As global markets navigate a landscape marked by policy shifts and economic optimism, U.S. stocks are reaching new heights, buoyed by hopes for reduced tariffs and enthusiasm surrounding artificial intelligence investments. In this dynamic environment, dividend stocks can offer stability and income potential, making them an attractive consideration for investors looking to balance growth with reliable returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.51% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.97% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.78% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

CNSIG Inner Mongolia Chemical IndustryLtd (SHSE:600328)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CNSIG Inner Mongolia Chemical Industry Co., Ltd. operates in the chemical industry and has a market capitalization of approximately CN¥11.07 billion.

Operations: Unfortunately, the revenue segment details for CNSIG Inner Mongolia Chemical Industry Co., Ltd. are not provided in the text.

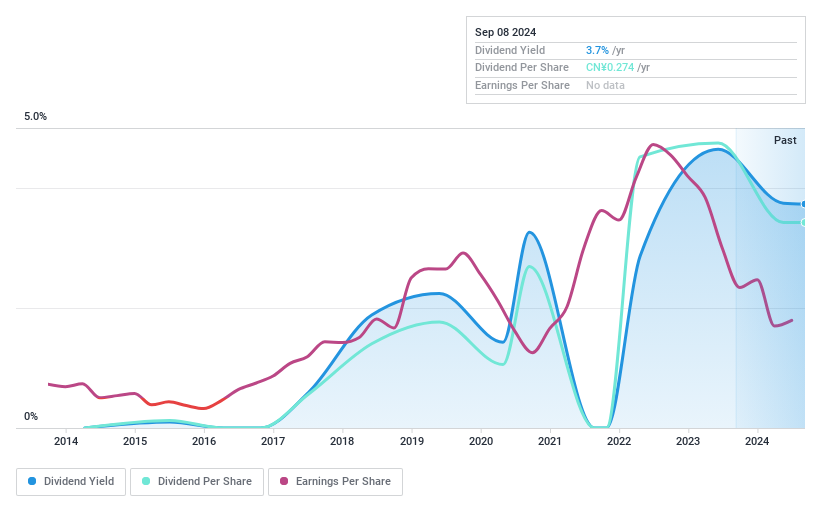

Dividend Yield: 3.6%

CNSIG Inner Mongolia Chemical Industry Ltd. offers a dividend yield of 3.64%, ranking it among the top 25% in the CN market, but its dividends are not well-covered by cash flows, with a high cash payout ratio of 1103.3%. Despite having a reasonable earnings payout ratio of 49.6%, past dividend payments have been volatile and unreliable over the last decade. Recent share buybacks totaling CNY 3.16 million may influence future shareholder value and dividend sustainability efforts.

- Navigate through the intricacies of CNSIG Inner Mongolia Chemical IndustryLtd with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of CNSIG Inner Mongolia Chemical IndustryLtd shares in the market.

Chengdu Gas Group (SHSE:603053)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chengdu Gas Group Corporation Ltd. operates in the urban gas supply business in China and has a market cap of approximately CN¥84 billion.

Operations: Chengdu Gas Group Corporation Ltd. generates its revenue primarily through its urban gas supply operations in China.

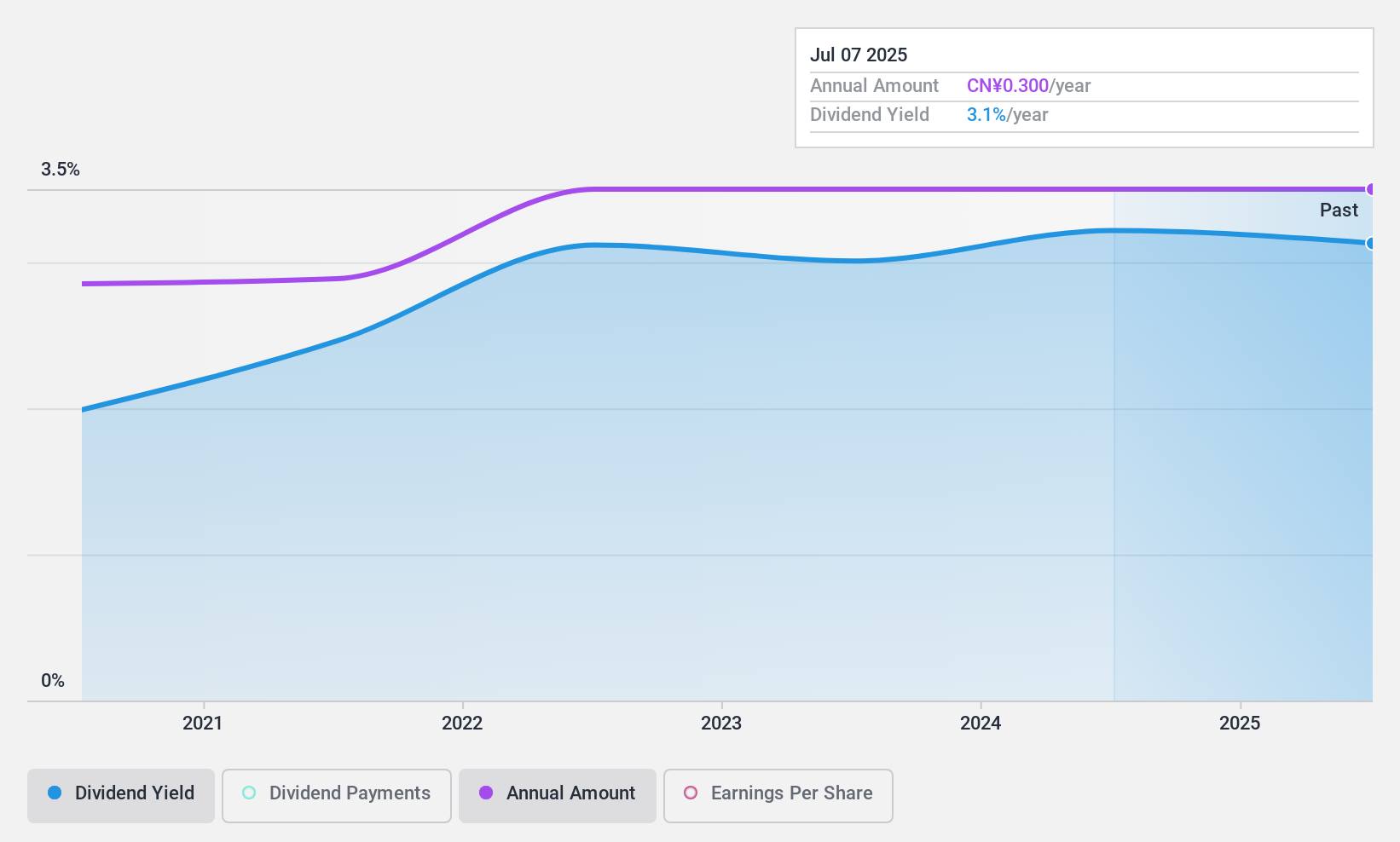

Dividend Yield: 3.2%

Chengdu Gas Group's dividend payments are well-supported by both earnings and cash flows, with a payout ratio of 52.6% and a cash payout ratio of 39.9%. Despite only five years of dividend history, payments have been stable, growing without significant volatility. The stock trades significantly below its estimated fair value, offering potential appeal for value-focused investors. Recent earnings show slight declines in net income to CNY 485.12 million from CNY 526.13 million the previous year.

- Click to explore a detailed breakdown of our findings in Chengdu Gas Group's dividend report.

- In light of our recent valuation report, it seems possible that Chengdu Gas Group is trading behind its estimated value.

Okamura (TSE:7994)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Okamura Corporation, with a market cap of ¥187.67 billion, operates in Japan through its subsidiaries to manufacture, sell, distribute, and install office furniture, store displays, material handling systems, and industrial machinery.

Operations: Okamura Corporation's revenue is primarily derived from its Office Environment Business, which accounts for ¥160.63 billion, followed by the Commercial Environment Business at ¥117.68 billion and the Logistics System Business at ¥19.64 billion.

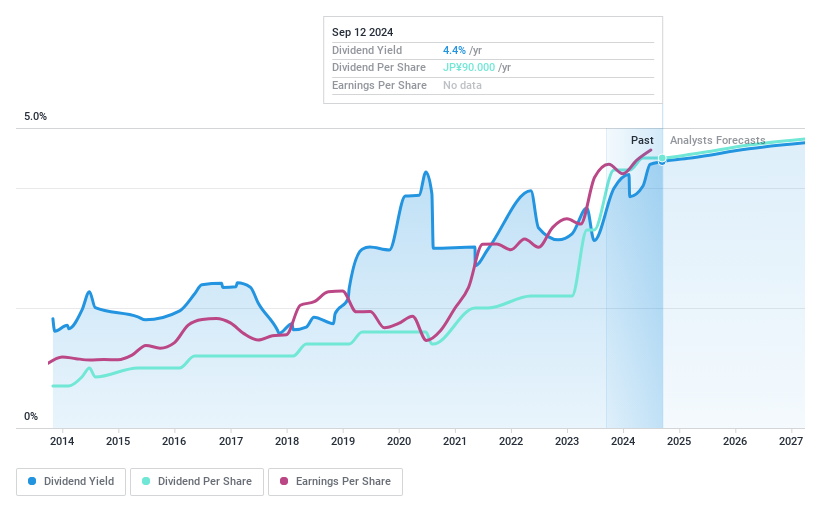

Dividend Yield: 4.5%

Okamura's dividend yield of 4.54% ranks among the top in Japan, though it is not well supported by free cash flows. Despite this, its payout ratio of 46.1% suggests dividends are covered by earnings. The company has a decade-long history of stable and growing dividends, indicating reliability. Trading at a significant discount to estimated fair value, Okamura may attract investors seeking undervalued dividend stocks despite concerns about cash flow coverage.

- Delve into the full analysis dividend report here for a deeper understanding of Okamura.

- Our valuation report unveils the possibility Okamura's shares may be trading at a discount.

Make It Happen

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1948 more companies for you to explore.Click here to unveil our expertly curated list of 1951 Top Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600328

CNSIG Inner Mongolia Chemical IndustryLtd

CNSIG Inner Mongolia Chemical Industry Co.,Ltd.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives