- Cyprus

- /

- Oil and Gas

- /

- CSE:PHL

Petrolina (Holdings) (CSE:PHL) Will Pay A Larger Dividend Than Last Year At €0.025

Petrolina (Holdings) Public Ltd (CSE:PHL) will increase its dividend on the 26th of October to €0.025. This makes the dividend yield 6.4%, which is above the industry average.

See our latest analysis for Petrolina (Holdings)

Petrolina (Holdings) Doesn't Earn Enough To Cover Its Payments

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Before making this announcement, Petrolina (Holdings)'s dividend was higher than its profits, but the free cash flows quite comfortably covered it. Healthy cash flows are always a positive sign, especially when they quite easily cover the dividend.

Looking forward, EPS could fall by 15.3% if the company can't turn things around from the last few years. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 209%, which is definitely a bit high to be sustainable going forward.

Dividend Volatility

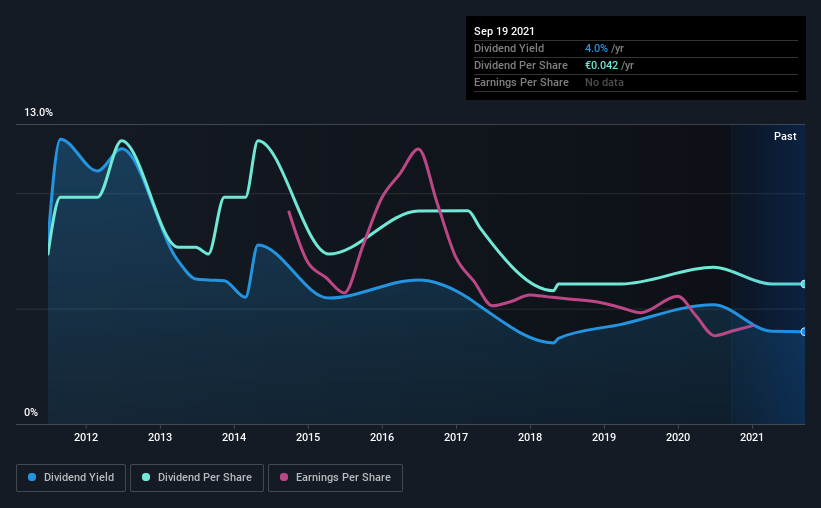

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. Since 2011, the first annual payment was €0.051, compared to the most recent full-year payment of €0.042. This works out to be a decline of approximately 1.9% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Petrolina (Holdings)'s EPS has fallen by approximately 15% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

The Dividend Could Prove To Be Unreliable

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The payments haven't been particularly stable and we don't see huge growth potential, but with the dividend well covered by cash flows it could prove to be reliable over the short term. We don't think Petrolina (Holdings) is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 3 warning signs for Petrolina (Holdings) (of which 2 make us uncomfortable!) you should know about. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CSE:PHL

Petrolina (Holdings)

Engages in the import and marketing of petroleum products in Cyprus.

Proven track record and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026