- China

- /

- Communications

- /

- SZSE:301600

Undiscovered Gems In Global Featuring 3 Promising Small Caps With Strong Foundations

Reviewed by Simply Wall St

In recent weeks, global markets have experienced mixed performances with smaller-cap indexes like the S&P MidCap 400 and Russell 2000 showing resilience, even as broader indices faced challenges due to trade uncertainties and economic policy signals. In this environment of volatility and opportunity, identifying stocks with strong foundations becomes crucial; these are companies that possess robust business models, sound financial health, and the potential for growth despite broader market headwinds.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Amir Marketing and Investments in Agriculture | 34.26% | 5.82% | 3.78% | ★★★★★★ |

| Mendelson Infrastructures & Industries | 25.31% | 6.39% | 13.45% | ★★★★★★ |

| Natural Food International Holding | NA | 5.61% | 32.98% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | 0.57% | 18.65% | ★★★★★★ |

| Shanghai Pioneer Holding | 5.59% | 4.81% | 18.86% | ★★★★★☆ |

| Malam - Team | 91.23% | 12.11% | -6.38% | ★★★★★☆ |

| Y.D. More Investments | 72.96% | 29.63% | 29.48% | ★★★★★☆ |

| Fengyinhe Holdings | 0.60% | 38.63% | 65.41% | ★★★★☆☆ |

| C. Mer Industries | 114.92% | 13.32% | 73.44% | ★★★★☆☆ |

| Polyram Plastic Industries | 41.71% | 10.42% | 9.94% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Suzhou Shihua New Material Technology (SHSE:688093)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Shihua New Material Technology Co., Ltd. specializes in the development and production of advanced materials, with a market cap of CN¥5.55 billion.

Operations: Suzhou Shihua generates revenue primarily from High Performance Optical Materials and Electronic Composite Functional Materials, with the latter contributing CN¥575.09 million. The company's gross profit margin is a key financial metric to consider, reflecting its ability to manage production costs relative to sales.

Suzhou Shihua New Material Technology seems to be making waves in the industry, with earnings growth of 44.6% over the past year, outpacing its sector's -3.3%. The company remains debt-free, a significant improvement from five years ago when its debt to equity ratio was 13.2%. Trading at about 56% below estimated fair value suggests potential upside for investors. Recent results show a robust performance with Q1 sales hitting CNY 255.66 million and net income reaching CNY 87.16 million, both significantly higher than last year's figures of CNY 133.13 million and CNY 41.26 million respectively, indicating strong operational momentum.

Jiangsu Cai Qin Technology (SHSE:688182)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Cai Qin Technology Co., Ltd specializes in the research, development, production, and sale of microwave dielectric ceramic components both domestically and internationally, with a market cap of CN¥9.05 billion.

