- China

- /

- Water Utilities

- /

- SHSE:600323

Earnings growth of 2.6% over 3 years hasn't been enough to translate into positive returns for Grandblue Environment (SHSE:600323) shareholders

One of the frustrations of investing is when a stock goes down. But no-one can make money on every call, especially in a declining market. The Grandblue Environment Co., Ltd. (SHSE:600323) is down 17% over three years, but the total shareholder return is -14% once you include the dividend. And that total return actually beats the market decline of 32%. More recently, the share price has dropped a further 12% in a month. However, we note the price may have been impacted by the broader market, which is down 4.8% in the same time period.

With the stock having lost 6.9% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Grandblue Environment

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate three years of share price decline, Grandblue Environment actually saw its earnings per share (EPS) improve by 8.1% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Revenue is actually up 6.5% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Grandblue Environment further; while we may be missing something on this analysis, there might also be an opportunity.

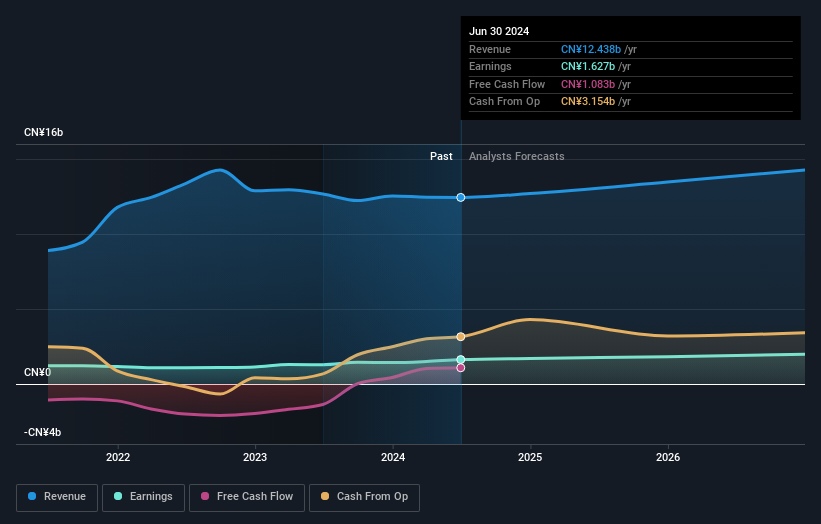

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Grandblue Environment has improved its bottom line lately, but what does the future have in store? If you are thinking of buying or selling Grandblue Environment stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Grandblue Environment's TSR for the last 3 years was -14%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Grandblue Environment shareholders have received a total shareholder return of 10% over the last year. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 2% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Grandblue Environment better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Grandblue Environment you should be aware of.

Of course Grandblue Environment may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600323

Grandblue Environment

Engages in the water supply, drainage, solid waste treatment, and energy businesses in China.

Very undervalued 6 star dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026