As global markets navigate a mixed landscape, with U.S. stocks closing out a strong year despite recent volatility and European inflationary pressures influencing economic sentiment, investors are increasingly seeking stability through dividend stocks. In such an environment, high-yield dividend stocks can offer attractive income potential while providing some cushion against market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.13% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.57% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.02% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.01% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 2019 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

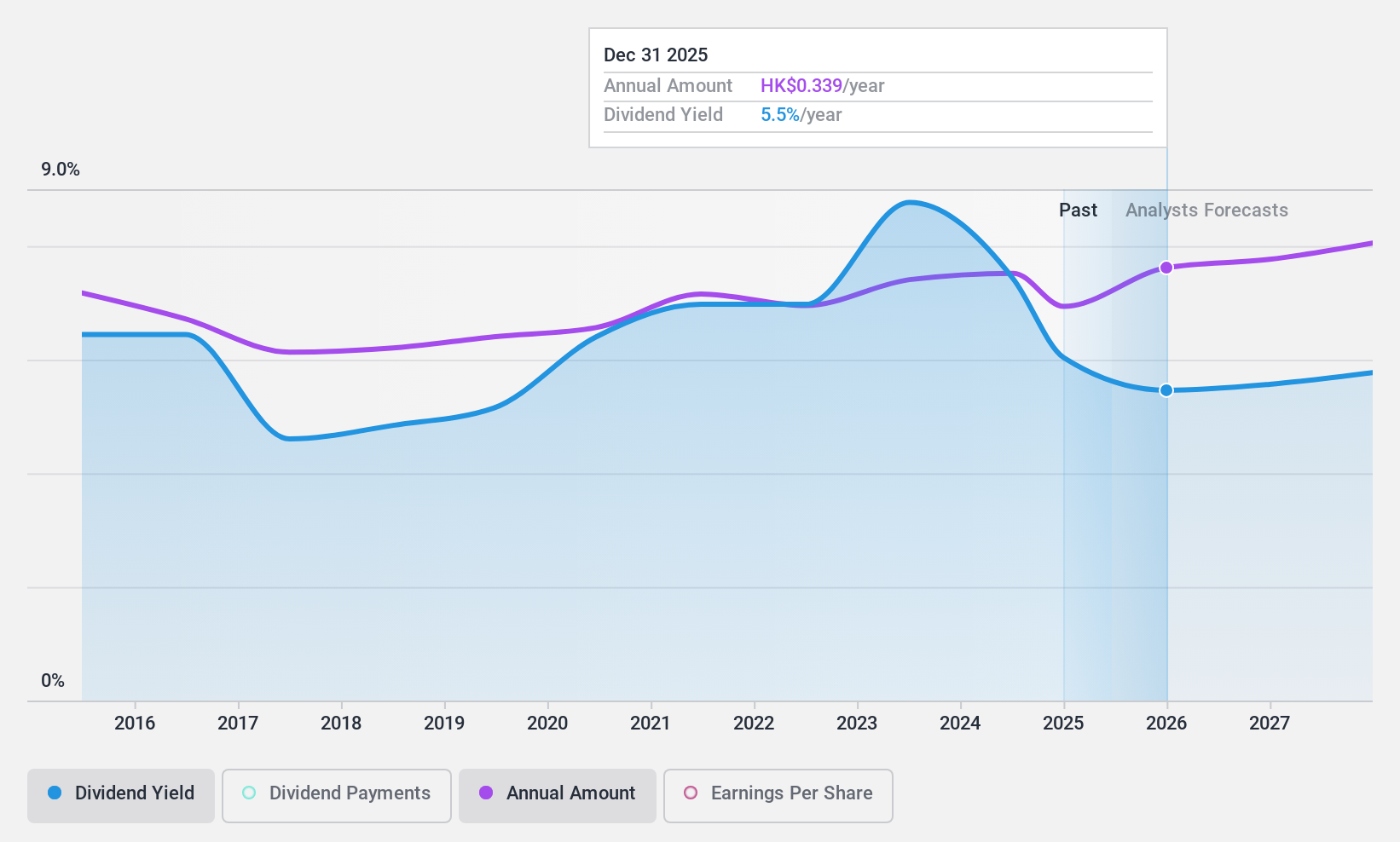

Industrial and Commercial Bank of China (SEHK:1398)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Industrial and Commercial Bank of China Limited, along with its subsidiaries, offers a range of banking products and services both in the People's Republic of China and internationally, with a market cap of HK$2.36 trillion.

Operations: Industrial and Commercial Bank of China Limited generates revenue through various segments, including corporate banking, personal banking, treasury operations, and others.

Dividend Yield: 6.2%

Industrial and Commercial Bank of China offers a stable dividend profile, with dividends reliably increasing over the past decade. The current payout ratio of 45.9% suggests sustainability, and future forecasts indicate further coverage improvement to 30.7%. Despite a lower yield (6.24%) compared to top-tier Hong Kong dividend payers (8.05%), it remains attractive due to its consistent performance and earnings growth of 3.7% annually over five years, complemented by recent board approvals for continued profit distribution plans.

- Get an in-depth perspective on Industrial and Commercial Bank of China's performance by reading our dividend report here.

- Our expertly prepared valuation report Industrial and Commercial Bank of China implies its share price may be lower than expected.

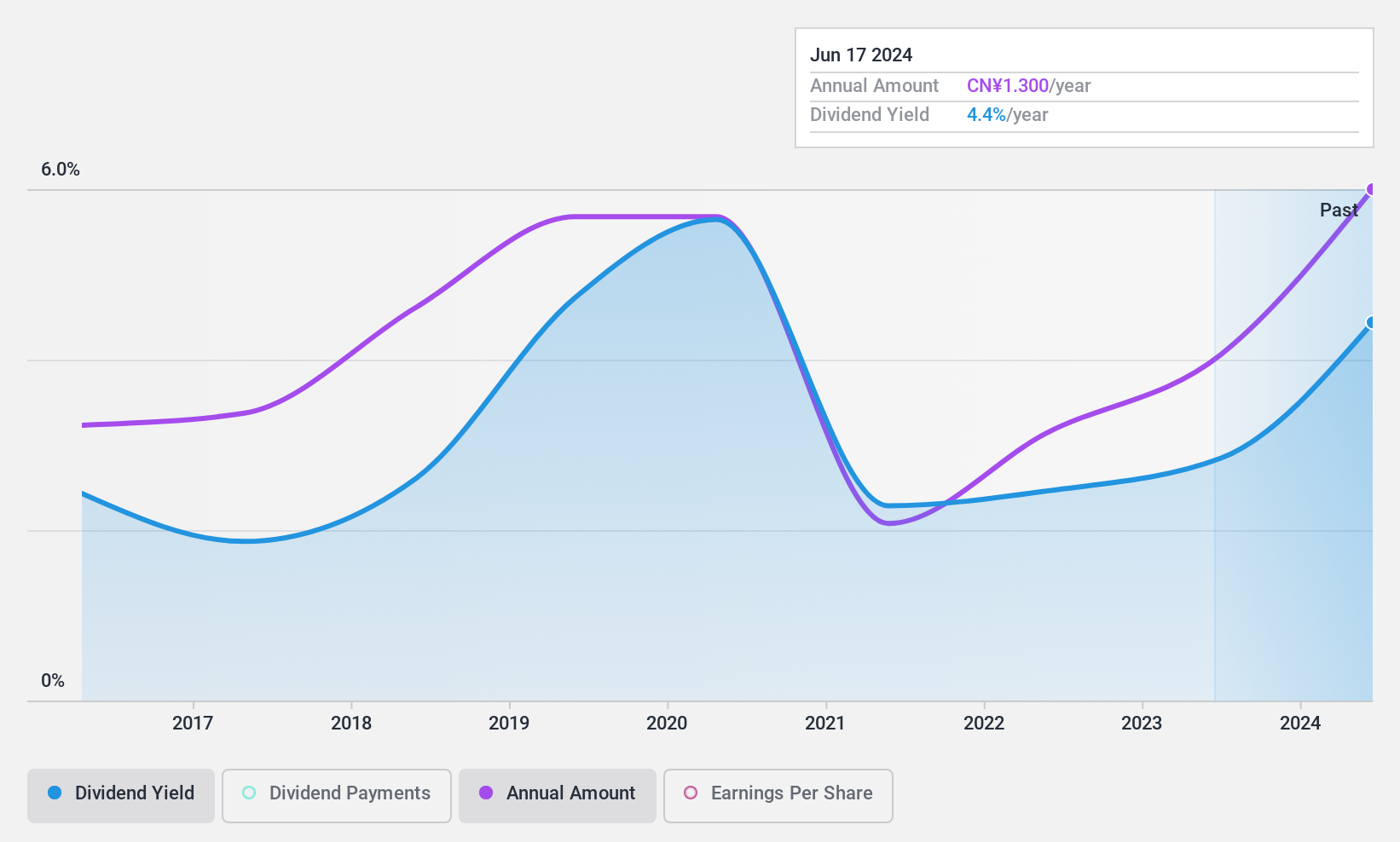

Hubei Jumpcan Pharmaceutical (SHSE:600566)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hubei Jumpcan Pharmaceutical Co., Ltd. focuses on the research, development, manufacturing, and trading of both Chinese traditional and western medicines as well as health products in China, with a market cap of approximately CN¥26 billion.

Operations: Hubei Jumpcan Pharmaceutical Co., Ltd. generates revenue through its activities in Chinese traditional medicines, western medicines, daily use chemical-based Chinese traditional medicines, and Chinese medicine health products within China.

Dividend Yield: 4.6%

Hubei Jumpcan Pharmaceutical's dividend payments are well-covered by earnings, with a payout ratio of 42.9% and a cash payout ratio of 56.1%. Despite this coverage, the dividend history has been volatile over the past decade, lacking reliability. The stock trades at a significant discount to its estimated fair value and offers a competitive yield in China's market. Recent financials show stable net income despite declining sales, indicating potential resilience in earnings capacity.

- Click to explore a detailed breakdown of our findings in Hubei Jumpcan Pharmaceutical's dividend report.

- The analysis detailed in our Hubei Jumpcan Pharmaceutical valuation report hints at an deflated share price compared to its estimated value.

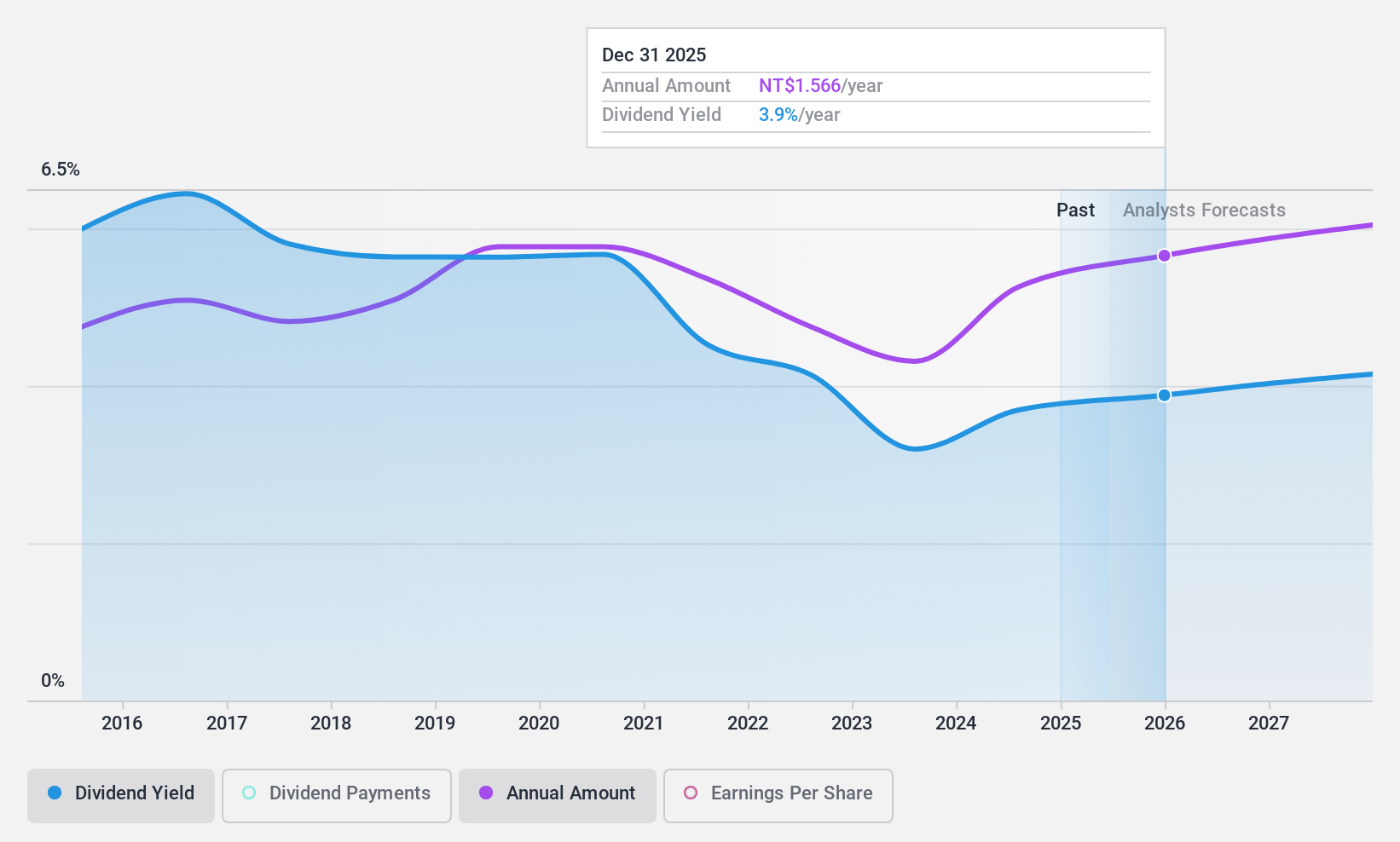

Mega Financial Holding (TWSE:2886)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mega Financial Holding Co., Ltd. offers a range of financial services and has a market cap of approximately NT$574.05 billion.

Operations: Mega Financial Holding Co., Ltd. generates revenue primarily from its Banking Business at NT$63.89 billion, followed by the Securities Business at NT$7.19 billion, Bills Business at NT$3.39 billion, and Insurance Business at NT$2.46 billion.

Dividend Yield: 3.8%

Mega Financial Holding maintains a reliable dividend, supported by a stable 60.3% payout ratio, though its yield of 3.77% is below Taiwan's top quartile. Despite past earnings growth of 12.1%, future declines are forecasted at 4% annually over three years. Recent Q3 results showed net income growth to TWD 8.92 billion from TWD 8.26 billion year-on-year, indicating current financial strength, although shareholder dilution remains a concern for long-term stability.

- Take a closer look at Mega Financial Holding's potential here in our dividend report.

- Our valuation report unveils the possibility Mega Financial Holding's shares may be trading at a premium.

Next Steps

- Delve into our full catalog of 2019 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2886

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives