Jiangxi Hongcheng EnvironmentLtd And 2 Other Undiscovered Gems With Strong Fundamentals

Reviewed by Simply Wall St

Amidst a backdrop of cautious optimism in global markets, Asian equities have been capturing attention with their potential for growth, especially as small-cap stocks demonstrate resilience and outperformance. In this context, identifying companies with strong fundamentals becomes crucial for investors seeking opportunities in the region's dynamic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | NA | 0.97% | 1.03% | ★★★★★★ |

| Jinghua Pharmaceutical Group | NA | 2.42% | 18.34% | ★★★★★★ |

| Kanro | 5.65% | 7.36% | 35.28% | ★★★★★★ |

| Shenke Slide Bearing | 10.82% | 13.63% | 33.31% | ★★★★★★ |

| Zkteco | 3.86% | 1.40% | 2.50% | ★★★★★☆ |

| Suzhou Xingye Materials TechnologyLtd | 0.14% | -3.11% | -19.10% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Zhejiang Jinghua Laser TechnologyLtd | 45.75% | 3.45% | -2.64% | ★★★★★☆ |

| Huasi Holding | 6.89% | 4.80% | 41.72% | ★★★★★☆ |

| Guangdong Sanhe Pile | 73.14% | -4.96% | -36.35% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Jiangxi Hongcheng EnvironmentLtd (SHSE:600461)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangxi Hongcheng Environment Co., Ltd., along with its subsidiaries, is engaged in the production and supply of tap water in China, with a market capitalization of approximately CN¥12.79 billion.

Operations: Jiangxi Hongcheng Environment Co., Ltd. generates revenue primarily through the production and supply of tap water in China. The company has a market capitalization of approximately CN¥12.79 billion.

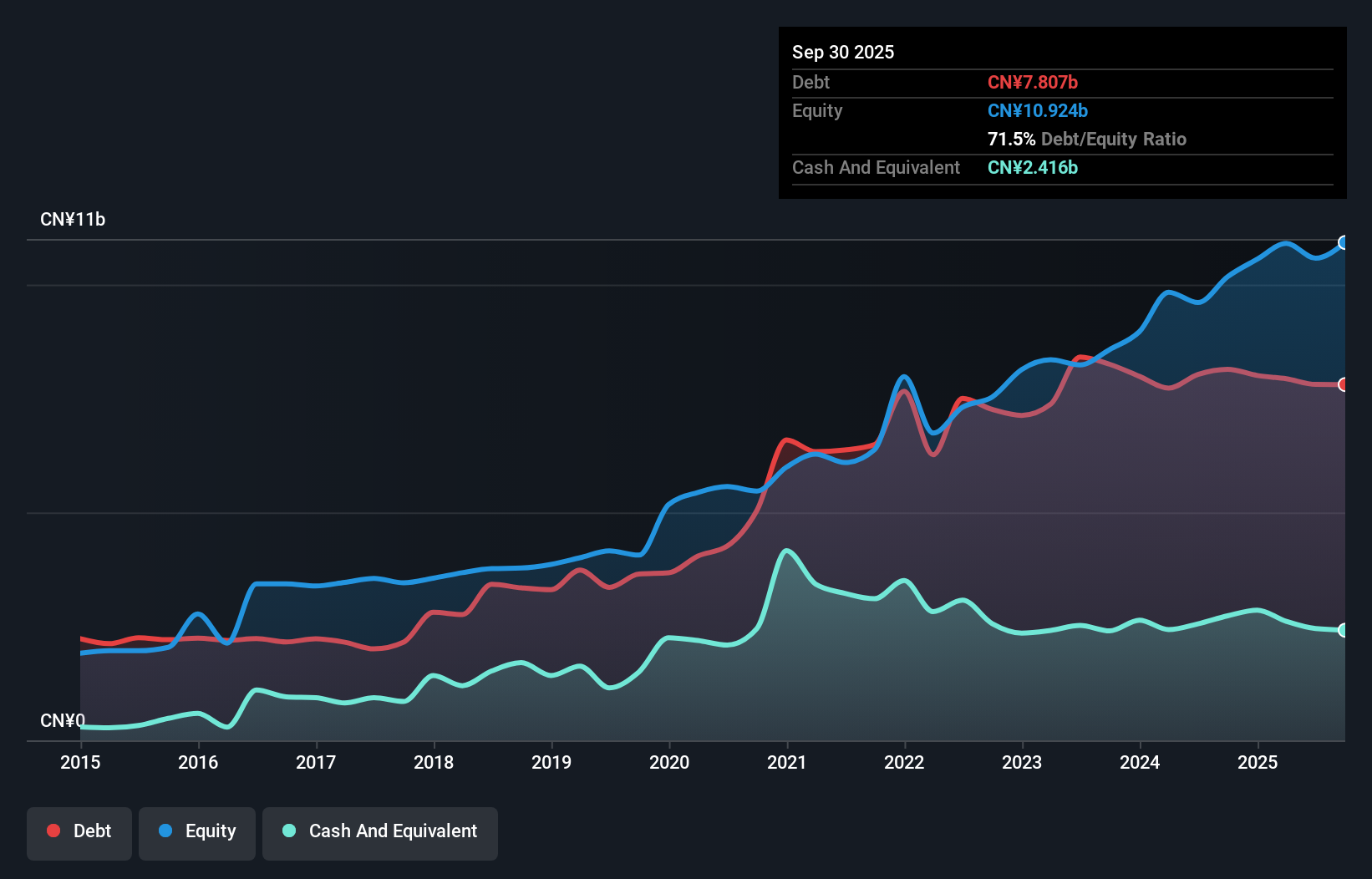

Jiangxi Hongcheng Environment, a promising name in the water utilities sector, has shown consistent earnings growth of 9.5% annually over the past five years. Despite a high net debt to equity ratio of 49.3%, its interest payments are well covered with EBIT covering them 9.7 times over, indicating solid financial management. Recent reports show a slight dip in revenue to CNY 5,425 million from CNY 5,643 million last year; however, net income rose slightly to CNY 933 million from CNY 922 million. The company trades at nearly 10% below its estimated fair value and offers good relative value compared to peers.

Anhui Huaren Health Pharmaceutical (SZSE:301408)

Simply Wall St Value Rating: ★★★★★☆

Overview: Anhui Huaren Health Pharmaceutical Co., Ltd. operates in the pharmaceutical industry with a market cap of CN¥6.77 billion, focusing on the development and distribution of health-related products.

Operations: Anhui Huaren Health Pharmaceutical generates revenue primarily from the sale of health-related products. The company has a market cap of CN¥6.77 billion, indicating its scale in the pharmaceutical sector.

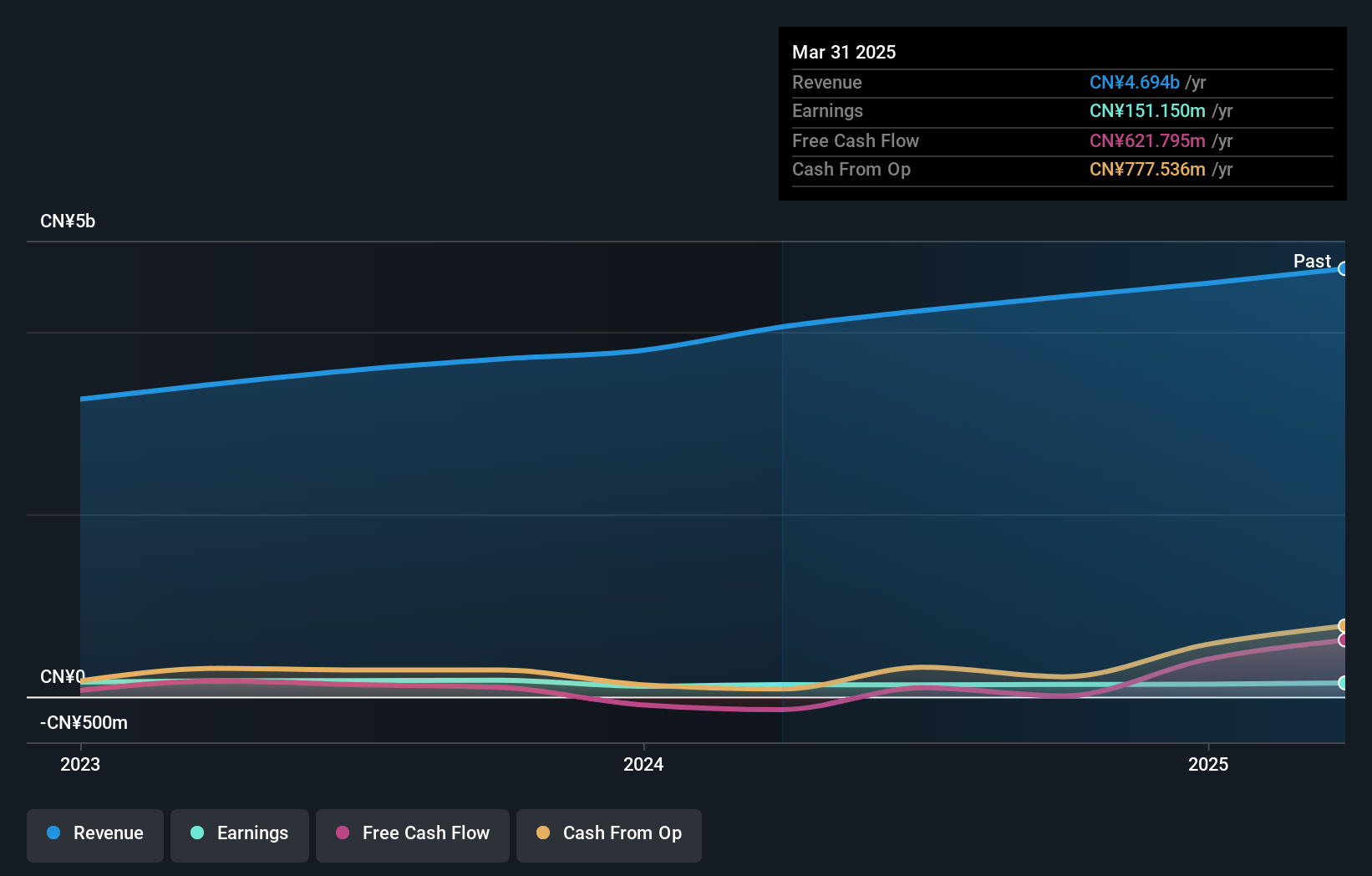

Anhui Huaren Health Pharmaceutical, a smaller player in the pharmaceutical industry, has demonstrated impressive earnings growth of 38.6% over the past year, outpacing its industry peers. The company's debt to equity ratio increased from 18.4% to 55.2% over five years, yet its interest payments are well covered by EBIT at a multiple of 20.1x. Recent financial results for the nine months ending September 2025 show sales rising to CNY3.89 billion from CNY3.27 billion and net income improving to CNY156 million from CNY108 million last year, indicating robust performance despite share price volatility in recent months.

Bank of Nagoya (TSE:8522)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Bank of Nagoya, Ltd. offers a range of banking, financial leasing, and credit card services in Japan and has a market capitalization of ¥217.70 billion.

Operations: The bank generates revenue primarily through its banking services, financial leasing, and credit card operations. Its net profit margin is 15.3%, reflecting the efficiency in managing costs relative to income.

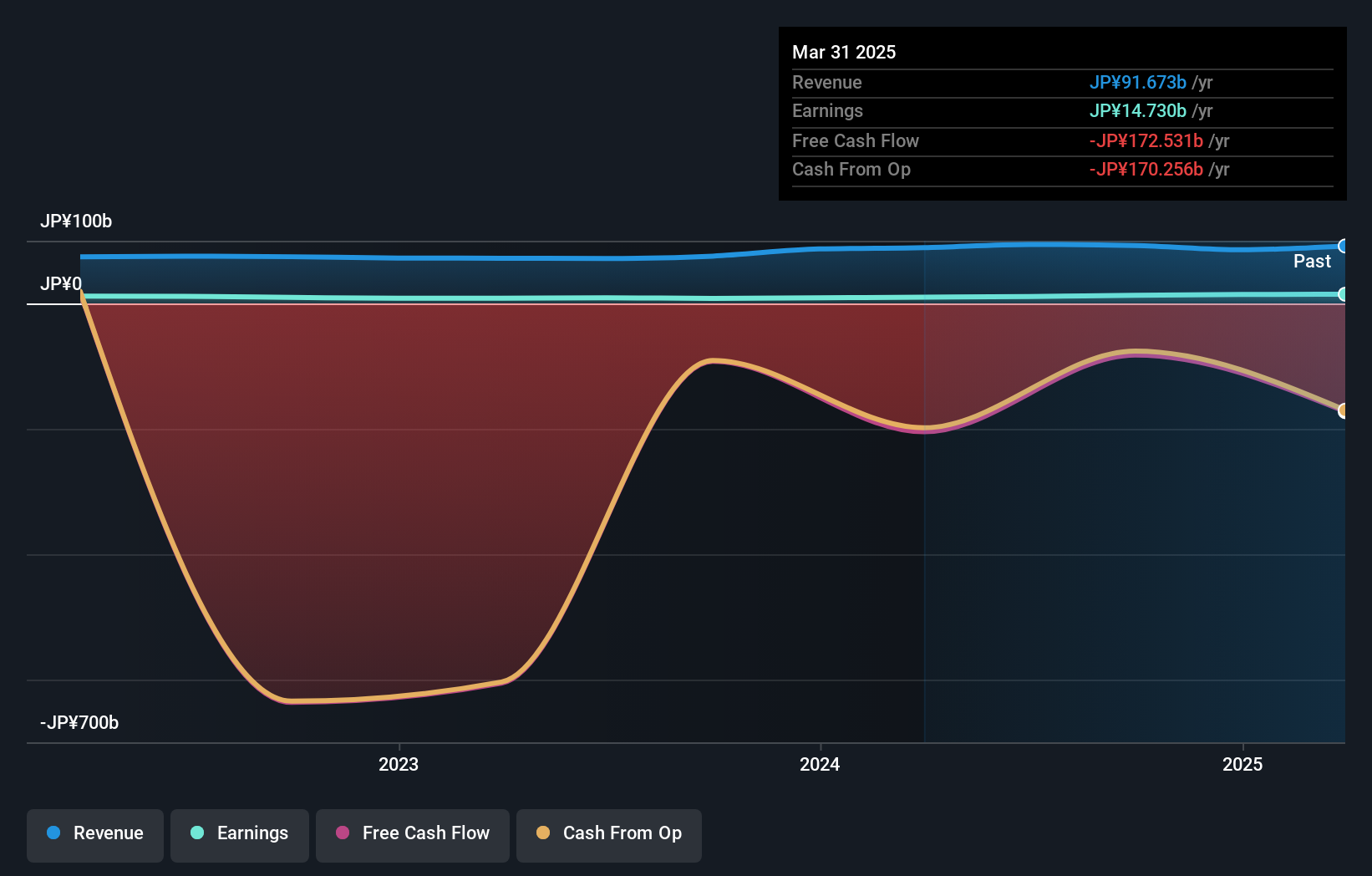

Nagoya Bank, with assets totaling ¥6,101.1B and equity of ¥297.4B, has been making waves despite its compact size. The bank's total deposits stand at ¥5,323.3B against loans of ¥4,092.0B but struggles with a 2% allowance for bad loans which is considered insufficient. It boasts a price-to-earnings ratio of 13x, offering better value compared to the broader JP market at 14x. Earnings have grown by an average of 10% annually over five years; however, recent dividends increased from JPY110 to JPY150 per share suggest a focus on rewarding shareholders amidst strategic shifts in shareholdings.

Summing It All Up

- Click this link to deep-dive into the 2498 companies within our Asian Undiscovered Gems With Strong Fundamentals screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Nagoya might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8522

Bank of Nagoya

Provides various banking, financial leasing, and credit card services in Japan.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026