After Leaping 25% STO Express Co.,Ltd (SZSE:002468) Shares Are Not Flying Under The Radar

STO Express Co.,Ltd (SZSE:002468) shareholders have had their patience rewarded with a 25% share price jump in the last month. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

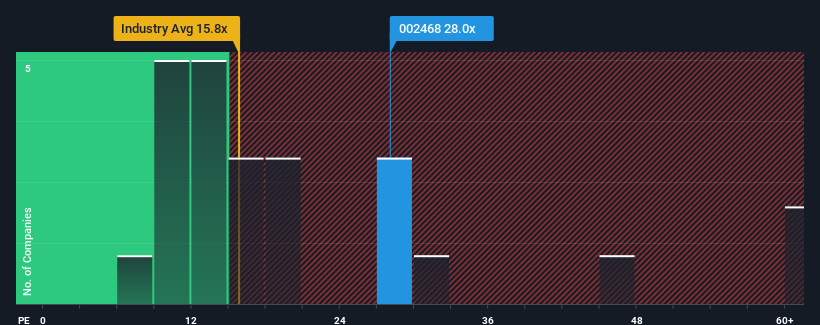

In spite of the firm bounce in price, it's still not a stretch to say that STO ExpressLtd's price-to-earnings (or "P/E") ratio of 28x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 26x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Recent times have been pleasing for STO ExpressLtd as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for STO ExpressLtd

How Is STO ExpressLtd's Growth Trending?

STO ExpressLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 83%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next three years should generate growth of 17% per year as estimated by the analysts watching the company. That's shaping up to be similar to the 19% per annum growth forecast for the broader market.

With this information, we can see why STO ExpressLtd is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On STO ExpressLtd's P/E

STO ExpressLtd's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that STO ExpressLtd maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for STO ExpressLtd with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002468

STO ExpressLtd

Provides express delivery services in China and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives