As we enter December 2025, the Asian markets are navigating a landscape shaped by global economic shifts, including recent interest rate cuts by the Federal Reserve and mixed signals from technology stocks. In this dynamic environment, identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals and resilience to broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Soliton Systems K.K | 0.47% | 2.84% | 2.40% | ★★★★★★ |

| Lion Rock Group | 5.00% | 14.21% | 13.26% | ★★★★★★ |

| Woori Technology Investment | NA | 8.42% | -4.10% | ★★★★★★ |

| Natural Food International Holding | NA | 8.04% | 37.71% | ★★★★★★ |

| Shenzhen Coship Electronics | NA | 34.28% | 60.52% | ★★★★★★ |

| GDEP ADVANCEInc | NA | 27.84% | 19.61% | ★★★★★★ |

| Suzhou Xingye Materials TechnologyLtd | 0.14% | -3.11% | -19.10% | ★★★★★☆ |

| Advancetek EnterpriseLtd | 60.69% | 28.66% | 48.38% | ★★★★★☆ |

| YFY | 69.02% | -0.89% | -31.10% | ★★★★☆☆ |

| Guangdong Brandmax MarketingLtd | 20.75% | -9.15% | -24.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Allied Machinery (SHSE:605060)

Simply Wall St Value Rating: ★★★★★☆

Overview: Allied Machinery Co., Ltd. specializes in the design, research and development, production, and sale of high-precision mechanical parts and precision cavity mold products in China and the United States, with a market cap of CN¥9.99 billion.

Operations: Allied Machinery generates revenue primarily from the sale of high-precision mechanical parts and precision cavity mold products. The company's cost structure includes expenses related to production and development, impacting its profitability. It has a market capitalization of CN¥9.99 billion, reflecting its scale in the industry.

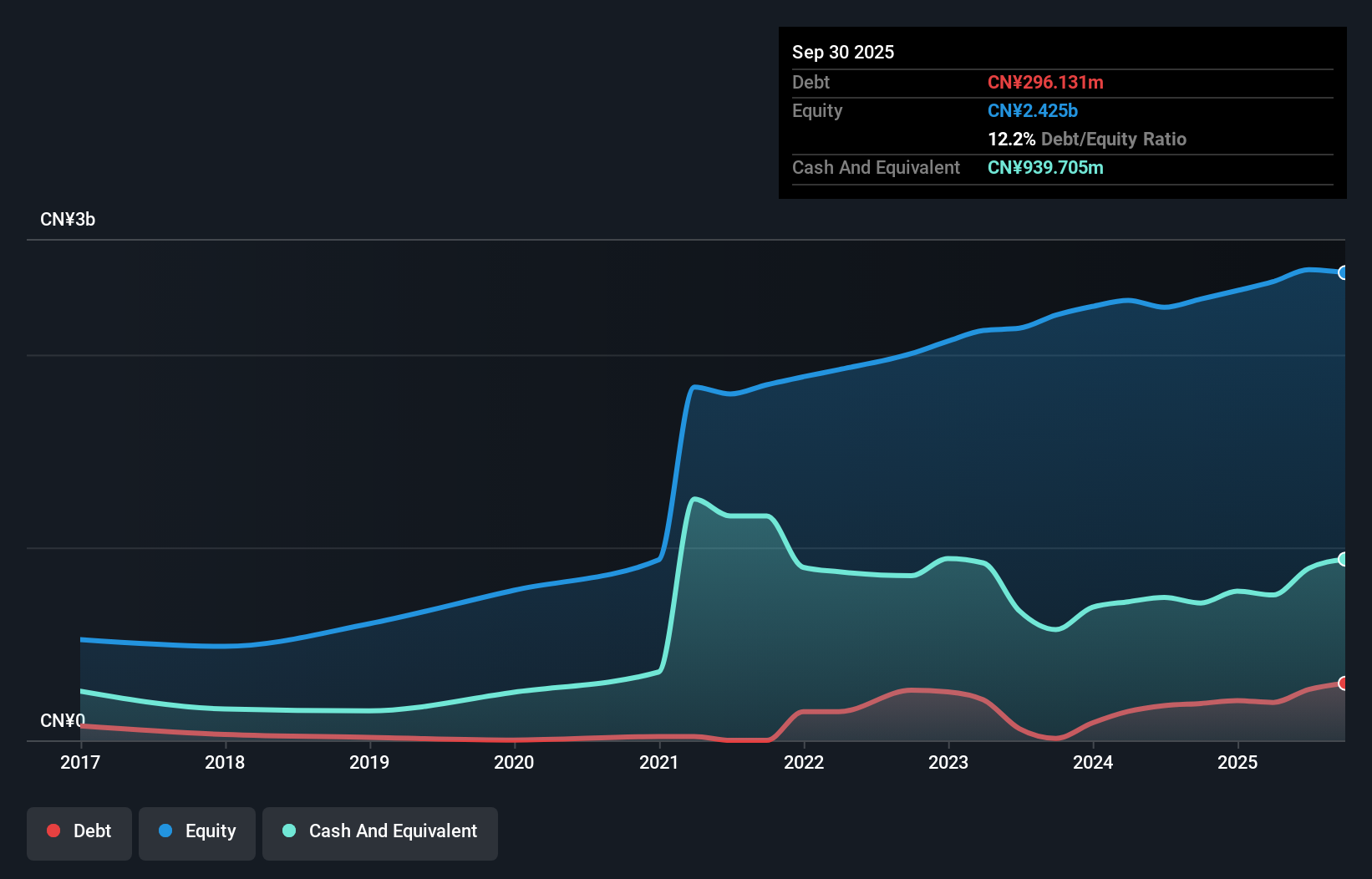

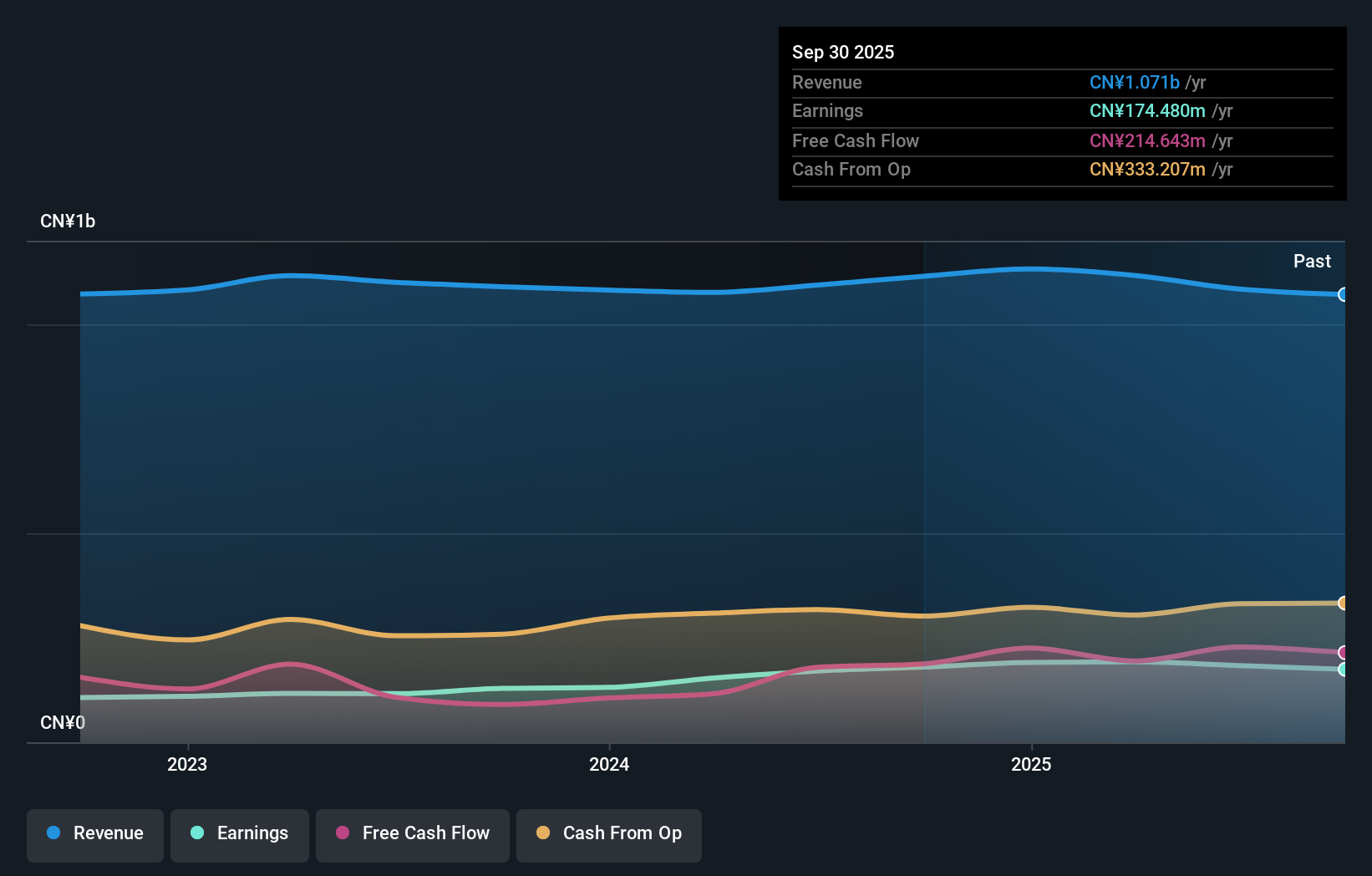

Allied Machinery, a smaller player in the machinery industry, has been making waves with its impressive financial performance. Over the past year, earnings grew by 13.4%, outpacing the industry's 6.1% growth rate, and net income reached CNY 177.81 million for the first nine months of 2025 compared to CNY 146.27 million a year ago. Despite an increase in its debt-to-equity ratio from 1.7% to 12.2% over five years, Allied maintains more cash than total debt and is considered good value with a price-to-earnings ratio of 45.6x below the industry average of 47x—suggesting potential for future growth as earnings are forecasted to grow at an impressive rate of over 37% annually.

- Navigate through the intricacies of Allied Machinery with our comprehensive health report here.

Understand Allied Machinery's track record by examining our Past report.

Jiangxi Bestoo EnergyLtd (SZSE:001376)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Bestoo Energy Co., Ltd. specializes in providing centralized heating services to industrial parks, clusters, and downstream industrial customers in China, with a market capitalization of CN¥6.78 billion.

Operations: Bestoo Energy generates revenue primarily from centralized heating services. The company's net profit margin has shown variability, with the latest figure at 18.5%.

Jiangxi Bestoo Energy, a smaller player in the energy sector, showcases a mixed financial picture. While its price-to-earnings ratio of 38.8x is attractive compared to the CN market's 43.5x, earnings growth has taken a hit with a -3% change over the past year. The company's debt situation seems well-managed, as it holds more cash than total debt and enjoys robust interest coverage at 165.4x EBIT. Recent earnings for nine months ending September 2025 show revenue at CNY 756 million and net income at CNY 132 million, both slightly down from last year’s figures.

Suzhou Hailu Heavy IndustryLtd (SZSE:002255)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Hailu Heavy Industry Co., Ltd specializes in the design, manufacture, and sale of industrial waste heat boilers, large and special material pressure vessels, and nuclear safety equipment with a market cap of CN¥11.05 billion.

Operations: Suzhou Hailu Heavy Industry Co., Ltd generates revenue primarily through the sale of industrial waste heat boilers, large and special material pressure vessels, and nuclear safety equipment. The company's market capitalization is CN¥11.05 billion.

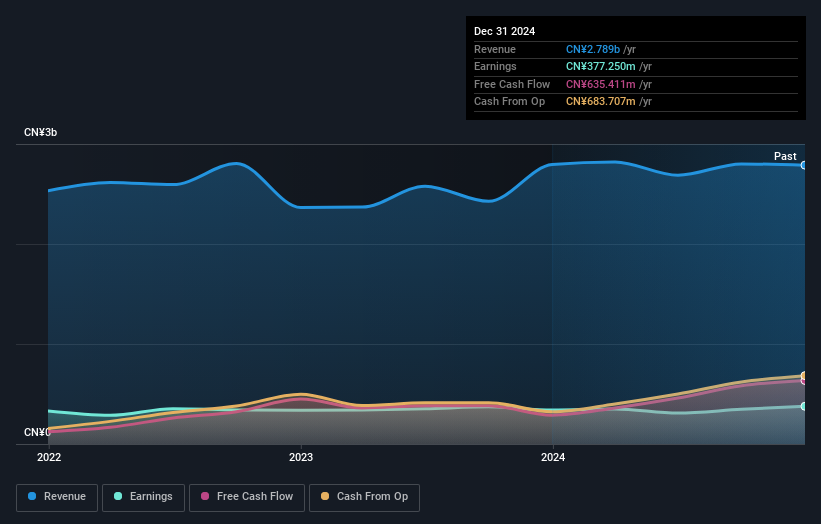

Suzhou Hailu Heavy Industry, a notable player in the machinery sector, has demonstrated robust performance despite a volatile share price. The company is debt-free, contrasting with five years ago when its debt-to-equity ratio was 3.6%. Recent earnings growth of 31% outpaced the industry average of 6%, showcasing its competitive edge. Although sales for the first nine months of 2025 dropped to ¥1.68 billion from ¥1.78 billion last year, net income increased to ¥319.69 million from ¥240.96 million, reflecting high-quality earnings and effective cost management strategies that could support future growth prospects within this dynamic market segment.

- Dive into the specifics of Suzhou Hailu Heavy IndustryLtd here with our thorough health report.

Learn about Suzhou Hailu Heavy IndustryLtd's historical performance.

Next Steps

- Take a closer look at our Asian Undiscovered Gems With Strong Fundamentals list of 2487 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605060

Allied Machinery

Designs, researches and develops, produces, and sells high-precision mechanical parts and precision cavity mold products in China and the United States.

High growth potential with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)