- China

- /

- Infrastructure

- /

- SZSE:002930

The three-year shareholder returns and company earnings persist lower as Guangdong Great River Smarter Logistics (SZSE:002930) stock falls a further 8.4% in past week

If you love investing in stocks you're bound to buy some losers. But the long term shareholders of Guangdong Great River Smarter Logistics Co., Ltd. (SZSE:002930) have had an unfortunate run in the last three years. Sadly for them, the share price is down 58% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 46% lower in that time. More recently, the share price has dropped a further 15% in a month.

Since Guangdong Great River Smarter Logistics has shed CN¥430m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for Guangdong Great River Smarter Logistics

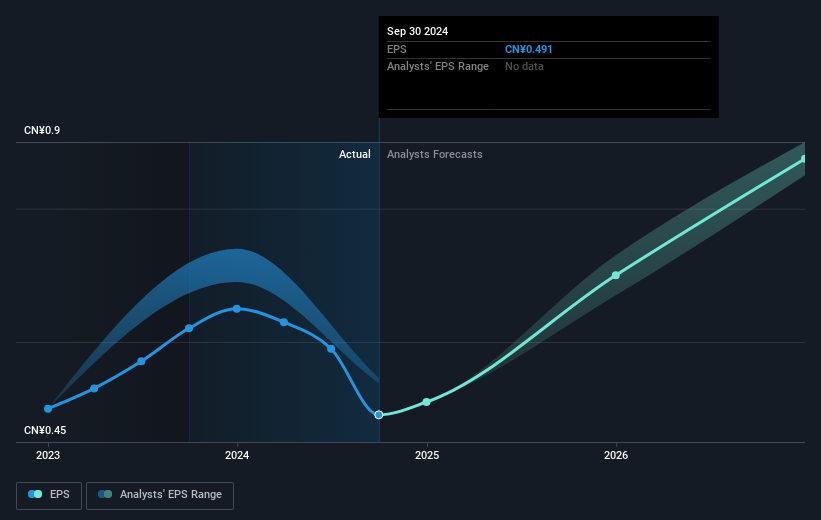

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years that the share price fell, Guangdong Great River Smarter Logistics' earnings per share (EPS) dropped by 7.2% each year. The share price decline of 25% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Guangdong Great River Smarter Logistics' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Guangdong Great River Smarter Logistics the TSR over the last 3 years was -56%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in Guangdong Great River Smarter Logistics had a tough year, with a total loss of 45% (including dividends), against a market gain of about 7.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 0.9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Guangdong Great River Smarter Logistics (1 is concerning!) that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002930

Guangdong Great River Smarter Logistics

A logistics company, provides warehousing and other related services for petrochemical product manufacturers, traders, and end users in China and internationally.

Fair value second-rate dividend payer.

Market Insights

Community Narratives