- Czech Republic

- /

- Banks

- /

- SEP:KOMB

Don't Race Out To Buy Komercní banka, a.s. (SEP:KOMB) Just Because It's Going Ex-Dividend

Komercní banka, a.s. (SEP:KOMB) is about to trade ex-dividend in the next three days. Typically, the ex-dividend date is two business days before the record date, which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Accordingly, Komercní banka investors that purchase the stock on or after the 5th of May will not receive the dividend, which will be paid on the 26th of May.

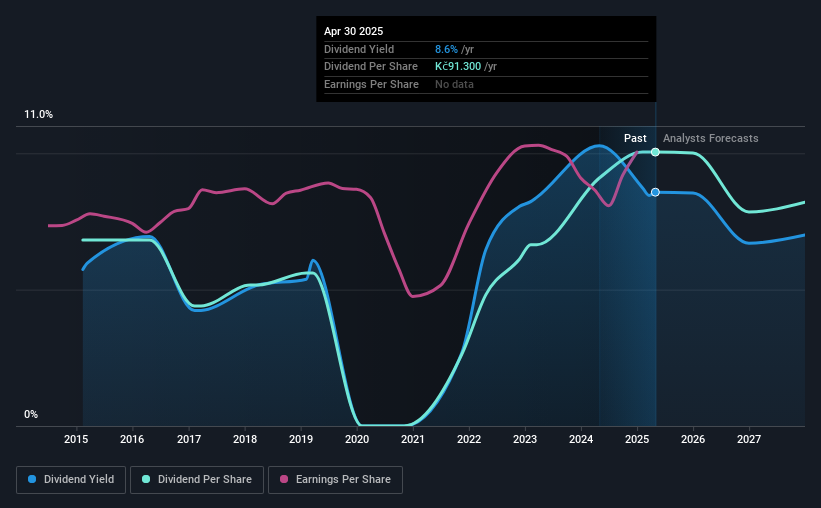

The company's next dividend payment will be Kč91.30 per share. Last year, in total, the company distributed Kč91.30 to shareholders. Last year's total dividend payments show that Komercní banka has a trailing yield of 8.6% on the current share price of Kč1065.00. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. We need to see whether the dividend is covered by earnings and if it's growing.

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Last year Komercní banka paid out 100% of its profits as dividends to shareholders, suggesting the dividend is not well covered by earnings.

When the dividend payout ratio is high, as it is in this case, the dividend is usually at greater risk of being cut in the future.

View our latest analysis for Komercní banka

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're encouraged by the steady growth at Komercní banka, with earnings per share up 3.0% on average over the last five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the past 10 years, Komercní banka has increased its dividend at approximately 3.9% a year on average. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

The Bottom Line

Is Komercní banka worth buying for its dividend? While we like that its earnings are growing somewhat, we're not enamored that it's paying out 100% of last year's earnings. Komercní banka doesn't appear to have a lot going for it, and we're not inclined to take a risk on owning it for the dividend.

So if you're still interested in Komercní banka despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. Our analysis shows 1 warning sign for Komercní banka and you should be aware of this before buying any shares.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

If you're looking to trade Komercní banka, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Komercní banka might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEP:KOMB

Komercní banka

Provides various retail, corporate, and investment banking services primarily in the Czech Republic, and Central and Eastern Europe.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives