Vassiliko Cement Works Public Company Ltd's (CSE:VCW) dividend is being reduced to €0.13 on the 28th of June. However, the dividend yield of 7.7% is still a decent boost to shareholder returns.

View our latest analysis for Vassiliko Cement Works

Vassiliko Cement Works' Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, Vassiliko Cement Works' dividend was making up a very large proportion of earnings and perhaps more concerning was that it was 359% of cash flows. Paying out such a high proportion of cash flows certainly exposes the company to cutting the dividend if cash flows were to reduce.

If the company can't turn things around, EPS could fall by 3.3% over the next year. However, if the dividend continues along recent trends, we estimate the payout ratio could reach 91%, meaning that most of the company's earnings is being paid out to shareholders.

Dividend Volatility

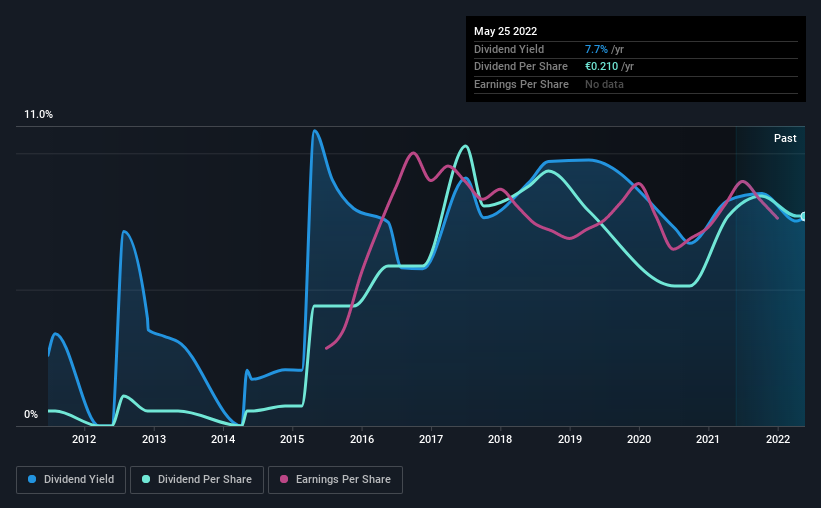

The company has a long dividend track record, but it doesn't look great with cuts in the past. The first annual payment during the last 10 years was €0.015 in 2012, and the most recent fiscal year payment was €0.21. This implies that the company grew its distributions at a yearly rate of about 30% over that duration. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

Vassiliko Cement Works May Find It Hard To Grow The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Vassiliko Cement Works has seen earnings per share falling at 3.3% per year over the last five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

Vassiliko Cement Works' Dividend Doesn't Look Sustainable

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. The track record isn't great, and the payments are a bit high to be considered sustainable. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 2 warning signs for Vassiliko Cement Works (1 is a bit unpleasant!) that you should be aware of before investing. Is Vassiliko Cement Works not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CSE:VCW

Vassiliko Cement Works

Engages in the production and sale of clinker and cement products in Cyprus and Israel.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026