- China

- /

- Communications

- /

- SZSE:301600

Flaircomm Microelectronics, Inc. (SZSE:301600) Stock Rockets 45% As Investors Are Less Pessimistic Than Expected

Flaircomm Microelectronics, Inc. (SZSE:301600) shareholders would be excited to see that the share price has had a great month, posting a 45% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

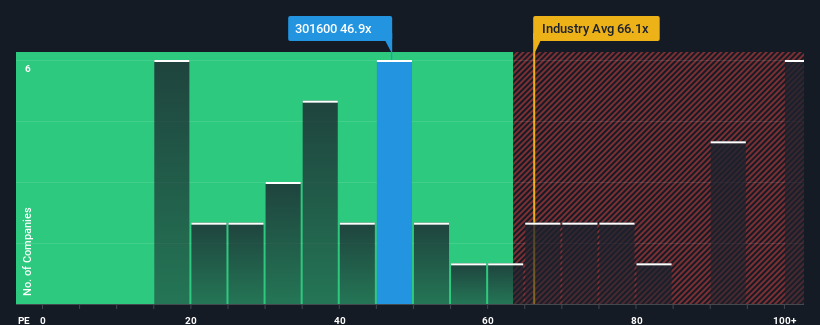

Following the firm bounce in price, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 36x, you may consider Flaircomm Microelectronics as a stock to potentially avoid with its 46.9x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Flaircomm Microelectronics has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Flaircomm Microelectronics

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Flaircomm Microelectronics' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 45%. The strong recent performance means it was also able to grow EPS by 104% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 6.3% as estimated by the one analyst watching the company. With the market predicted to deliver 39% growth , the company is positioned for a weaker earnings result.

With this information, we find it concerning that Flaircomm Microelectronics is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Flaircomm Microelectronics' P/E

Flaircomm Microelectronics shares have received a push in the right direction, but its P/E is elevated too. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Flaircomm Microelectronics currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Flaircomm Microelectronics that you should be aware of.

You might be able to find a better investment than Flaircomm Microelectronics. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301600

Flaircomm Microelectronics

Develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China.

Exceptional growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026