- China

- /

- Renewable Energy

- /

- SZSE:000539

Not Many Are Piling Into Guangdong Electric Power Development Co., Ltd. (SZSE:000539) Just Yet

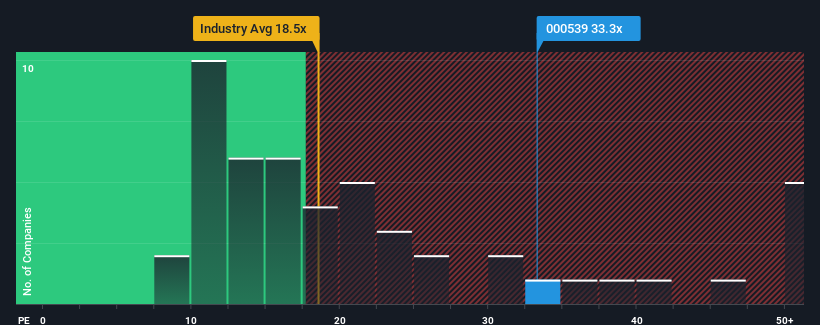

There wouldn't be many who think Guangdong Electric Power Development Co., Ltd.'s (SZSE:000539) price-to-earnings (or "P/E") ratio of 33.3x is worth a mention when the median P/E in China is similar at about 36x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Guangdong Electric Power Development has been doing quite well of late. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

See our latest analysis for Guangdong Electric Power Development

Is There Some Growth For Guangdong Electric Power Development?

There's an inherent assumption that a company should be matching the market for P/E ratios like Guangdong Electric Power Development's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 58% last year. Pleasingly, EPS has also lifted 200% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 201% during the coming year according to the following the company. Meanwhile, the rest of the market is forecast to only expand by 38%, which is noticeably less attractive.

In light of this, it's curious that Guangdong Electric Power Development's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Guangdong Electric Power Development's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Guangdong Electric Power Development currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Guangdong Electric Power Development (2 are concerning) you should be aware of.

If you're unsure about the strength of Guangdong Electric Power Development's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000539

Guangdong Electric Power Development

Develops and operates electric power projects in the People’s Republic of China.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives