- Czech Republic

- /

- Aerospace & Defense

- /

- SEP:CZG

Colt CZ Group SE's (SEP:CZG) Shares Not Telling The Full Story

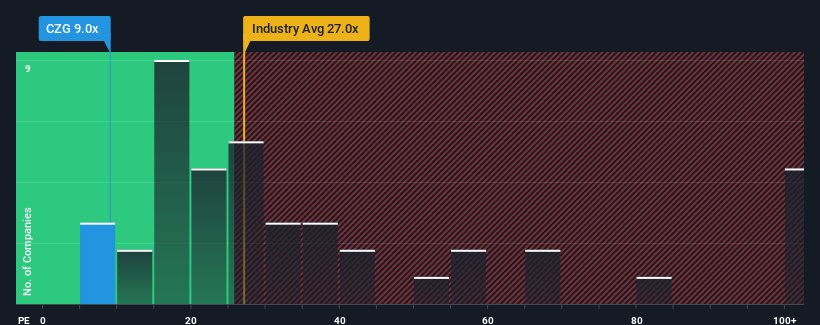

When close to half the companies in Czech Republic have price-to-earnings ratios (or "P/E's") above 12x, you may consider Colt CZ Group SE (SEP:CZG) as an attractive investment with its 9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's exceedingly strong of late, Colt CZ Group has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Colt CZ Group

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Colt CZ Group's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 84%. The strong recent performance means it was also able to grow EPS by 187% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 13% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Colt CZ Group is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Colt CZ Group revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 2 warning signs for Colt CZ Group (1 can't be ignored!) that we have uncovered.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEP:CZG

Colt CZ Group

Engages in the production and sale of firearms, ammunition products, and tactical accessories in the Czech Republic, Canada the United States, rest of Europe, Africa, Asia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026