- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6266

Discover Galp Energia SGPS And 2 More Premier Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year, with U.S. indices showing resilience despite economic uncertainties and European inflationary pressures, investors are increasingly seeking stability through dividend stocks. In this environment, a good dividend stock is characterized by its ability to provide consistent income streams and potential for capital appreciation, making it an attractive option for those looking to weather market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.60% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.74% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.53% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.51% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.43% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

Click here to see the full list of 1996 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

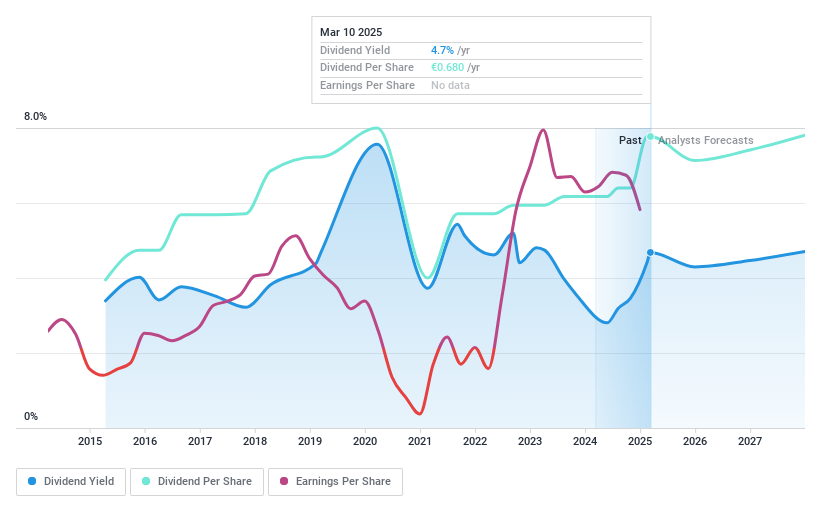

Galp Energia SGPS (ENXTLS:GALP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Galp Energia SGPS operates as an integrated energy company in Portugal and internationally, with a market cap of €11.18 billion.

Operations: Galp Energia SGPS generates revenue through its Upstream segment (€3.79 billion), Commercial segment (€10.29 billion), Industrial & Midstream segment (€9.25 billion), and Renewables and New Businesses segment (€89 million).

Dividend Yield: 3.5%

Galp Energia has a history of dividend growth over the past decade, with dividends well-covered by earnings and cash flows, as indicated by low payout ratios (31.8% for earnings and 39.4% for cash). Despite this, its dividend yield of 3.48% is below the top tier in Portugal, and its dividend track record is unstable with volatility noted. Recent earnings show steady revenue growth but a decline in quarterly net income to €269 million from €303 million year-on-year.

- Click here and access our complete dividend analysis report to understand the dynamics of Galp Energia SGPS.

- Our valuation report here indicates Galp Energia SGPS may be overvalued.

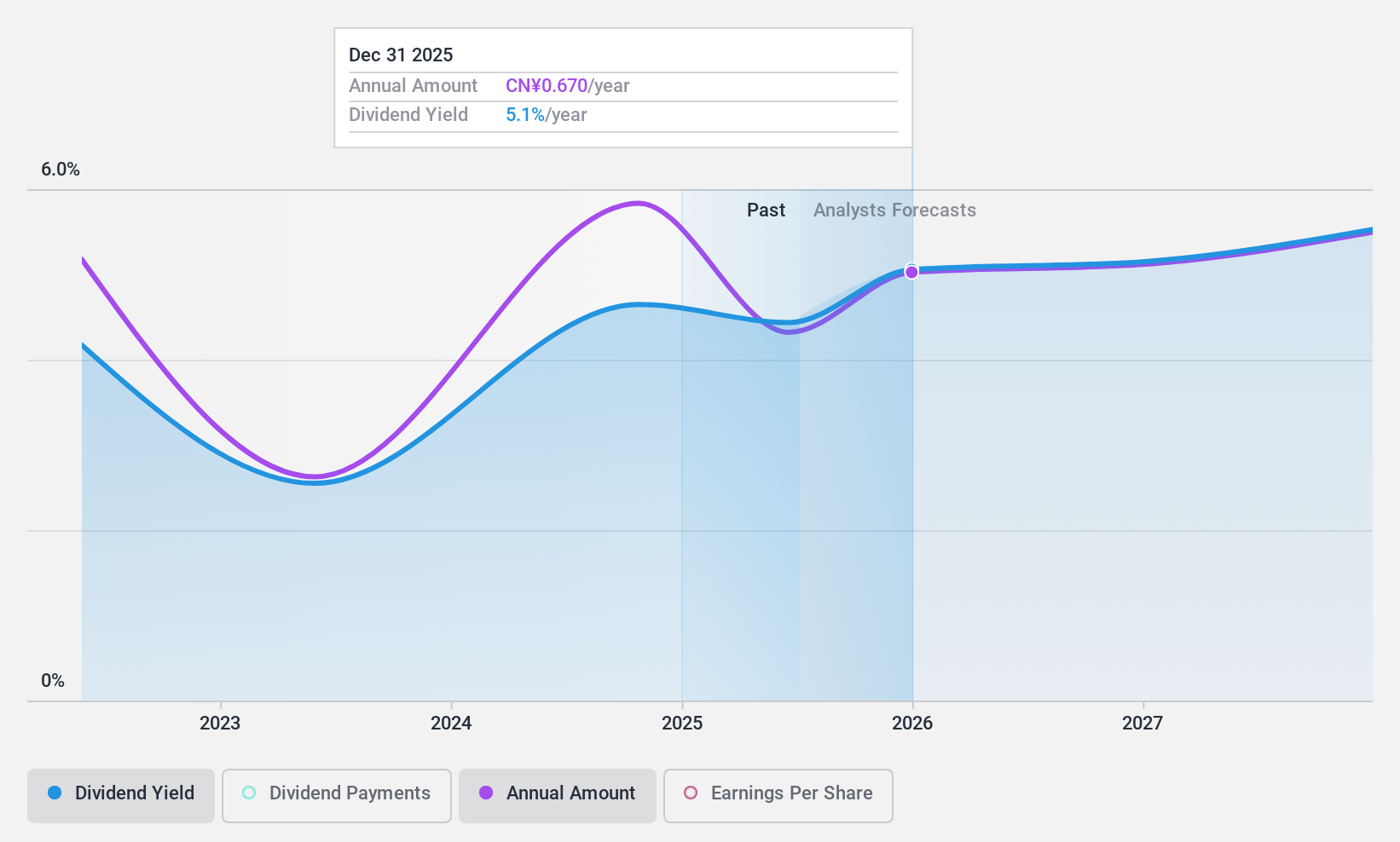

Eastern Air Logistics (SHSE:601156)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eastern Air Logistics Co., Ltd. offers air express, comprehensive ground, and multimodal transport services with a market cap of CN¥26.88 billion.

Operations: Eastern Air Logistics Co., Ltd. generates its revenue from three main segments: Air Express (CN¥9.27 billion), Comprehensive Ground Services (CN¥2.48 billion), and Integrated Logistics Solutions (CN¥12.30 billion).

Dividend Yield: 4.6%

Eastern Air Logistics offers a high dividend yield of 4.6%, ranking in the top 25% within China, supported by low payout ratios (21.4% earnings and 34.8% cash). However, its three-year dividend history is marked by volatility and unreliability, with payments experiencing significant fluctuations. Despite this, recent financial performance shows robust growth, with sales reaching CNY 17.67 billion and net income rising to CNY 2.07 billion for the first nine months of 2024.

- Click to explore a detailed breakdown of our findings in Eastern Air Logistics' dividend report.

- The valuation report we've compiled suggests that Eastern Air Logistics' current price could be quite moderate.

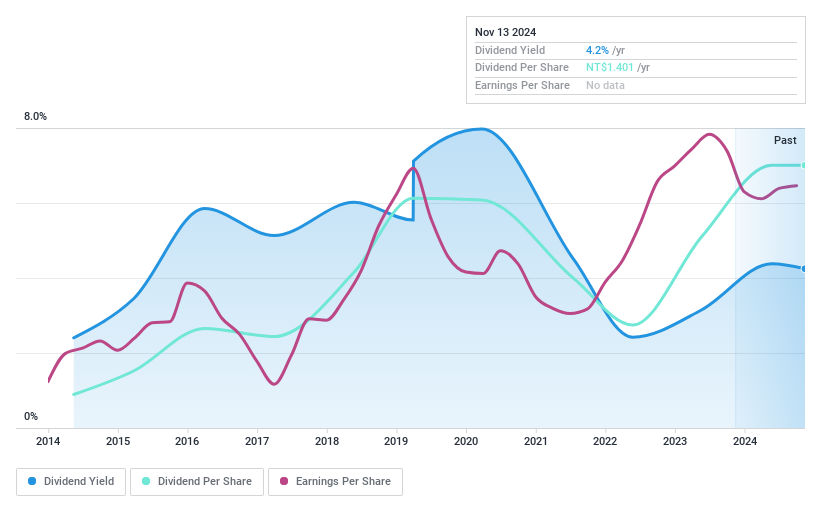

Top Union Electronics (TPEX:6266)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Top Union Electronics Corp. designs, manufactures, and provides technical support for electronic products and communication equipment across Taiwan, the United States, and China, with a market cap of NT$4.71 billion.

Operations: Top Union Electronics Corp. generates revenue from its Contract Electronics Manufacturing Services, amounting to NT$3.16 billion.

Dividend Yield: 4.3%

Top Union Electronics offers a dividend yield of 4.31%, slightly below the top tier in Taiwan, yet its dividends are supported by a reasonable payout ratio of 66.7% and a cash payout ratio of 39.3%. Despite an unstable dividend history marked by volatility, recent earnings show slight improvement with net income rising to TWD 275.59 million for the first nine months of 2024, indicating potential stability in future payouts.

- Take a closer look at Top Union Electronics' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Top Union Electronics is priced higher than what may be justified by its financials.

Seize The Opportunity

- Click here to access our complete index of 1996 Top Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Top Union Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6266

Top Union Electronics

Engages in design, manufacture, and technical support of electronic products and communication equipment in Taiwan, the United States, and China.

Flawless balance sheet average dividend payer.