- China

- /

- Gas Utilities

- /

- SHSE:603393

Little Excitement Around Xinjiang Xintai Natural Gas Co., Ltd.'s (SHSE:603393) Earnings

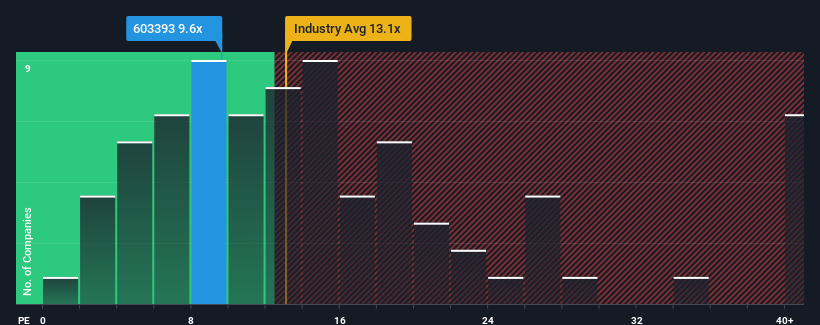

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 38x, you may consider Xinjiang Xintai Natural Gas Co., Ltd. (SHSE:603393) as a highly attractive investment with its 9.6x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been pleasing for Xinjiang Xintai Natural Gas as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Xinjiang Xintai Natural Gas

Does Growth Match The Low P/E?

Xinjiang Xintai Natural Gas' P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 42%. The latest three year period has also seen a 8.3% overall rise in EPS, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 20% during the coming year according to the dual analysts following the company. With the market predicted to deliver 37% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that Xinjiang Xintai Natural Gas' P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Xinjiang Xintai Natural Gas' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Xinjiang Xintai Natural Gas with six simple checks.

You might be able to find a better investment than Xinjiang Xintai Natural Gas. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603393

Xinjiang Xintai Natural Gas

Xinjiang Xintai Natural Gas Co., Ltd. transmits, distributes, and sells natural gas in China.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives