- China

- /

- Renewable Energy

- /

- SZSE:000040

Tunghsu Azure Renewable EnergyLtd (SZSE:000040 investor five-year losses grow to 80% as the stock sheds CN¥178m this past week

We're definitely into long term investing, but some companies are simply bad investments over any time frame. We really hate to see fellow investors lose their hard-earned money. Spare a thought for those who held Tunghsu Azure Renewable Energy Co.,Ltd. (SZSE:000040) for five whole years - as the share price tanked 80%. And it's not just long term holders hurting, because the stock is down 77% in the last year. The falls have accelerated recently, with the share price down 52% in the last three months.

After losing 14% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Tunghsu Azure Renewable EnergyLtd

Tunghsu Azure Renewable EnergyLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Tunghsu Azure Renewable EnergyLtd reduced its trailing twelve month revenue by 30% for each year. That's definitely a weaker result than most pre-profit companies report. So it's not altogether surprising to see the share price down 12% per year in the same time period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

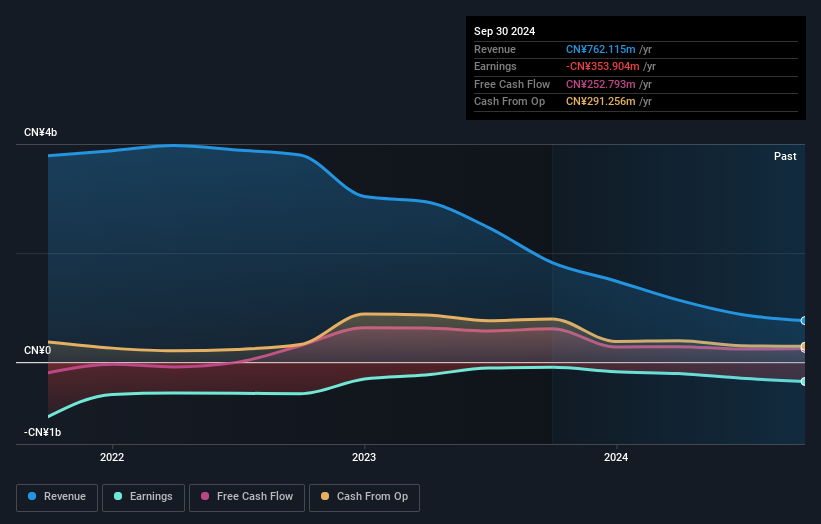

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Investors in Tunghsu Azure Renewable EnergyLtd had a tough year, with a total loss of 77%, against a market gain of about 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Tunghsu Azure Renewable EnergyLtd better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Tunghsu Azure Renewable EnergyLtd .

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

If you're looking to trade Tunghsu Azure Renewable EnergyLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tunghsu Azure Renewable EnergyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000040

Tunghsu Azure Renewable EnergyLtd

Engages in new energy business in China and internationally.

Excellent balance sheet and slightly overvalued.