- China

- /

- Communications

- /

- SZSE:301600

Global Growth Companies With High Insider Ownership That Insiders Favor

Reviewed by Simply Wall St

In a week where global markets showed muted reactions to new U.S. tariffs, the Nasdaq Composite Index stood out by holding up best among major U.S. indexes, highlighting the resilience of growth stocks in uncertain times. Amid these conditions, companies with high insider ownership often attract attention as they can signal confidence from those closest to the business, making them intriguing options for investors seeking long-term growth potential amidst fluctuating market dynamics.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.6% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Pharma Mar (BME:PHM) | 11.8% | 44.9% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 42.3% |

| KebNi (OM:KEBNI B) | 38.3% | 94.5% |

| Fulin Precision (SZSE:300432) | 13.6% | 43.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| Circus (XTRA:CA1) | 24.7% | 94.8% |

Let's dive into some prime choices out of the screener.

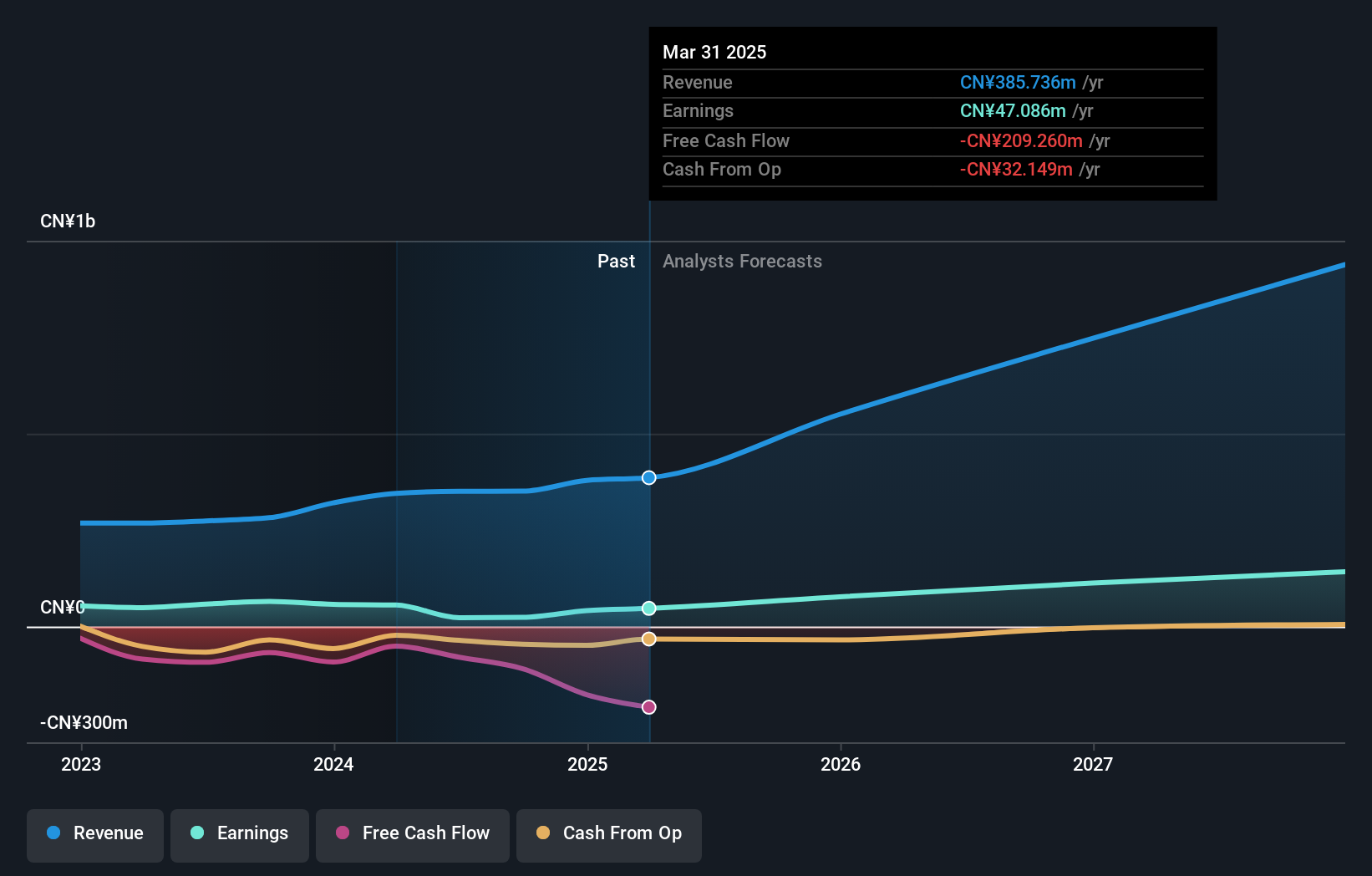

Shanghai Suochen Information TechnologyLtd (SHSE:688507)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Suochen Information Technology Ltd (SHSE:688507) operates in the technology sector, focusing on information technology services, with a market cap of CN¥6.90 billion.

Operations: Shanghai Suochen Information Technology Ltd's revenue segments are currently not specified in the provided text.

Insider Ownership: 26.9%

Shanghai Suochen Information Technology Ltd. is poised for strong growth, with revenue expected to increase by 30.6% annually, outpacing the Chinese market's 12.5%. Despite a net loss of CNY 15.63 million in Q1 2025, this marks an improvement from the previous year. Earnings are forecast to grow significantly at 36.57% per year over the next three years, although insider buying has not been substantial recently and share price volatility remains high.

- Click here to discover the nuances of Shanghai Suochen Information TechnologyLtd with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Shanghai Suochen Information TechnologyLtd is priced higher than what may be justified by its financials.

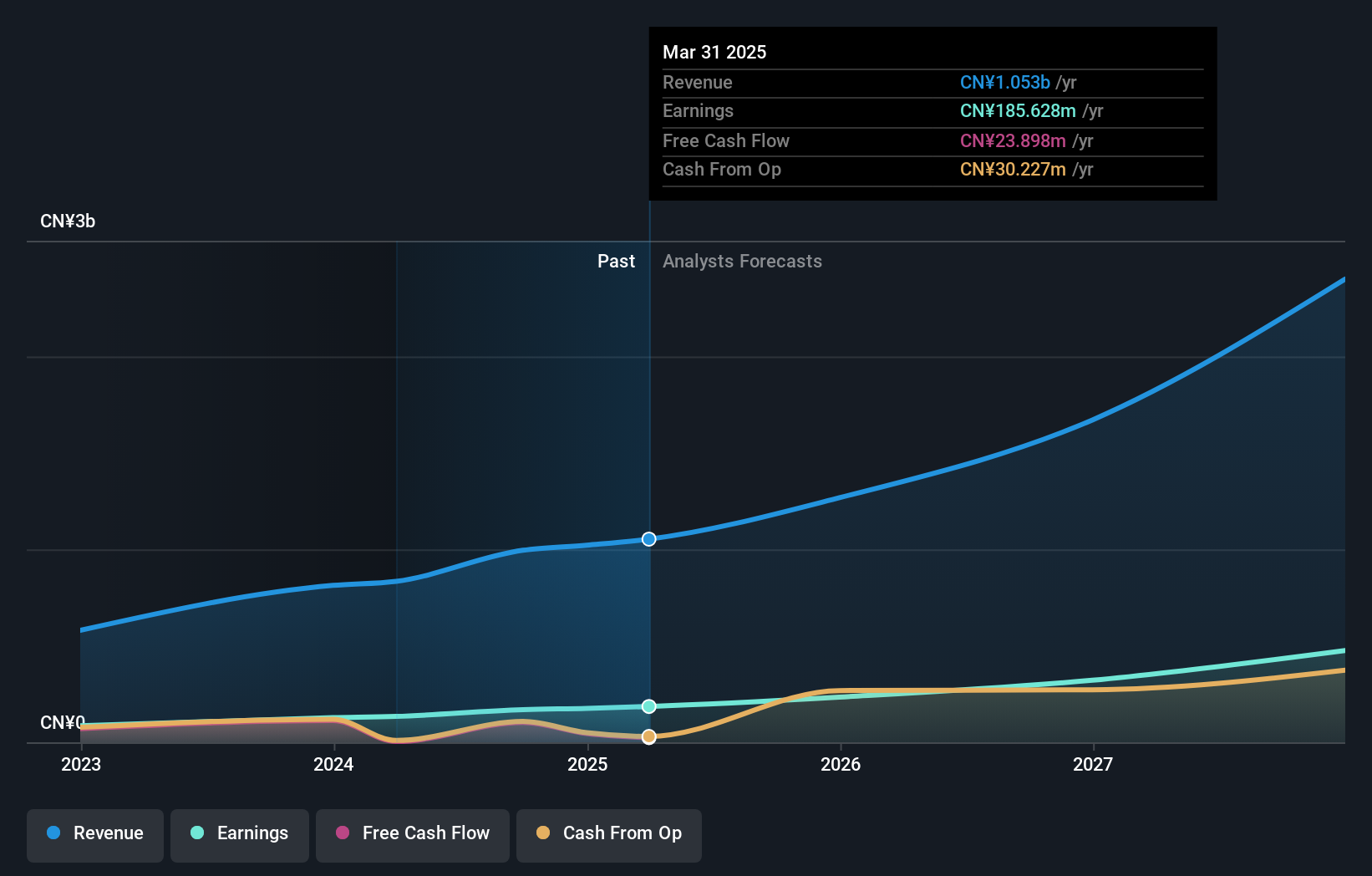

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Flaircomm Microelectronics, Inc. develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China with a market cap of CN¥10.45 billion.

Operations: The company's revenue is primarily derived from its wireless communications equipment segment, totaling CN¥1.05 billion.

Insider Ownership: 35.5%

Flaircomm Microelectronics is positioned for robust growth, with revenue expected to grow at 30.4% annually, surpassing the Chinese market's 12.5%. Recent earnings showed a solid increase, with net income rising from CNY 127.58 million to CNY 175.47 million year-over-year. Despite a high P/E ratio of 59.7x, it remains below the industry average of 72.4x, suggesting potential value in its sector amidst no significant recent insider trading activity or substantial dividend coverage by free cash flow.

- Click to explore a detailed breakdown of our findings in Flaircomm Microelectronics' earnings growth report.

- Our expertly prepared valuation report Flaircomm Microelectronics implies its share price may be too high.

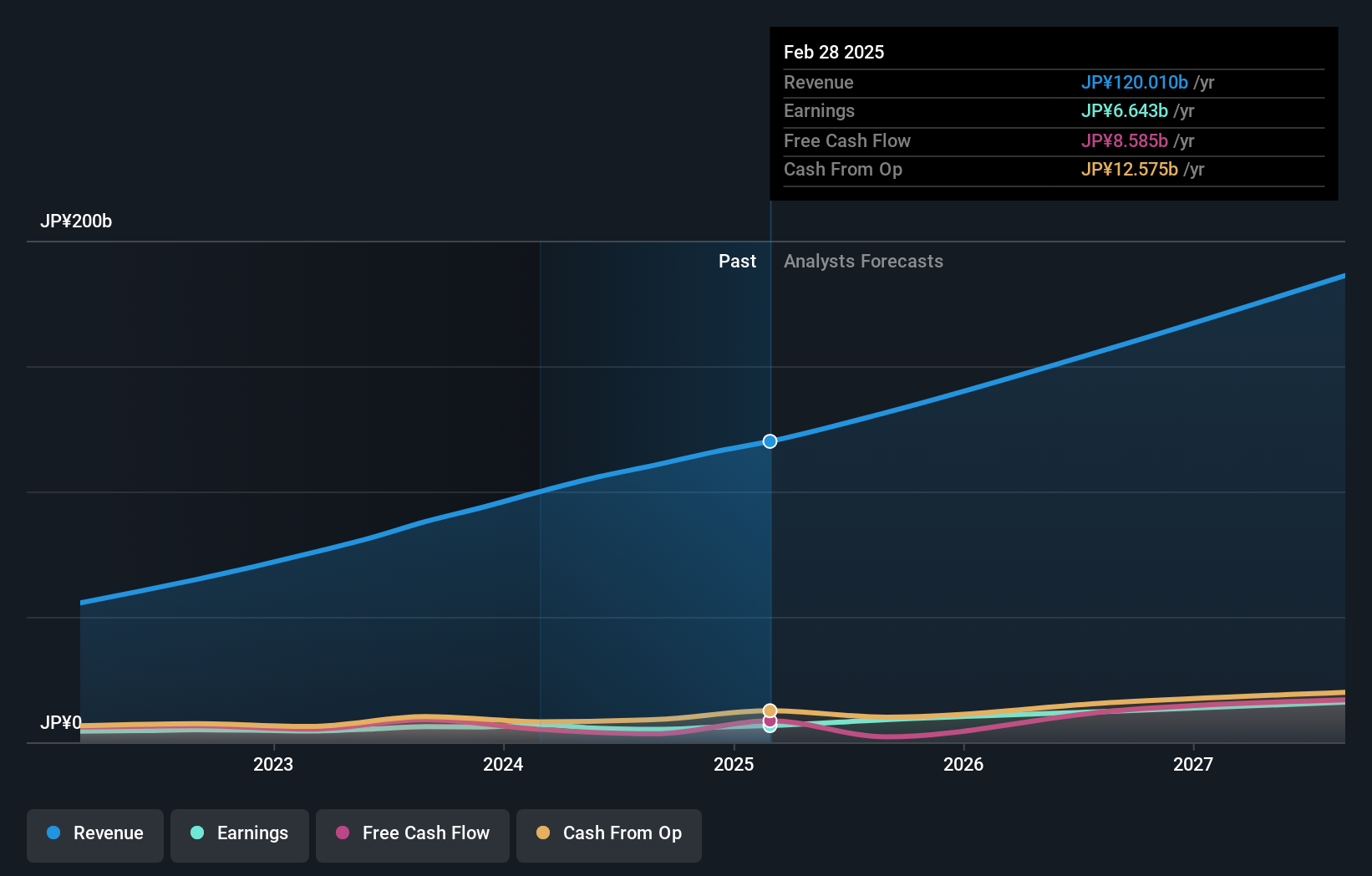

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SHIFT Inc. offers software quality assurance and testing solutions in Japan, with a market cap of ¥428.10 billion.

Operations: SHIFT Inc.'s revenue is primarily derived from Software Testing Related Services, which contribute ¥80.79 billion, and Software Development Related Services, accounting for ¥39.11 billion.

Insider Ownership: 32.9%

SHIFT is experiencing robust growth, with earnings projected to rise 33.07% annually, outpacing the Japanese market's 7.7%. The company recently raised its financial forecast for fiscal year ending August 2025, anticipating net sales of ¥130 billion and operating profit of ¥15 billion. Despite a volatile share price recently, SHIFT's return on equity is expected to reach a high level in three years. There has been no significant insider trading activity reported in the last three months.

- Click here and access our complete growth analysis report to understand the dynamics of SHIFT.

- Our valuation report here indicates SHIFT may be overvalued.

Make It Happen

- Click this link to deep-dive into the 812 companies within our Fast Growing Global Companies With High Insider Ownership screener.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301600

Flaircomm Microelectronics

Develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives