- China

- /

- Marine and Shipping

- /

- SHSE:603162

There Are Some Holes In Fujian Highton Development's (SHSE:603162) Solid Earnings Release

Following the release of a positive earnings report recently, Fujian Highton Development Co., Ltd.'s (SHSE:603162) stock performed well. Investors should be cautious however, as there some causes of concern deeper in the numbers.

Check out our latest analysis for Fujian Highton Development

A Closer Look At Fujian Highton Development's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

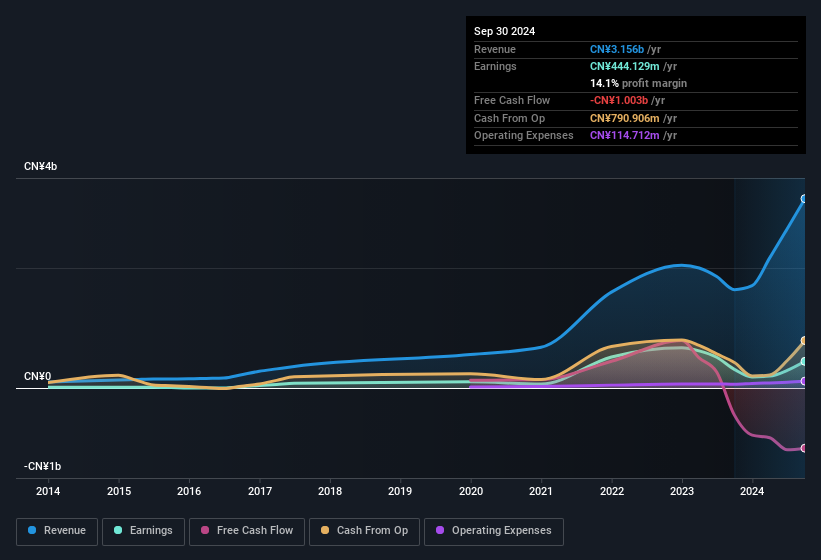

Over the twelve months to September 2024, Fujian Highton Development recorded an accrual ratio of 0.50. As a general rule, that bodes poorly for future profitability. To wit, the company did not generate one whit of free cashflow in that time. Over the last year it actually had negative free cash flow of CN¥1.0b, in contrast to the aforementioned profit of CN¥444.1m. We also note that Fujian Highton Development's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of CN¥1.0b. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Fujian Highton Development.

The Impact Of Unusual Items On Profit

The fact that the company had unusual items boosting profit by CN¥43m, in the last year, probably goes some way to explain why its accrual ratio was so weak. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On Fujian Highton Development's Profit Performance

Summing up, Fujian Highton Development received a nice boost to profit from unusual items, but could not match its paper profit with free cash flow. Considering all this we'd argue Fujian Highton Development's profits probably give an overly generous impression of its sustainable level of profitability. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Our analysis shows 2 warning signs for Fujian Highton Development (1 is concerning!) and we strongly recommend you look at these before investing.

Our examination of Fujian Highton Development has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603162

Fujian Highton Development

Engages in the coastal and international ocean dry bulk transportation business in China and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives