- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:8046

High Growth Tech Stocks In Asia To Watch In May 2025

Reviewed by Simply Wall St

As global markets react positively to the recent U.S.-China tariff suspension, Asian tech stocks are drawing increased attention, buoyed by a broader rally in equities and improved trade outlooks. In this dynamic environment, identifying high-growth tech stocks involves considering factors such as innovation potential, market adaptability, and resilience to economic fluctuations.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 29.38% | 30.19% | ★★★★★★ |

| Fositek | 26.71% | 33.90% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.98% | 29.01% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.10% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| ALTEOGEN | 54.92% | 71.24% | ★★★★★★ |

| PharmaResearch | 25.33% | 28.36% | ★★★★★★ |

| giftee | 21.53% | 63.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| RemeGen | 22.70% | 64.67% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

China Ruyi Holdings (SEHK:136)

Simply Wall St Growth Rating: ★★★★★☆

Overview: China Ruyi Holdings Limited is an investment holding company involved in content production and online streaming, operating in the People's Republic of China, Hong Kong, Europe, and internationally, with a market capitalization of HK$31.97 billion.

Operations: The company generates revenue primarily through its online streaming and online gaming businesses, which contribute CN¥3.51 billion, and content production business, adding CN¥127.04 million.

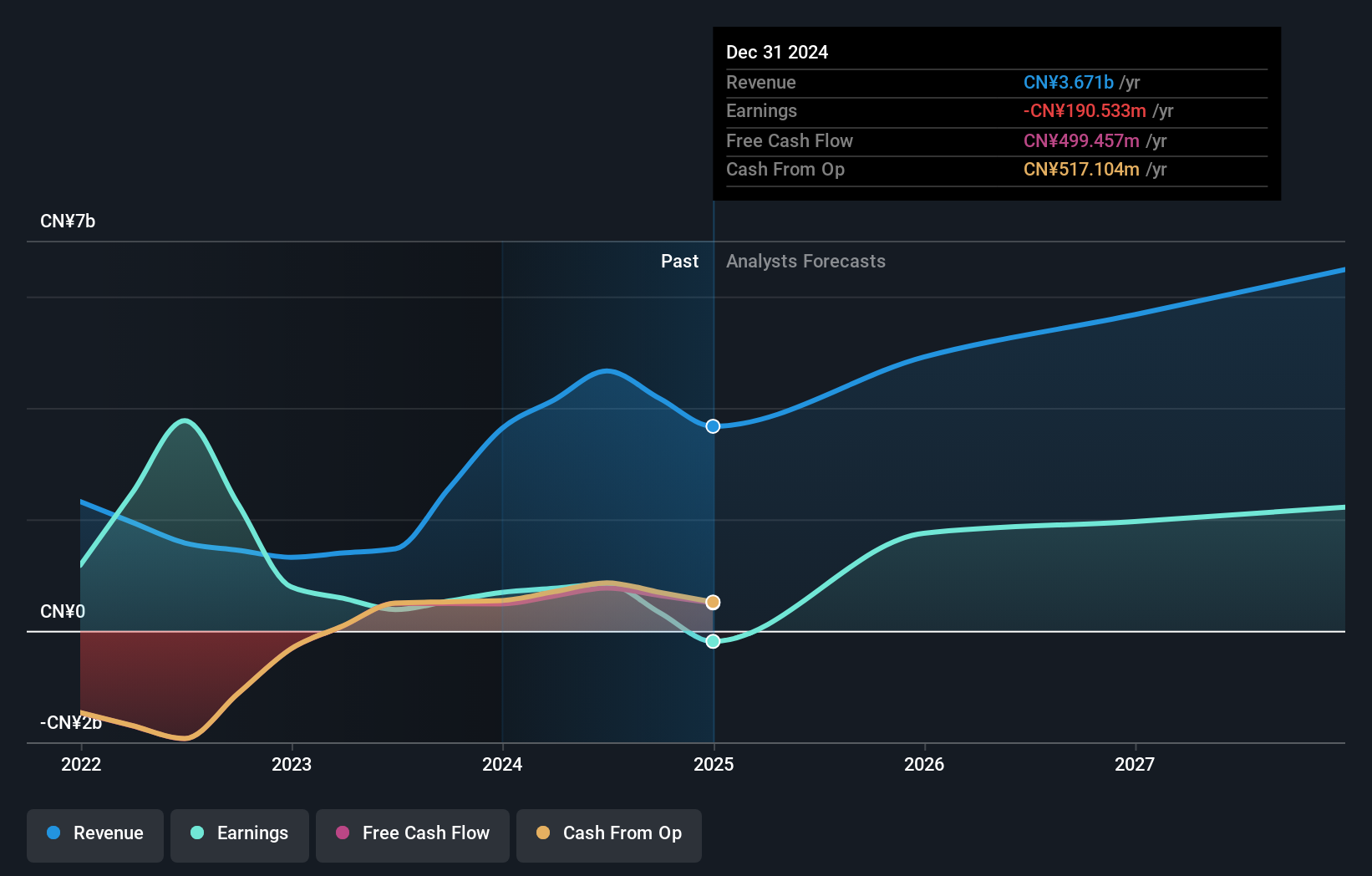

Despite recent financial turbulence, China Ruyi Holdings shows promise with an expected revenue growth rate of 27.4% annually, outpacing the Hong Kong market average of 8.4%. The company's strategic moves, including a substantial fixed-income offering and private placements aimed at raising up to $500 million, underscore its aggressive capital management strategy to fuel growth. Moreover, its pivot towards innovative sectors is evident from its recent acquisitions and investments in entertainment technologies. While currently unprofitable with a significant net loss reported in the latest fiscal year, Ruyi is forecasted to swing to profitability within three years, supported by an impressive projected annual earnings growth rate of 87.9%. This potential turnaround is critical as it aligns with broader industry trends where tech firms are increasingly leveraging digital transformation strategies to enhance their market position.

- Navigate through the intricacies of China Ruyi Holdings with our comprehensive health report here.

Examine China Ruyi Holdings' past performance report to understand how it has performed in the past.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Flaircomm Microelectronics, Inc. specializes in developing and selling wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China, with a market cap of CN¥11.82 billion.

Operations: Flaircomm generates revenue primarily from the sale of wireless communications equipment, which totaled CN¥1.05 billion. The company focuses on providing solutions for automotive and M2M applications within China.

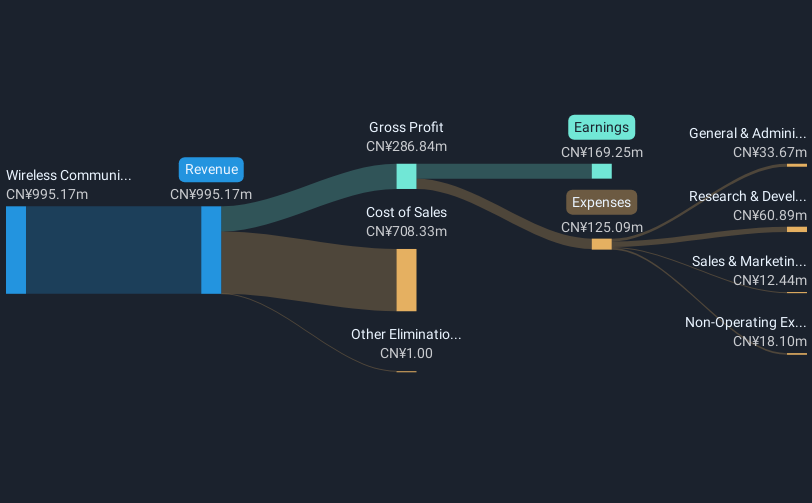

Flaircomm Microelectronics has shown robust financial performance, with a notable increase in annual revenue by 30.4% and earnings growth of 34.4%. This surge is underpinned by significant R&D investments, accounting for approximately 15% of its total revenue, reflecting the company's commitment to innovation and maintaining a competitive edge in the tech sector. Recent strategic activities include dividend affirmations and amendments to company bylaws, signaling stable governance amidst expansion efforts. With recent inclusion in the S&P Global BMI Index and consistent financial improvements, Flaircomm is positioned as an influential entity within Asia’s tech landscape, potentially shaping future industry standards through technological advancements.

Nan Ya Printed Circuit Board (TWSE:8046)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nan Ya Printed Circuit Board Corporation is a company that produces and distributes printed circuit boards across Taiwan, the United States, Mainland China, Korea, and other international markets with a market capitalization of NT$67.85 billion.

Operations: The company focuses on the production and sale of printed circuit boards (PCBs) across multiple regions, including Taiwan, the United States, Mainland China, and Korea. With a market capitalization of NT$67.85 billion, it serves a diverse international market.

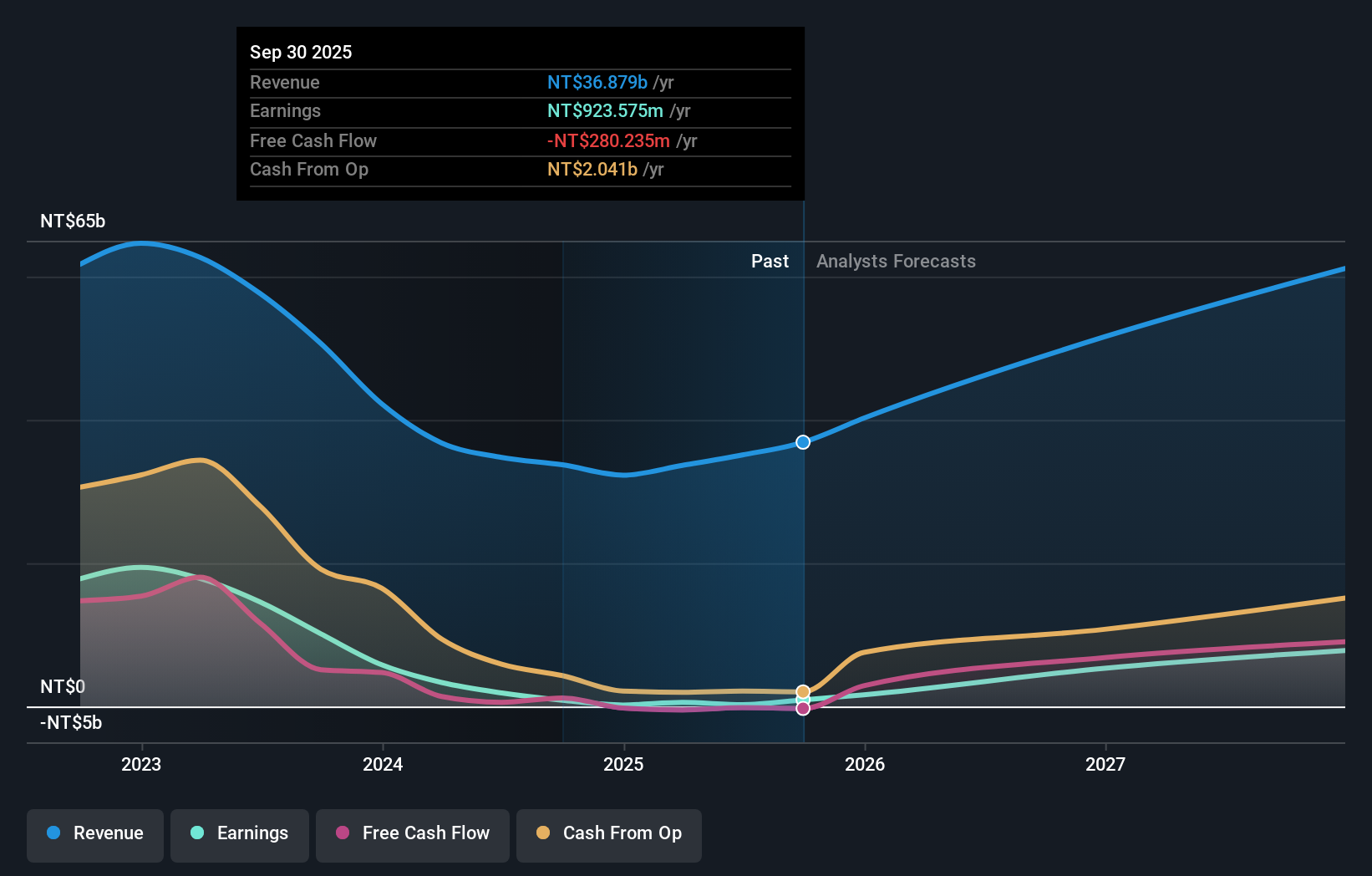

Nan Ya Printed Circuit Board's recent turnaround from a net loss to a profit in Q1 2025, with earnings per share improving from TWD -0.24 to TWD 0.32, signals a positive shift. This recovery is underscored by a significant sales increase from TWD 7.1 billion to TWD 8.46 billion year-over-year. Despite this progress and an expected annual profit growth of 56.6%, challenges remain, such as the company's highly volatile share price and a lower than industry average net profit margin of 1.7%. These financial dynamics illustrate both the resilience and the areas for improvement as Nan Ya aims to stabilize its position in the competitive tech sector of Asia.

- Take a closer look at Nan Ya Printed Circuit Board's potential here in our health report.

Learn about Nan Ya Printed Circuit Board's historical performance.

Taking Advantage

- Click this link to deep-dive into the 488 companies within our Asian High Growth Tech and AI Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Nan Ya Printed Circuit Board, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nan Ya Printed Circuit Board might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8046

Nan Ya Printed Circuit Board

Manufactures and sells printed circuit boards (PCBs) in Taiwan, the United States, Mainland China, Korea, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives