Eastern Air Logistics Co., Ltd.'s (SHSE:601156) Price Is Right But Growth Is Lacking After Shares Rocket 25%

The Eastern Air Logistics Co., Ltd. (SHSE:601156) share price has done very well over the last month, posting an excellent gain of 25%. The last 30 days bring the annual gain to a very sharp 47%.

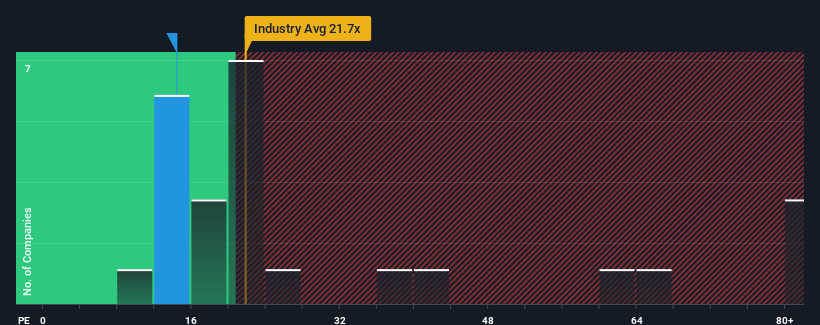

Although its price has surged higher, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 33x, you may still consider Eastern Air Logistics as a highly attractive investment with its 14.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

While the market has experienced earnings growth lately, Eastern Air Logistics' earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Eastern Air Logistics

Is There Any Growth For Eastern Air Logistics?

The only time you'd be truly comfortable seeing a P/E as depressed as Eastern Air Logistics' is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 14% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 21% per year over the next three years. With the market predicted to deliver 26% growth per annum, the company is positioned for a weaker earnings result.

With this information, we can see why Eastern Air Logistics is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Eastern Air Logistics' recent share price jump still sees its P/E sitting firmly flat on the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Eastern Air Logistics' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Eastern Air Logistics with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Eastern Air Logistics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Eastern Air Logistics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eastern Air Logistics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601156

Eastern Air Logistics

Provides air express, comprehensive ground, and multimodal transport services.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives