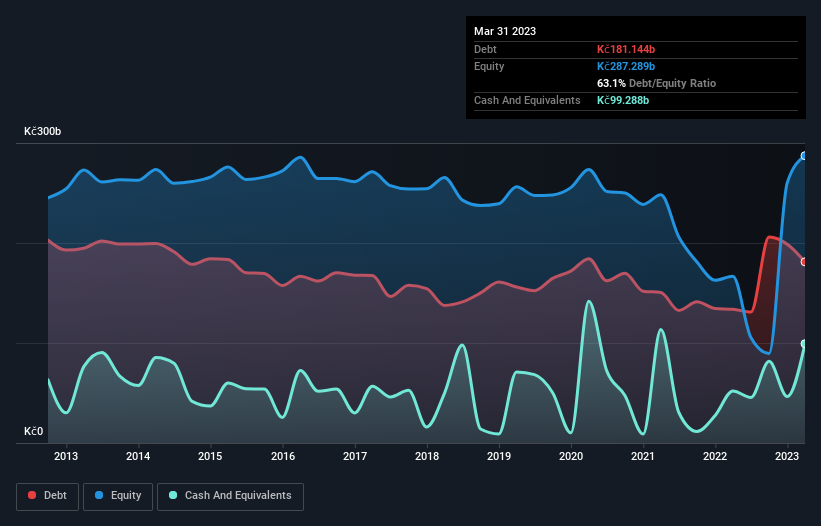

The image below, which you can click on for greater detail, shows that at March 2023 CEZ a. s had debt of Kč181.1b, up from Kč133.7b in one year. However, it also had Kč99.3b in cash, and so its net debt is Kč81.9b.

How Strong Is CEZ a. s' Balance Sheet?

We can see from the most recent balance sheet that CEZ a. s had liabilities of Kč325.1b falling due within a year, and liabilities of Kč330.7b due beyond that. On the other hand, it had cash of Kč99.3b and Kč114.1b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by Kč442.4b.

This deficit is considerable relative to its very significant market capitalization of Kč484.7b, so it does suggest shareholders should keep an eye on CEZ a. s' use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

CEZ a. s has a low net debt to EBITDA ratio of only 0.67. And its EBIT easily covers its interest expense, being 17.2 times the size. So we're pretty relaxed about its super-conservative use of debt. In addition to that, we're happy to report that CEZ a. s has boosted its EBIT by 62%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine CEZ a. s's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, CEZ a. s produced sturdy free cash flow equating to 60% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Happily, CEZ a. s's impressive interest cover implies it has the upper hand on its debt. But truth be told we feel its level of total liabilities does undermine this impression a bit. It's also worth noting that CEZ a. s is in the Electric Utilities industry, which is often considered to be quite defensive. When we consider the range of factors above, it looks like CEZ a. s is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with CEZ a. s , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEP:CEZ

CEZ a. s

Engages in the generation, distribution, trade, and sale of electricity and heat in Western, Central, and Southeastern Europe.

Mediocre balance sheet second-rate dividend payer.