Earnings growth of 2.1% over 1 year hasn't been enough to translate into positive returns for DEPPON LOGISTICS (SHSE:603056) shareholders

One simple way to benefit from a rising market is to buy an index fund. In contrast individual stocks will provide a wide range of possible returns, and may fall short. One such example is DEPPON LOGISTICS Co., LTD. (SHSE:603056), which saw its share price fall 22% over a year, against a market decline of 18%. On the other hand, the stock is actually up 13% over three years. Shareholders have had an even rougher run lately, with the share price down 13% in the last 90 days. Of course, this share price action may well have been influenced by the 11% decline in the broader market, throughout the period.

With the stock having lost 4.9% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for DEPPON LOGISTICS

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Even though the DEPPON LOGISTICS share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

It seems quite likely that the market was expecting higher growth from the stock. But looking to other metrics might better explain the share price change.

Given the yield is quite low, at 0.6%, we doubt the dividend can shed much light on the share price. DEPPON LOGISTICS' revenue is actually up 21% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

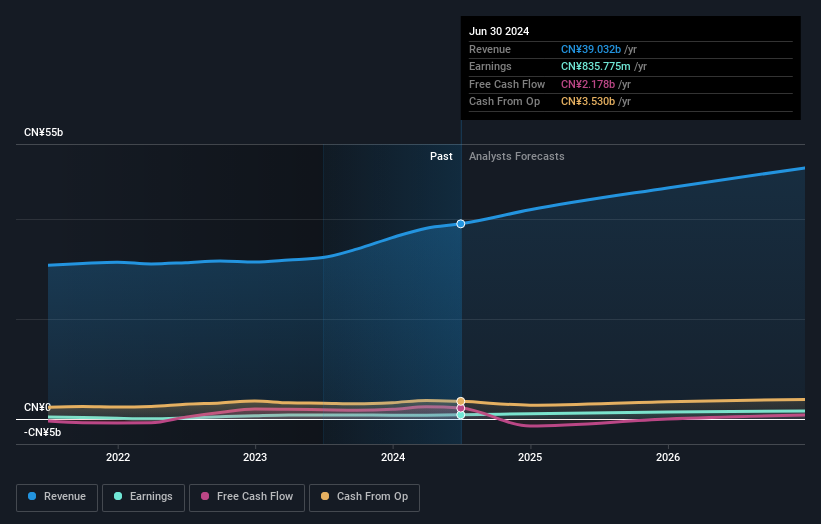

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market lost about 18% in the twelve months, DEPPON LOGISTICS shareholders did even worse, losing 21% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for DEPPON LOGISTICS that you should be aware of before investing here.

Of course DEPPON LOGISTICS may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603056

DEPPON LOGISTICS

Operates as a customer-centered logistics company in Mainland China, Japan, South Korea, Europe, America, Southeast Asia, Hong Kong, Macao, and Taiwan, and internationally.

Flawless balance sheet and good value.