- China

- /

- Transportation

- /

- SHSE:603069

Hainan Haiqi Transportation Group Co.,Ltd.'s (SHSE:603069) Business Is Yet to Catch Up With Its Share Price

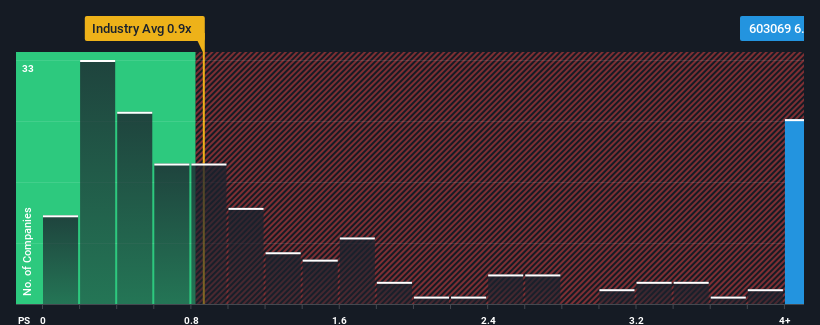

With a price-to-sales (or "P/S") ratio of 6.9x Hainan Haiqi Transportation Group Co.,Ltd. (SHSE:603069) may be sending very bearish signals at the moment, given that almost half of all the Transportation companies in China have P/S ratios under 3.7x and even P/S lower than 1.7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Hainan Haiqi Transportation GroupLtd

What Does Hainan Haiqi Transportation GroupLtd's Recent Performance Look Like?

For example, consider that Hainan Haiqi Transportation GroupLtd's financial performance has been pretty ordinary lately as revenue growth is non-existent. Perhaps the market believes that revenue growth will improve markedly over current levels, inflating the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Hainan Haiqi Transportation GroupLtd's earnings, revenue and cash flow.How Is Hainan Haiqi Transportation GroupLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Hainan Haiqi Transportation GroupLtd would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Regardless, revenue has managed to lift by a handy 12% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 5.2% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's curious that Hainan Haiqi Transportation GroupLtd's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Nevertheless, they may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From Hainan Haiqi Transportation GroupLtd's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Hainan Haiqi Transportation GroupLtd has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Before you settle on your opinion, we've discovered 1 warning sign for Hainan Haiqi Transportation GroupLtd that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hainan Haiqi Transportation GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603069

Hainan Haiqi Transportation GroupLtd

Hainan Haiqi Transportation Group Co.,Ltd.

Imperfect balance sheet minimal.