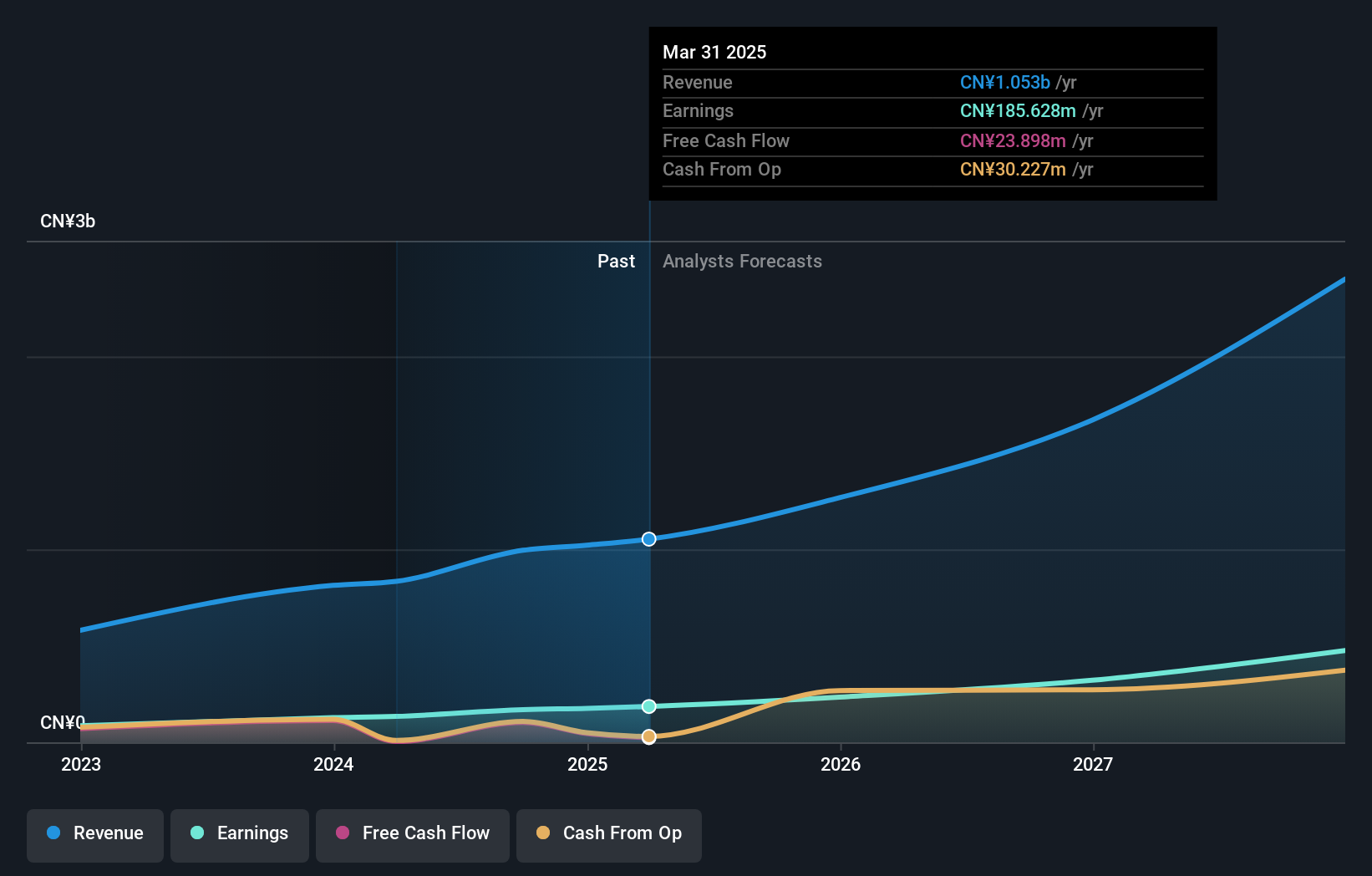

Operations: Jiangsu Cai Qin Technology generates revenue primarily through the sale of microwave dielectric ceramic components. The company's financial performance is marked by a net profit margin of 15.3%, reflecting its ability to manage costs effectively while generating income from its core business activities.

In the bustling world of tech, Jiangsu Cai Qin Technology stands out with its impressive earnings growth of 28.9% over the past year, outpacing the electronic industry’s average of 5.8%. Despite a volatile share price recently, this small player reported a solid CNY 125.08 million in sales for Q1 2025, up from CNY 81.61 million last year. Net income also saw an uptick to CNY 22.66 million from last year's CNY 14.57 million, reflecting strong operational performance and potential for further revenue growth at an anticipated rate of approximately 29.62% per year.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Value Rating: ★★★★★★

Overview: Flaircomm Microelectronics, Inc. specializes in the development and sale of wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China with a market capitalization of CN¥10.81 billion.

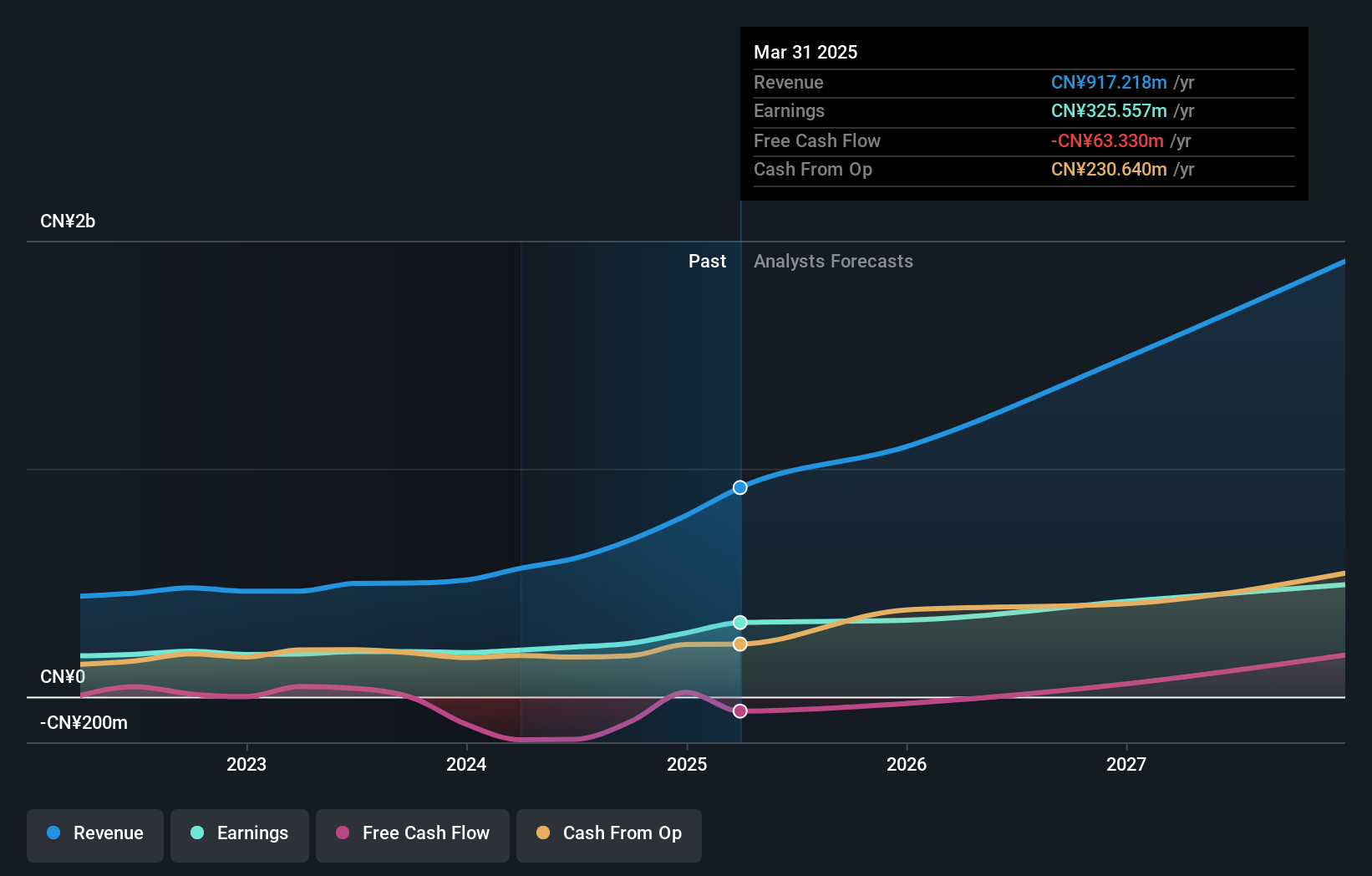

Operations: Flaircomm generates revenue primarily from its wireless communications equipment segment, amounting to CN¥995.17 million. The company's financial performance is highlighted by a notable gross profit margin trend that warrants attention for potential investors.

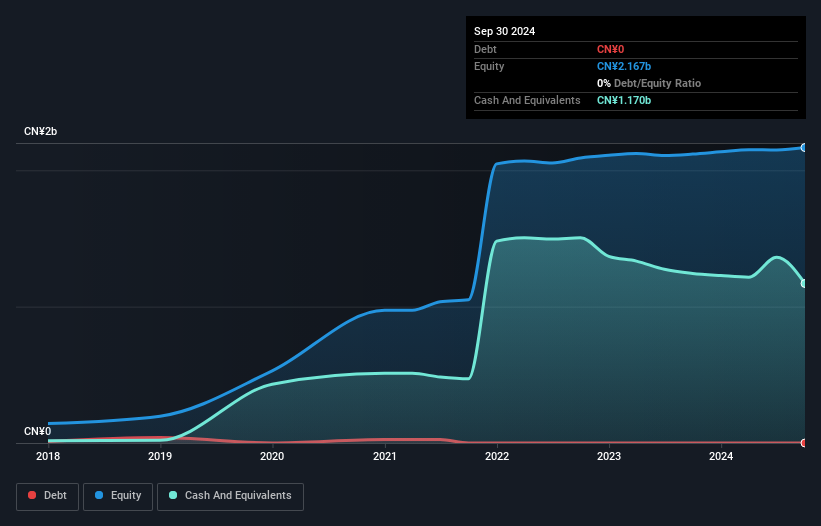

Flaircomm Microelectronics stands out with its impressive earnings growth of 44.7% over the past year, significantly outpacing the Communications industry's -5.5%. This company is debt-free now, a notable improvement from five years ago when its debt to equity ratio was 4.2%. With a levered free cash flow of US$102.59 million as of April 2025 and consistently high levels of non-cash earnings, Flaircomm shows financial robustness. Recently added to the S&P Global BMI Index, it seems poised for continued recognition in the market despite recent share price volatility over three months.

- Click here and access our complete health analysis report to understand the dynamics of Flaircomm Microelectronics.

Gain insights into Flaircomm Microelectronics' past trends and performance with our Past report.

Next Steps

- Explore the 3242 names from our Global Undiscovered Gems With Strong Fundamentals screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Flaircomm Microelectronics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301600

Flaircomm Microelectronics

Develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives