- China

- /

- Water Utilities

- /

- SZSE:300055

It's Down 26% But Beijing Water Business Doctor Co., Ltd. (SZSE:300055) Could Be Riskier Than It Looks

Beijing Water Business Doctor Co., Ltd. (SZSE:300055) shares have had a horrible month, losing 26% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 28% in that time.

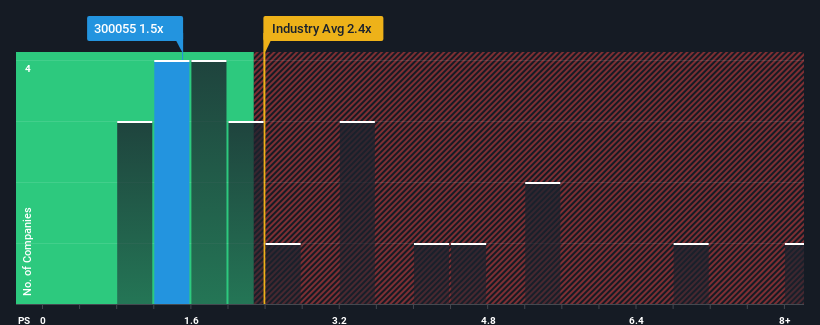

Following the heavy fall in price, Beijing Water Business Doctor may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.5x, since almost half of all companies in the Water Utilities industry in China have P/S ratios greater than 2.4x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Beijing Water Business Doctor

How Beijing Water Business Doctor Has Been Performing

As an illustration, revenue has deteriorated at Beijing Water Business Doctor over the last year, which is not ideal at all. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on Beijing Water Business Doctor will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Beijing Water Business Doctor, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Beijing Water Business Doctor's Revenue Growth Trending?

In order to justify its P/S ratio, Beijing Water Business Doctor would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 21%. Still, the latest three year period has seen an excellent 55% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 12%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that Beijing Water Business Doctor's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Beijing Water Business Doctor's P/S Mean For Investors?

Beijing Water Business Doctor's recently weak share price has pulled its P/S back below other Water Utilities companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Beijing Water Business Doctor currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Beijing Water Business Doctor that you should be aware of.

If you're unsure about the strength of Beijing Water Business Doctor's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Water Business Doctor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300055

Beijing Water Business Doctor

Engages in water engineering and operation, hazardous and solid waste treatment, environmental protection, and equipment manufacturing businesses in China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives