- Czech Republic

- /

- Diversified Financial

- /

- SEP:PVT

RMS Mezzanine, a.s. (SEP:PVT) Stocks Pounded By 31% But Not Lagging Market On Growth Or Pricing

RMS Mezzanine, a.s. (SEP:PVT) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 31% in that time.

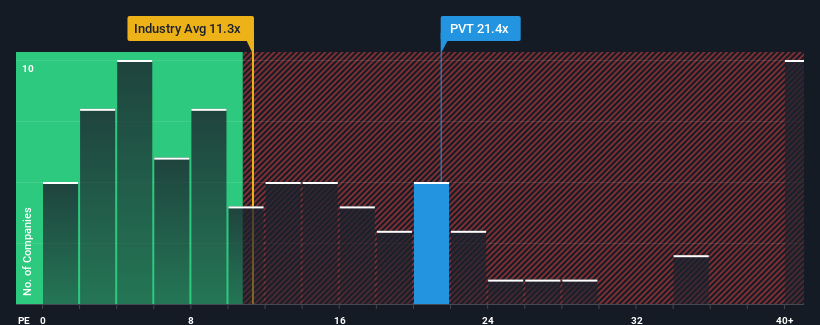

Although its price has dipped substantially, RMS Mezzanine's price-to-earnings (or "P/E") ratio of 21.4x might still make it look like a strong sell right now compared to the market in Czech Republic, where around half of the companies have P/E ratios below 12x and even P/E's below 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For example, consider that RMS Mezzanine's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for RMS Mezzanine

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, RMS Mezzanine would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 17%. Even so, admirably EPS has lifted 105% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's noticeably more attractive on an annualised basis.

In light of this, it's understandable that RMS Mezzanine's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Bottom Line On RMS Mezzanine's P/E

Even after such a strong price drop, RMS Mezzanine's P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that RMS Mezzanine maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 4 warning signs for RMS Mezzanine (2 are concerning!) that you should be aware of before investing here.

If you're unsure about the strength of RMS Mezzanine's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEP:PVT

RMS Mezzanine

Engages in the provision of capital to small-and medium-sized enterprises.

Moderate risk with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion