Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that CEZ, a. s. (SEP:CEZ) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for CEZ a. s

How Much Debt Does CEZ a. s Carry?

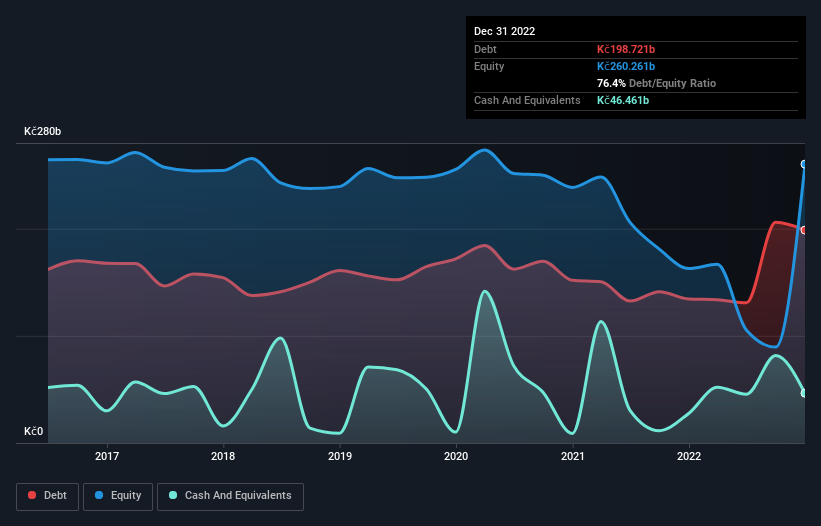

The image below, which you can click on for greater detail, shows that at December 2022 CEZ a. s had debt of Kč198.7b, up from Kč134.5b in one year. However, it does have Kč46.5b in cash offsetting this, leading to net debt of about Kč152.3b.

How Healthy Is CEZ a. s' Balance Sheet?

According to the last reported balance sheet, CEZ a. s had liabilities of Kč507.4b due within 12 months, and liabilities of Kč339.7b due beyond 12 months. Offsetting these obligations, it had cash of Kč46.5b as well as receivables valued at Kč103.3b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by Kč697.3b.

Given this deficit is actually higher than the company's massive market capitalization of Kč564.2b, we think shareholders really should watch CEZ a. s's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

CEZ a. s's net debt is only 1.1 times its EBITDA. And its EBIT covers its interest expense a whopping 24.2 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Even more impressive was the fact that CEZ a. s grew its EBIT by 215% over twelve months. That boost will make it even easier to pay down debt going forward. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if CEZ a. s can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Looking at the most recent three years, CEZ a. s recorded free cash flow of 23% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Both CEZ a. s's ability to to cover its interest expense with its EBIT and its EBIT growth rate gave us comfort that it can handle its debt. But truth be told its level of total liabilities had us nibbling our nails. We would also note that Electric Utilities industry companies like CEZ a. s commonly do use debt without problems. Looking at all this data makes us feel a little cautious about CEZ a. s's debt levels. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 4 warning signs for CEZ a. s (3 are potentially serious) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEP:CEZ

CEZ a. s

Engages in the generation, distribution, trade, and sale of electricity and heat in Western, Central, and Southeastern Europe.

Mediocre balance sheet second-rate dividend payer.