- China

- /

- Gas Utilities

- /

- SZSE:002700

There's Reason For Concern Over Xinjiang Haoyuan Natural Gas Co., Ltd.'s (SZSE:002700) Massive 25% Price Jump

Xinjiang Haoyuan Natural Gas Co., Ltd. (SZSE:002700) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 31% in the last year.

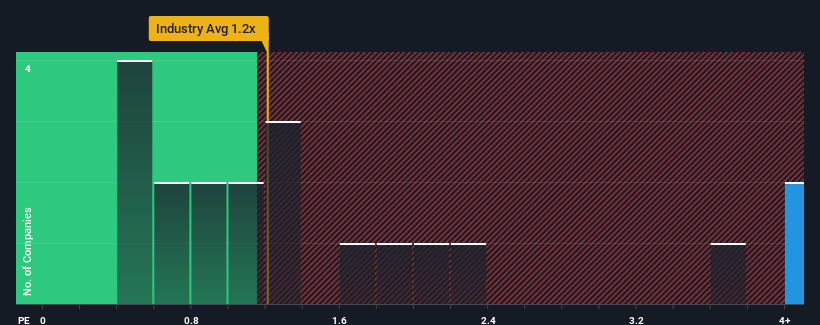

Following the firm bounce in price, you could be forgiven for thinking Xinjiang Haoyuan Natural Gas is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.2x, considering almost half the companies in China's Gas Utilities industry have P/S ratios below 1.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Xinjiang Haoyuan Natural Gas

What Does Xinjiang Haoyuan Natural Gas' P/S Mean For Shareholders?

For instance, Xinjiang Haoyuan Natural Gas' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Xinjiang Haoyuan Natural Gas, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Xinjiang Haoyuan Natural Gas would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 37% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 10% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that Xinjiang Haoyuan Natural Gas' P/S exceeds that of its industry peers. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Key Takeaway

The strong share price surge has lead to Xinjiang Haoyuan Natural Gas' P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Xinjiang Haoyuan Natural Gas revealed its three-year revenue trends aren't impacting its high P/S as much as we would have predicted, given they look similar to current industry expectations. When we see average revenue with industry-like growth combined with a high P/S, we suspect the share price is at risk of declining, bringing the P/S back in line with the industry too. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Xinjiang Haoyuan Natural Gas (at least 1 which makes us a bit uncomfortable), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002700

Xinjiang Wanjing Energy

Engages in the transmission, distribution, and sale of natural gas in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives