- Czech Republic

- /

- Banks

- /

- SEP:KOMB

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As we step into January 2025, global markets present a mixed landscape, with U.S. stocks ending the year on a high note despite some recent volatility and economic indicators like the Chicago PMI showing signs of contraction. In this environment, dividend stocks can offer investors a degree of stability and income potential, making them an attractive option amid fluctuating market conditions and economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.06% | ★★★★★★ |

Click here to see the full list of 1971 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

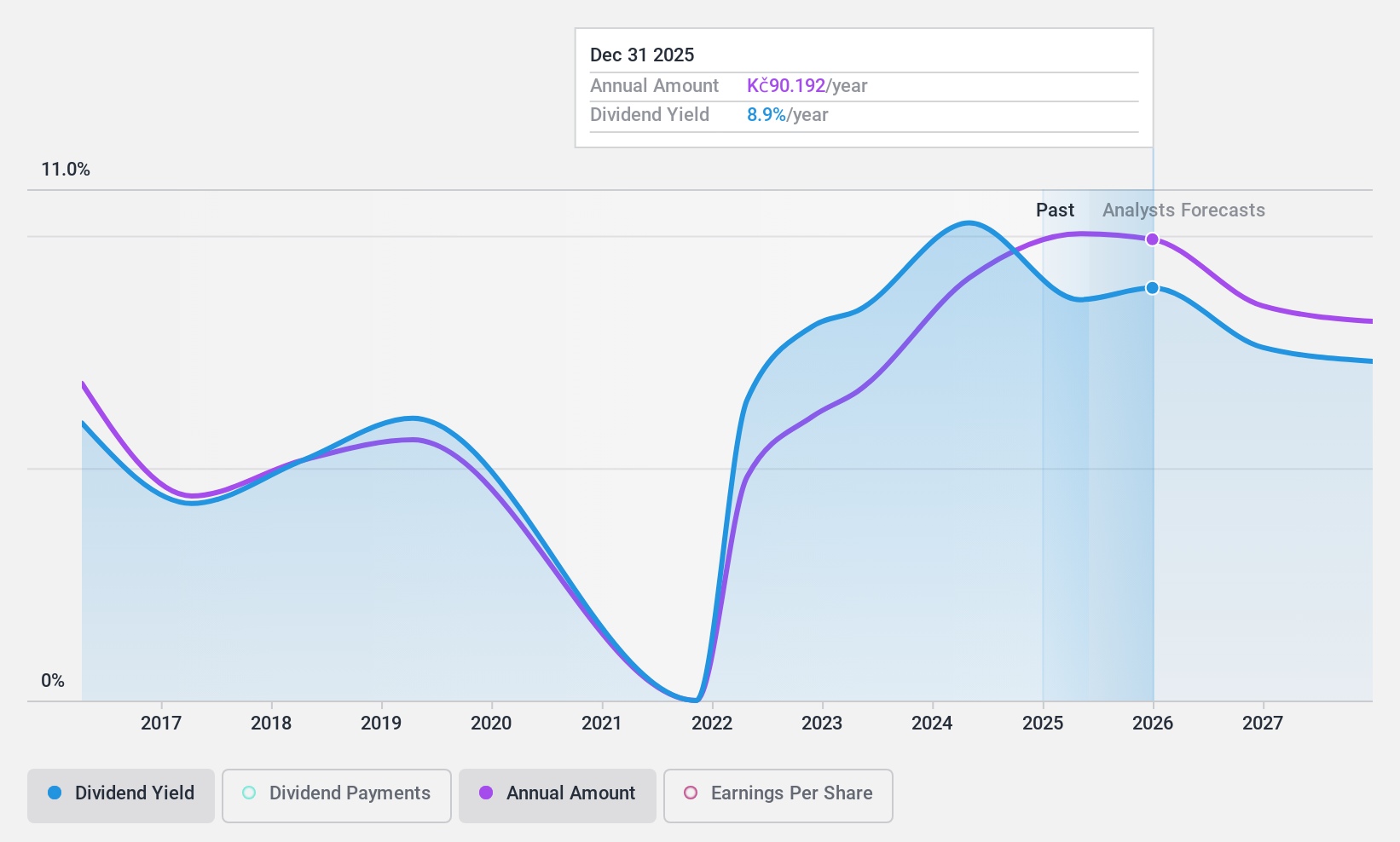

Hanwha General Insurance (KOSE:A000370)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanwha General Insurance Co., Ltd. operates as a provider of insurance services in South Korea with a market capitalization of ₩475.78 billion.

Operations: Hanwha General Insurance Co., Ltd. generates revenue primarily from its Property & Casualty insurance segment, amounting to ₩5.55 billion.

Dividend Yield: 4.9%

Hanwha General Insurance offers an attractive dividend yield of 4.86%, placing it in the top 25% of dividend payers in South Korea. Despite only having a five-year history of dividend payments, which have been volatile, the company's dividends are well-covered by earnings and cash flows with low payout ratios (9.5% and 1.9%, respectively). Trading significantly below its estimated fair value, it presents good relative value compared to peers and industry standards.

- Get an in-depth perspective on Hanwha General Insurance's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Hanwha General Insurance's share price might be too pessimistic.

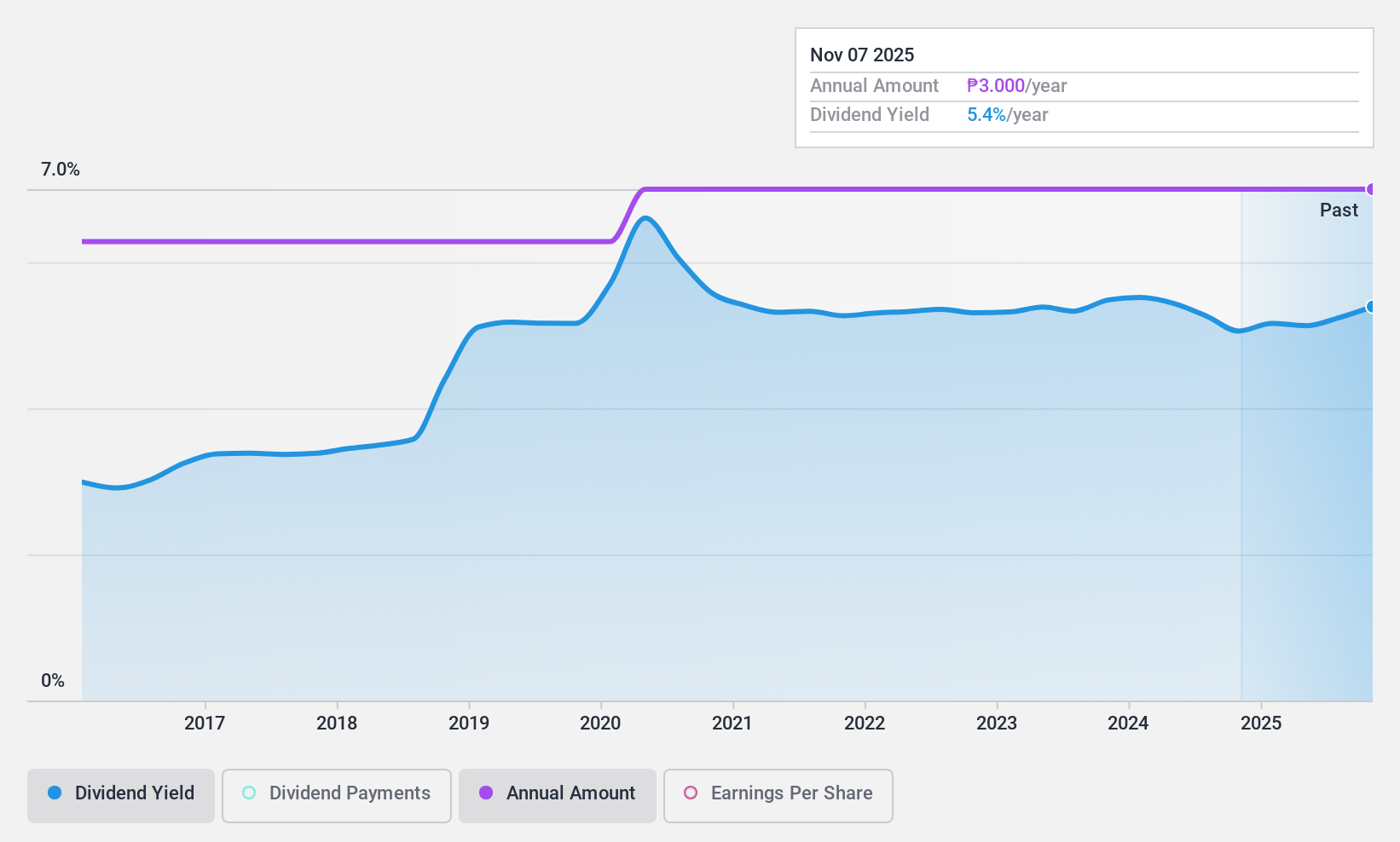

Philippine Savings Bank (PSE:PSB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Philippine Savings Bank primarily engages in savings and mortgage banking activities in the Philippines, with a market cap of ₱25.10 billion.

Operations: Philippine Savings Bank generates its revenue from several key segments: Treasury (₱2.25 billion), Branch Banking (₱7.58 billion), Consumer Banking (₱4.01 billion), and Corporate Banking (₱711.58 million).

Dividend Yield: 5.1%

Philippine Savings Bank offers a stable and growing dividend, with payments increasing over the past decade. Its recent third-quarter earnings showed strong growth, with net income rising to PHP 1.44 billion from PHP 1.20 billion a year ago, supporting its reliable dividend distribution. The bank's payout ratio is low at 24.8%, indicating dividends are well-covered by earnings. However, its yield of 5.1% is below the top tier in the Philippine market.

- Click to explore a detailed breakdown of our findings in Philippine Savings Bank's dividend report.

- Our valuation report unveils the possibility Philippine Savings Bank's shares may be trading at a premium.

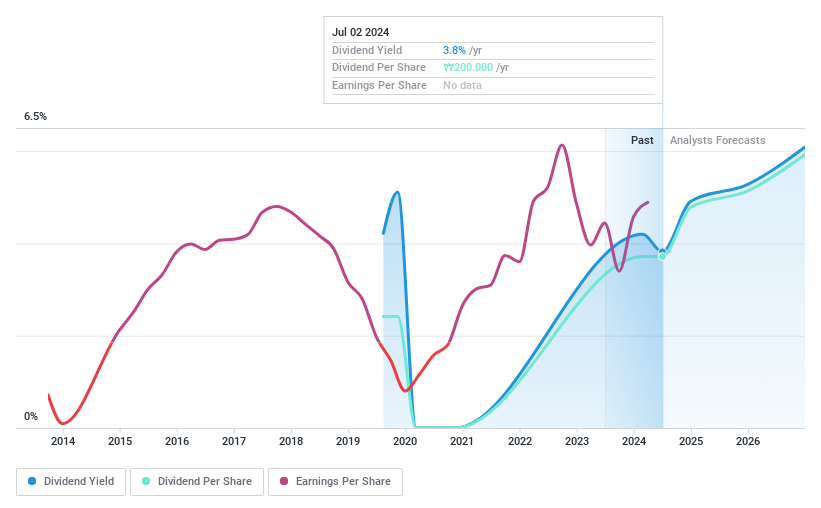

Komercní banka (SEP:KOMB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Komercní banka, a.s. is a financial institution offering retail, corporate, and investment banking services mainly in the Czech Republic and Central and Eastern Europe, with a market cap of CZK161.85 billion.

Operations: Komercní banka generates its revenue from providing a range of banking services, including retail, corporate, and investment solutions across the Czech Republic and Central and Eastern Europe.

Dividend Yield: 9.6%

Komercní banka's dividend yield of 9.65% ranks within the top 25% in the Czech market but is not well-covered by earnings, with a high payout ratio of 98.8%. Although dividends have increased over the past decade, they have been volatile and unreliable. Earnings are forecast to decline slightly, while revenue is expected to grow at 5.94% annually. The stock trades at a discount of 26.5% below its estimated fair value, offering potential value for investors despite challenges in dividend sustainability.

- Take a closer look at Komercní banka's potential here in our dividend report.

- According our valuation report, there's an indication that Komercní banka's share price might be on the cheaper side.

Make It Happen

- Take a closer look at our Top Dividend Stocks list of 1971 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Komercní banka might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEP:KOMB

Komercní banka

Provides various retail, corporate, and investment banking services primarily in the Czech Republic, and Central and Eastern Europe.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives