Henan Xinning Modern Logistics Co.,Ltd.'s (SZSE:300013) Popularity With Investors Under Threat As Stock Sinks 29%

To the annoyance of some shareholders, Henan Xinning Modern Logistics Co.,Ltd. (SZSE:300013) shares are down a considerable 29% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 44% share price drop.

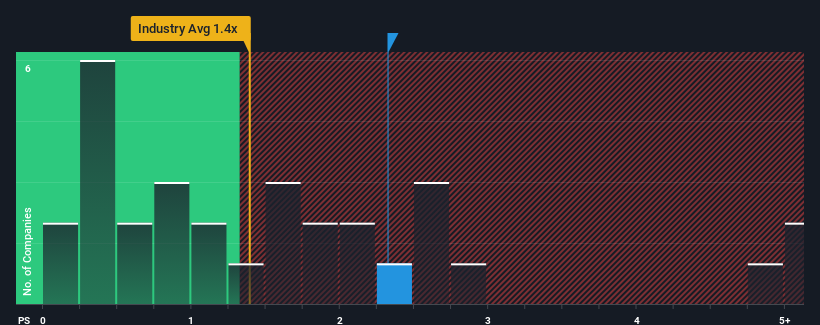

In spite of the heavy fall in price, you could still be forgiven for thinking Henan Xinning Modern LogisticsLtd is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.3x, considering almost half the companies in China's Logistics industry have P/S ratios below 1.4x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Henan Xinning Modern LogisticsLtd

How Has Henan Xinning Modern LogisticsLtd Performed Recently?

For instance, Henan Xinning Modern LogisticsLtd's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Henan Xinning Modern LogisticsLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Henan Xinning Modern LogisticsLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Henan Xinning Modern LogisticsLtd would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 48% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 46% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 13% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's alarming that Henan Xinning Modern LogisticsLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Henan Xinning Modern LogisticsLtd's P/S?

There's still some elevation in Henan Xinning Modern LogisticsLtd's P/S, even if the same can't be said for its share price recently. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Henan Xinning Modern LogisticsLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 2 warning signs for Henan Xinning Modern LogisticsLtd that we have uncovered.

If you're unsure about the strength of Henan Xinning Modern LogisticsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Henan Xinning Modern LogisticsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300013

Henan Xinning Modern LogisticsLtd

Provides logistics and supply chain management services in China.

Adequate balance sheet low.

Market Insights

Community Narratives