- Sweden

- /

- Life Sciences

- /

- OM:ALIF B

3 European Stocks That May Be Undervalued By As Much As 39.6%

Reviewed by Simply Wall St

As European markets grapple with concerns over U.S. trade tariffs and monetary policy uncertainties, the pan-European STOXX Europe 600 Index has recently experienced a decline, reflecting broader economic apprehensions. In such an environment, identifying undervalued stocks can be crucial for investors seeking opportunities; these stocks often exhibit strong fundamentals or potential for growth that may not yet be fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.02 | SEK164.54 | 49.5% |

| Wienerberger (WBAG:WIE) | €35.24 | €69.57 | 49.3% |

| CTT Systems (OM:CTT) | SEK228.00 | SEK443.67 | 48.6% |

| Net Insight (OM:NETI B) | SEK4.92 | SEK9.58 | 48.6% |

| Storytel (OM:STORY B) | SEK90.85 | SEK180.37 | 49.6% |

| Star7 (BIT:STAR7) | €6.30 | €12.42 | 49.3% |

| InTiCa Systems (XTRA:IS7) | €4.22 | €8.25 | 48.9% |

| Fodelia Oyj (HLSE:FODELIA) | €7.12 | €13.91 | 48.8% |

| MilDef Group (OM:MILDEF) | SEK208.50 | SEK405.57 | 48.6% |

| Galderma Group (SWX:GALD) | CHF96.38 | CHF189.25 | 49.1% |

Let's take a closer look at a couple of our picks from the screened companies.

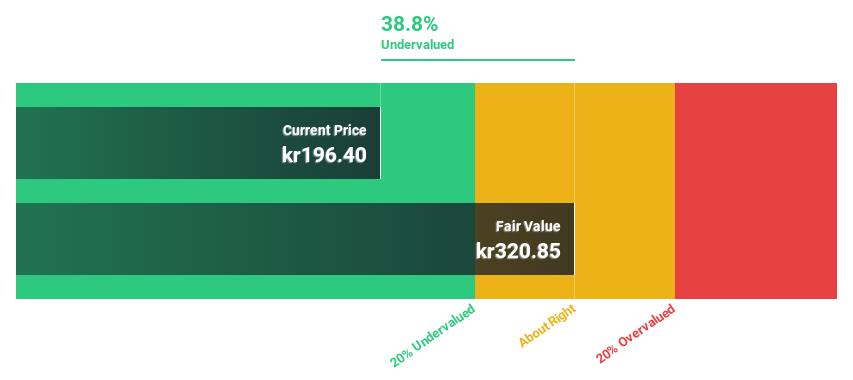

Borregaard (OB:BRG)

Overview: Borregaard ASA develops, produces, and markets specialized biomaterials and biochemicals globally, with a market cap of NOK17.56 billion.

Operations: The company's revenue segments consist of Bio Materials at NOK2.62 billion, Bio Solutions at NOK4.24 billion, and Fine Chemicals at NOK799 million.

Estimated Discount To Fair Value: 39.6%

Borregaard is trading at NOK176, significantly below its estimated fair value of NOK291.48, suggesting it may be undervalued based on cash flows. Analysts forecast earnings growth of 14.6% annually, outpacing the Norwegian market's 8%. Recent financials show Q4 sales increased to NOK1.74 billion from NOK1.61 billion year-over-year, though full-year net income slightly declined to NOK823 million from NOK870 million. The proposed dividend for 2024 is set at NOK4.25 per share.

- Our earnings growth report unveils the potential for significant increases in Borregaard's future results.

- Click here to discover the nuances of Borregaard with our detailed financial health report.

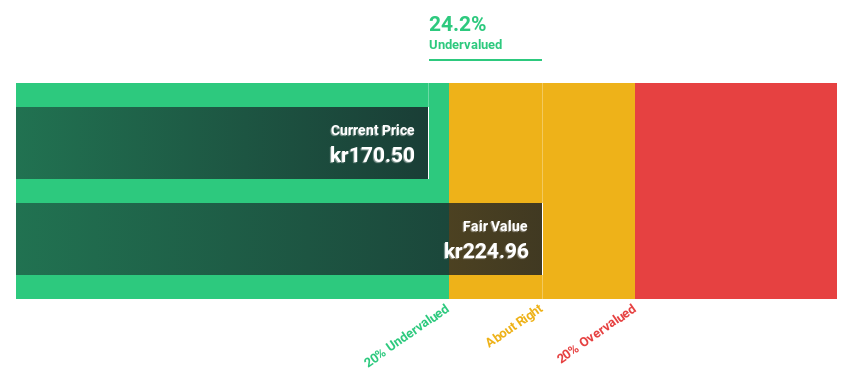

AddLife (OM:ALIF B)

Overview: AddLife AB (publ) and its subsidiaries supply equipment, consumables, and reagents to the healthcare sector, research institutions, educational entities, and the food and pharmaceutical industries with a market cap of SEK18.21 billion.

Operations: The company's revenue is primarily derived from its Labtech segment, which generated SEK3.80 billion, and its Medtech segment, which contributed SEK6.50 billion.

Estimated Discount To Fair Value: 32%

AddLife, trading at SEK149.4, is valued below its estimated fair value of SEK219.82, highlighting potential undervaluation based on cash flows. Analysts project significant earnings growth of 30.22% annually over the next three years, surpassing the Swedish market's average. Recent results show Q4 sales increased to SEK2.82 billion from SEK2.54 billion year-over-year, with net income improving to SEK94 million from a loss previously reported; a dividend of SEK0.75 per share was proposed for 2024.

- Upon reviewing our latest growth report, AddLife's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of AddLife stock in this financial health report.

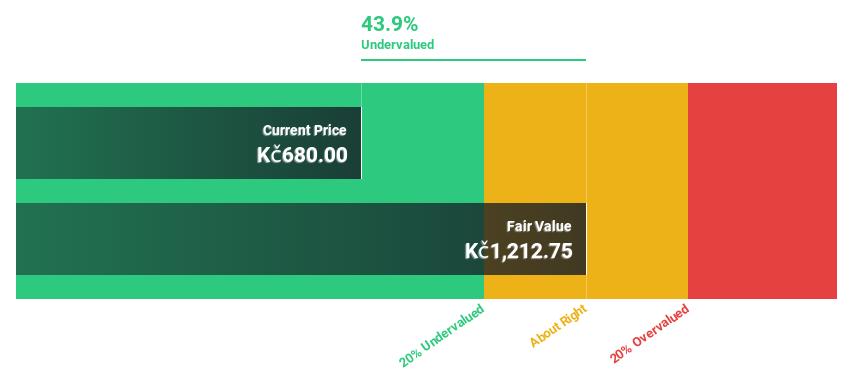

Colt CZ Group (SEP:CZG)

Overview: Colt CZ Group SE, along with its subsidiaries, is involved in the production, purchase, and sale of firearms, ammunition products, and tactical accessories across various regions including the Czech Republic, Canada the United States Europe Africa Asia and other international markets; it has a market cap of CZK43.31 billion.

Operations: The company's revenue primarily comes from its Firearms and Accessories segment, which generated CZK26.22 billion.

Estimated Discount To Fair Value: 30.9%

Colt CZ Group, trading at CZK767, is significantly undervalued based on discounted cash flow analysis, with an estimated fair value of CZK1110.53. Despite a decline in profit margins from last year and high debt relative to operating cash flow, earnings are forecast to grow 58.3% annually over the next three years—outpacing the Czech market's growth rate. However, shareholders faced substantial dilution recently and dividends remain unsustainably covered by earnings or free cash flows.

- Our comprehensive growth report raises the possibility that Colt CZ Group is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Colt CZ Group.

Seize The Opportunity

- Unlock our comprehensive list of 208 Undervalued European Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade AddLife, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:ALIF B

AddLife

Provides equipment, consumables, and reagents primarily to healthcare sector, research, colleges, and universities, as well as the food and pharmaceutical industries.

Reasonable growth potential with proven track record.