- China

- /

- Infrastructure

- /

- SHSE:600368

Guangxi Wuzhou Communications Co., Ltd.'s (SHSE:600368) Share Price Is Matching Sentiment Around Its Earnings

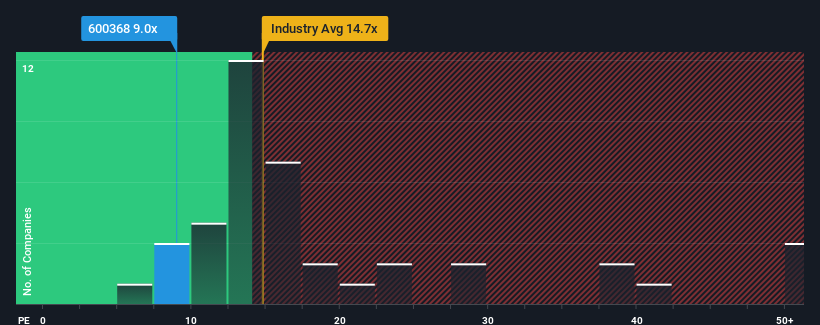

With a price-to-earnings (or "P/E") ratio of 9x Guangxi Wuzhou Communications Co., Ltd. (SHSE:600368) may be sending very bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 28x and even P/E's higher than 53x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Guangxi Wuzhou Communications has been doing a decent job lately as it's been growing earnings at a reasonable pace. It might be that many expect the respectable earnings performance to degrade, which has repressed the P/E. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

See our latest analysis for Guangxi Wuzhou Communications

Is There Any Growth For Guangxi Wuzhou Communications?

In order to justify its P/E ratio, Guangxi Wuzhou Communications would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings growth, the company posted a worthy increase of 2.5%. Still, lamentably EPS has fallen 15% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's an unpleasant look.

In light of this, it's understandable that Guangxi Wuzhou Communications' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Guangxi Wuzhou Communications revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Guangxi Wuzhou Communications (including 1 which is a bit unpleasant).

Of course, you might also be able to find a better stock than Guangxi Wuzhou Communications. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600368

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives