- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A091700

3 Prominent Asian Dividend Stocks Yielding Up To 5.2%

Reviewed by Simply Wall St

Amidst the backdrop of renewed U.S.-China trade tensions and mixed economic signals from major global markets, Asian equities have been navigating a complex landscape. Despite these challenges, certain dividend stocks in Asia continue to attract attention for their potential to provide steady income streams, making them appealing options for investors seeking stability in uncertain times.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.29% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.83% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.19% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.99% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.98% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.52% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.77% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.67% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.39% | ★★★★★★ |

Click here to see the full list of 1073 stocks from our Top Asian Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Partron (KOSDAQ:A091700)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Partron Co., Ltd. manufactures and sells electronic components in South Korea and internationally, with a market cap of approximately ₩340.34 billion.

Operations: Partron Co., Ltd.'s revenue from the Electronic Component Manufacturing Sector is approximately ₩1.38 billion.

Dividend Yield: 4.4%

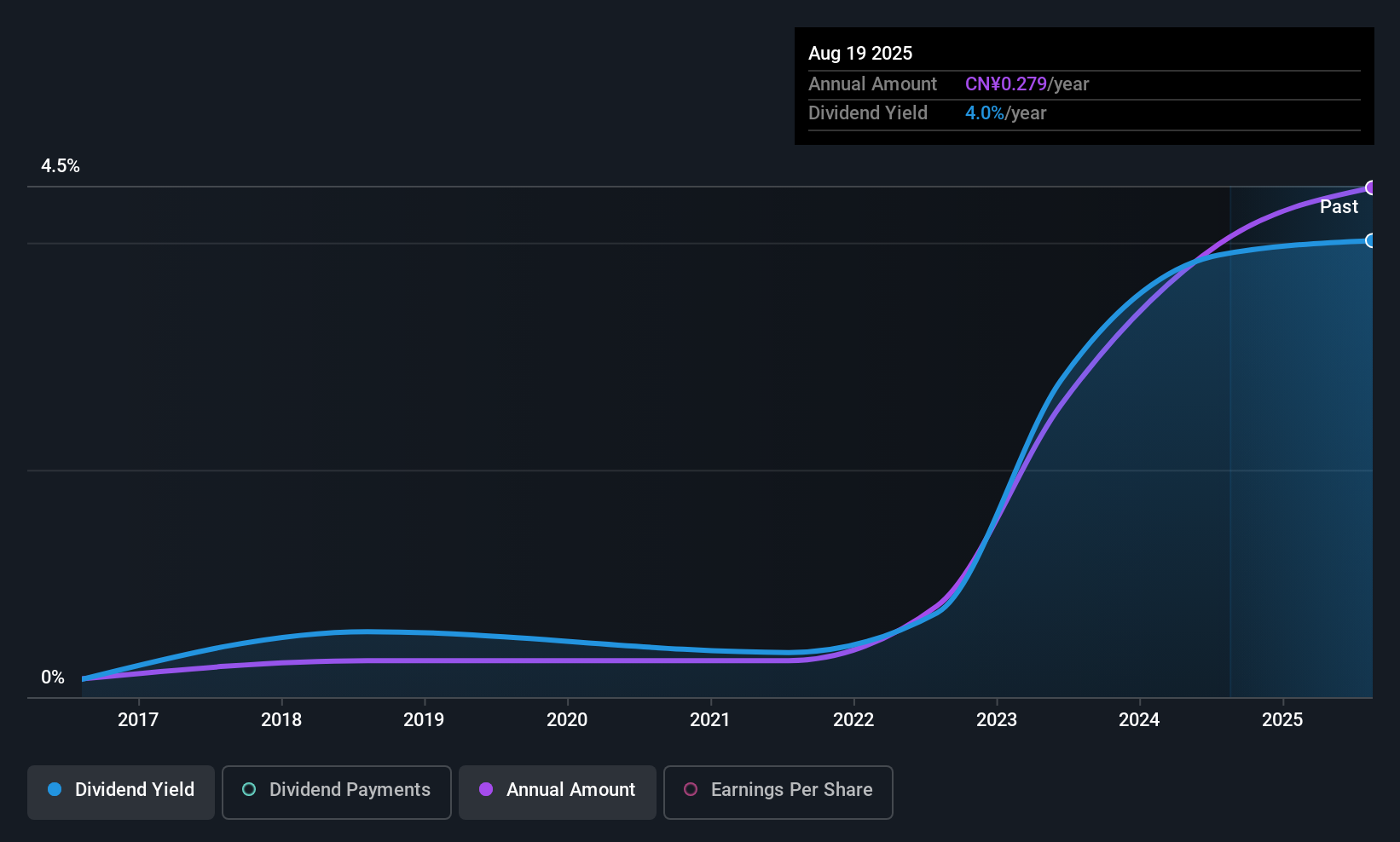

Partron's dividend yield of 4.41% ranks in the top 25% of Korean market payers, though its dividend history is marked by volatility and has been unreliable over six years. Despite this, dividends are well-covered by both earnings and cash flows with payout ratios at 53.3% and 24.2%, respectively. Recently, Partron completed a share buyback worth KRW 3.20 billion to enhance shareholder value, which may positively impact future dividend stability and stock price performance.

- Get an in-depth perspective on Partron's performance by reading our dividend report here.

- Our valuation report unveils the possibility Partron's shares may be trading at a discount.

COSCO SHIPPING Specialized CarriersLtd (SHSE:600428)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: COSCO SHIPPING Specialized Carriers Co., Ltd. (SHSE:600428) operates in the shipping industry, focusing on specialized cargo transportation, with a market cap of approximately CN¥19.15 billion.

Operations: COSCO SHIPPING Specialized Carriers Co., Ltd. generates revenue primarily from its Ocean Transportation segment, which amounted to CN¥20.08 billion.

Dividend Yield: 4%

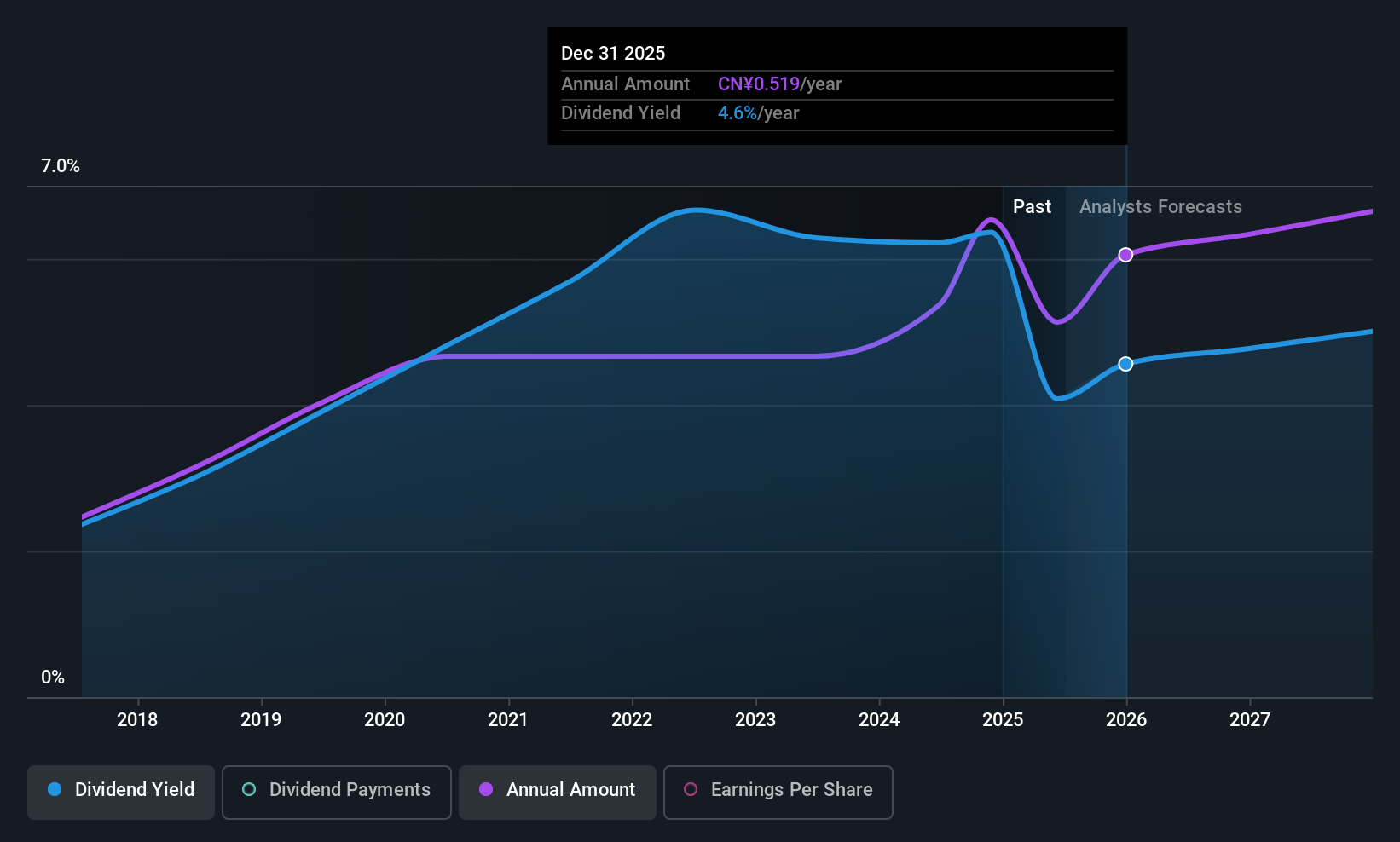

COSCO SHIPPING Specialized Carriers offers a dividend yield of 4%, placing it among the top 25% in the Chinese market. However, its dividend history is marked by volatility over the past decade. Despite this, dividends are well-covered by earnings and cash flows with low payout ratios of 39.4% and 20.6%, respectively. Recent earnings growth to CNY 824.93 million for H1 2025 suggests potential for future stability, though shareholders experienced dilution last year.

- Take a closer look at COSCO SHIPPING Specialized CarriersLtd's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of COSCO SHIPPING Specialized CarriersLtd shares in the market.

Bank of Shanghai (SHSE:601229)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Shanghai Co., Ltd. offers a range of banking products and services in China, with a market cap of CN¥134.27 billion.

Operations: Bank of Shanghai Co., Ltd. generates revenue primarily from its Wholesale Financial Operations, which account for CN¥34.47 billion, and Retail Financial Operation, contributing CN¥6.50 billion.

Dividend Yield: 5.3%

Bank of Shanghai offers a dividend yield of 5.29%, ranking it in the top 25% of Chinese dividend payers. Despite having paid dividends for only eight years, payments have been stable and show growth potential. The payout ratio is low at 32.1%, indicating strong coverage by earnings, which are forecast to grow annually by 5.09%. Recent H1 2025 results showed net income growth to CNY 13.23 billion, supporting sustainable dividend payouts moving forward.

- Click to explore a detailed breakdown of our findings in Bank of Shanghai's dividend report.

- Our expertly prepared valuation report Bank of Shanghai implies its share price may be lower than expected.

Taking Advantage

- Embark on your investment journey to our 1073 Top Asian Dividend Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A091700

Partron

Manufactures and sells electronic components South Korea and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives