- China

- /

- Real Estate

- /

- SHSE:600094

Asian Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

Amidst global market fluctuations and geopolitical tensions, the Asian markets have shown a mixed performance with some regions experiencing growth, particularly in technology sectors. As investors navigate these uncertain times, penny stocks—often smaller or newer companies—remain an intriguing area of interest due to their potential for both affordability and growth. While the term "penny stocks" might seem outdated, they can still offer significant opportunities when backed by strong financials. In this article, we'll highlight several promising Asian penny stocks that stand out for their financial strength and potential long-term success.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| T.A.C. Consumer (SET:TACC) | THB4.22 | THB2.53B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.91 | HK$44.89B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.20 | HK$761.75M | ★★★★★★ |

| Activation Group Holdings (SEHK:9919) | HK$0.87 | HK$647.93M | ★★★★★★ |

| Newborn Town (SEHK:9911) | HK$4.92 | HK$6.94B | ★★★★★★ |

| Beng Kuang Marine (SGX:BEZ) | SGD0.21 | SGD41.83M | ★★★★★★ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.05 | CN¥3.53B | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.44 | SGD9.64B | ★★★★★☆ |

| Interlink Telecom (SET:ITEL) | THB1.53 | THB2.13B | ★★★★☆☆ |

| TTCL (SET:TTCL) | THB1.55 | THB954.8M | ★★★★★☆ |

Click here to see the full list of 1,162 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Xinyi Solar Holdings (SEHK:968)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xinyi Solar Holdings Limited is an investment holding company that produces and sells solar glass products across various regions including the People's Republic of China, Asia, North America, Europe, and internationally; it has a market cap of approximately HK$32.68 billion.

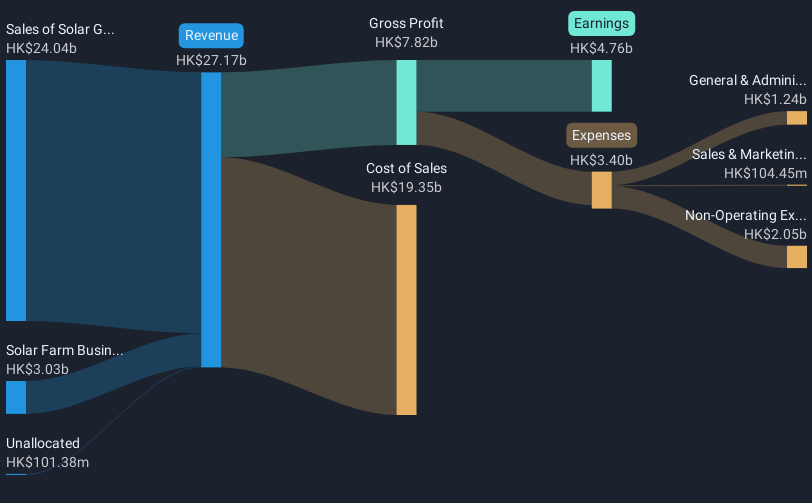

Operations: The company generates revenue primarily from the sales of solar glass, amounting to HK$24.04 billion, and its solar farm business, including EPC services, which contributes HK$3.03 billion.

Market Cap: HK$32.68B

Xinyi Solar Holdings, with a market cap of HK$32.68 billion, primarily generates revenue from solar glass sales and its solar farm business. Despite a satisfactory net debt to equity ratio of 23.9% and strong interest coverage at 16.5x EBIT, the company anticipates a significant net profit decline due to reduced demand and pricing pressures in its solar glass segment alongside impairments on production facilities. While past earnings growth has been robust, recent guidance suggests challenges ahead. The dividend yield of 6.94% is not well covered by free cash flows, highlighting potential sustainability concerns amid current market conditions.

- Navigate through the intricacies of Xinyi Solar Holdings with our comprehensive balance sheet health report here.

- Understand Xinyi Solar Holdings' earnings outlook by examining our growth report.

Greattown Holdings (SHSE:600094)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Greattown Holdings Ltd. operates in the real estate development sector in China and has a market capitalization of CN¥8.34 billion.

Operations: The company generates revenue of CN¥5.28 billion from its operations in China.

Market Cap: CN¥8.34B

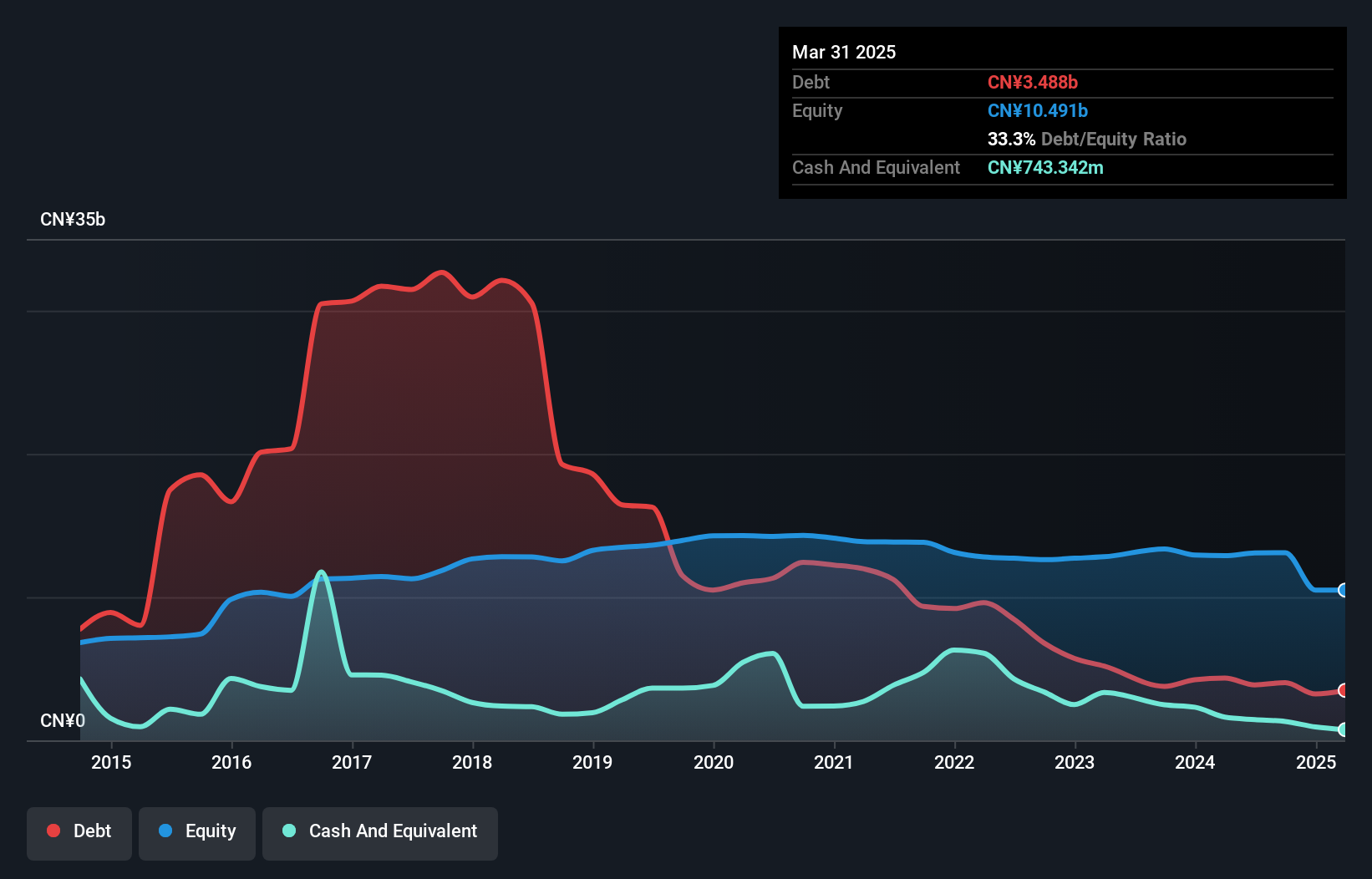

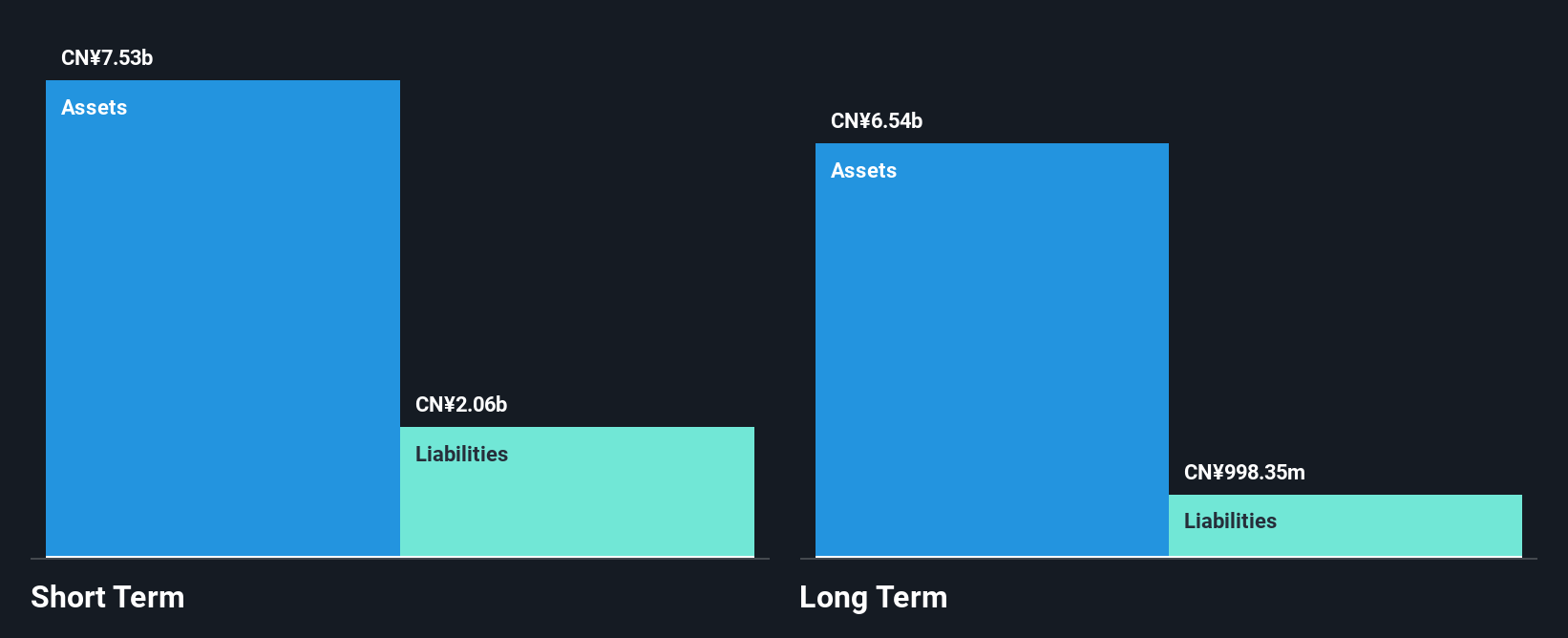

Greattown Holdings, with a market cap of CN¥8.34 billion, faces challenges in profitability despite having short-term assets of CN¥14.8 billion that exceed both its short and long-term liabilities. The company's net debt to equity ratio is satisfactory at 20.7%, and interest payments are well-covered by EBIT at 3.2x, yet it remains unprofitable with losses increasing by 31% annually over five years. The board and management teams are experienced, but the dividend track record is unstable, and operating cash flow covers only 8.5% of debt obligations, indicating potential financial constraints moving forward.

- Click here to discover the nuances of Greattown Holdings with our detailed analytical financial health report.

- Explore historical data to track Greattown Holdings' performance over time in our past results report.

Antong Holdings (SHSE:600179)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Antong Holdings Co., Ltd. operates in the container shipping and transport logistics sector in China, with a market capitalization of approximately CN¥11.93 billion.

Operations: Antong Holdings Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥11.93B

Antong Holdings, with a market cap of CN¥11.93 billion, demonstrates financial resilience by having more cash than total debt and well-covered operating cash flow. However, it faces challenges as its return on equity is low at 3.2%, and recent earnings growth has been negative at -69.5%. The company's profit margins have declined to 4.6% from last year's 13.8%, partly due to a large one-off gain of CN¥261.2 million impacting results. Despite these hurdles, Antong's short-term assets significantly exceed both short-term and long-term liabilities, offering some financial stability amidst volatility in the shipping sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Antong Holdings.

- Gain insights into Antong Holdings' past trends and performance with our report on the company's historical track record.

Where To Now?

- Reveal the 1,162 hidden gems among our Asian Penny Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600094

Greattown Holdings

Engages in the real estate development business in China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives