- China

- /

- Infrastructure

- /

- SHSE:600004

Guangzhou Baiyun International Airport Company Limited's (SHSE:600004) Subdued P/S Might Signal An Opportunity

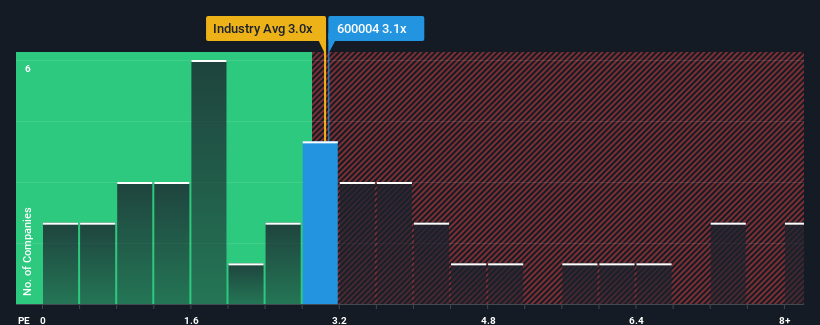

There wouldn't be many who think Guangzhou Baiyun International Airport Company Limited's (SHSE:600004) price-to-sales (or "P/S") ratio of 3.1x is worth a mention when the median P/S for the Infrastructure industry in China is similar at about 3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Guangzhou Baiyun International Airport

How Has Guangzhou Baiyun International Airport Performed Recently?

With revenue growth that's superior to most other companies of late, Guangzhou Baiyun International Airport has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guangzhou Baiyun International Airport.Is There Some Revenue Growth Forecasted For Guangzhou Baiyun International Airport?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Guangzhou Baiyun International Airport's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 35%. Pleasingly, revenue has also lifted 40% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 13% during the coming year according to the analysts following the company. With the industry only predicted to deliver 6.9%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Guangzhou Baiyun International Airport's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Looking at Guangzhou Baiyun International Airport's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Guangzhou Baiyun International Airport that you should be aware of.

If you're unsure about the strength of Guangzhou Baiyun International Airport's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600004

Guangzhou Baiyun International Airport

Manages and operates Guangzhou Baiyun International Airport in China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives