- China

- /

- Communications

- /

- SZSE:301600

Asian Growth Companies With High Insider Ownership In September 2025

Reviewed by Simply Wall St

As global markets navigate through interest rate expectations and technological advancements, Asian stock markets are experiencing a period of optimism, bolstered by ample liquidity and investor enthusiasm for domestic tech sectors. In this environment, companies with strong growth potential and high insider ownership often stand out as attractive investments, as they typically signal confidence from those closest to the business in its future prospects.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Tongguan Gold Group (SEHK:340) | 30.1% | 29.5% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.6% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| M31 Technology (TPEX:6643) | 30.7% | 96.8% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

We're going to check out a few of the best picks from our screener tool.

Zhejiang XCC GroupLtd (SHSE:603667)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang XCC Group Co., Ltd specializes in the research, development, manufacture, and sale of bearings globally, with a market cap of CN¥15.97 billion.

Operations: The company generates revenue from the research, development, manufacture, and sale of bearings across markets including the United States, Japan, Korea, Brazil, and other international regions.

Insider Ownership: 31.9%

Revenue Growth Forecast: 15.1% p.a.

Zhejiang XCC Group Ltd. is experiencing significant earnings growth, forecasted at 47.8% annually, surpassing the Chinese market average of 26.5%. Despite a decline in profit margins from last year and large one-off items affecting results, revenue increased to CNY 1.89 billion for H1 2025 from CNY 1.75 billion a year ago. A recent private placement raised CNY 1 billion, signaling confidence but no substantial insider trading activity was noted recently.

- Get an in-depth perspective on Zhejiang XCC GroupLtd's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Zhejiang XCC GroupLtd shares in the market.

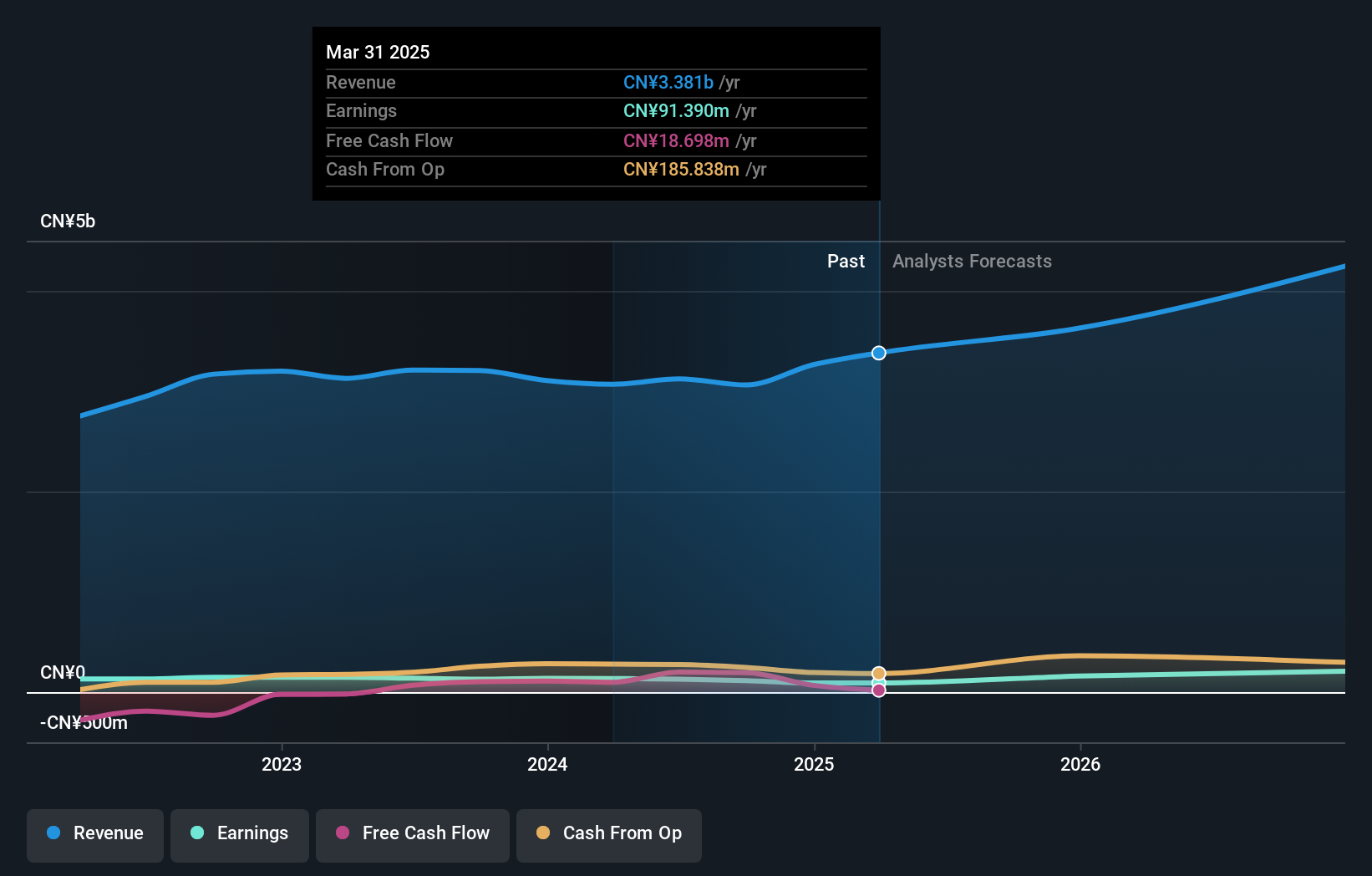

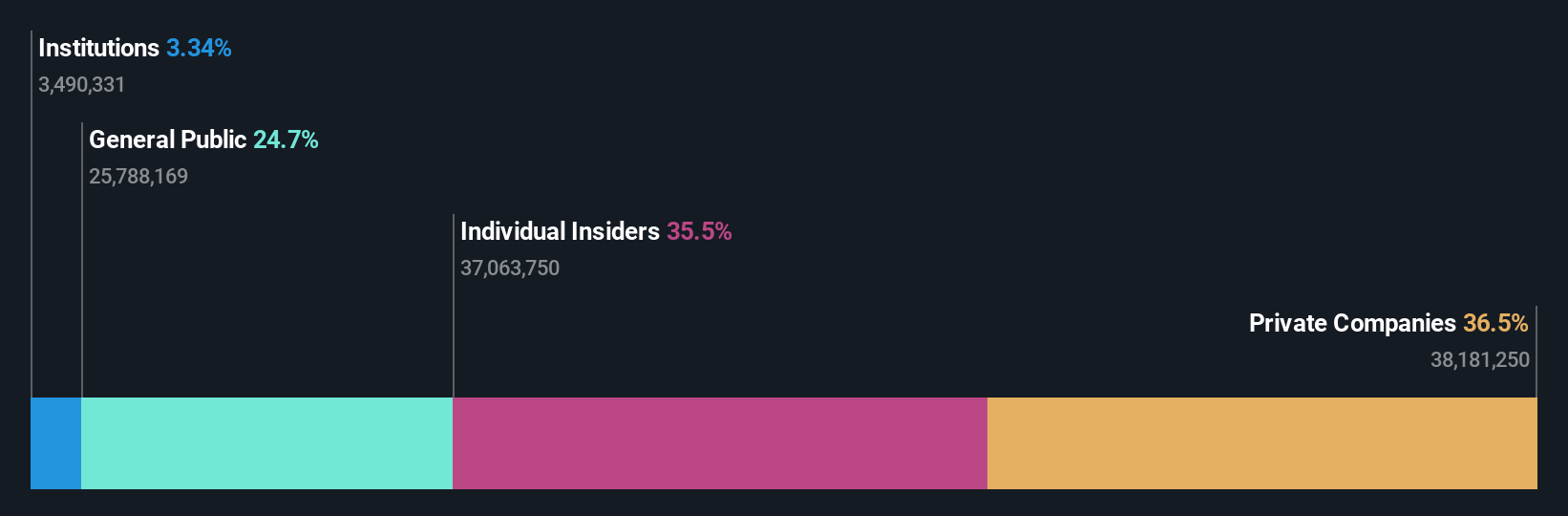

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Growth Rating: ★★★★★★

Overview: Flaircomm Microelectronics, Inc. develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China with a market cap of CN¥14.40 billion.

Operations: The company generates revenue of CN¥1.04 billion from its wireless communications equipment segment.

Insider Ownership: 35.5%

Revenue Growth Forecast: 33.3% p.a.

Flaircomm Microelectronics is experiencing robust growth, with earnings rising 25.6% over the past year and revenue expected to grow at 33.3% annually, outpacing the Chinese market's 13.9%. Despite a volatile share price recently, its Price-To-Earnings ratio of 73.9x remains below industry average. Recent earnings showed sales increasing to CNY 450.65 million for H1 2025 from CNY 429.85 million last year, with net income climbing to CNY 93.83 million from CNY 74.27 million previously reported.

- Click here and access our complete growth analysis report to understand the dynamics of Flaircomm Microelectronics.

- Our valuation report unveils the possibility Flaircomm Microelectronics' shares may be trading at a premium.

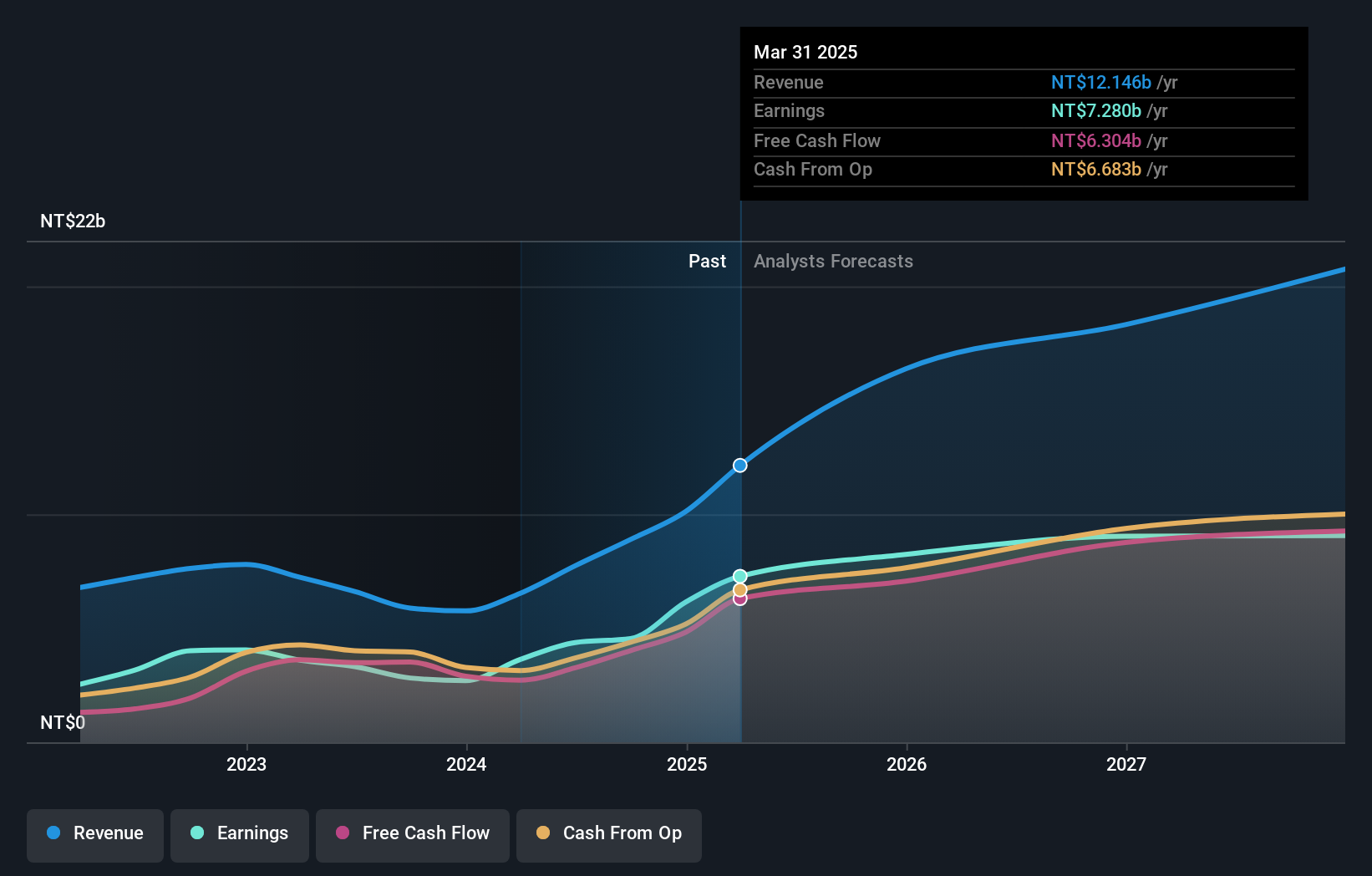

King Slide Works (TWSE:2059)

Simply Wall St Growth Rating: ★★★★★★

Overview: King Slide Works Co., Ltd. designs, manufactures, and sells rail kits for computer and network communications equipment, furniture wooden kitchen accessories, slides, and molds across Taiwan, the United States, China, and internationally with a market cap of NT$326.87 billion.

Operations: King Slide Works generates revenue from its primary segments, with NT$2.09 billion attributed to King Slide Works Co., Ltd. and NT$12.22 billion from King Slide Technology Co., Ltd.

Insider Ownership: 14.3%

Revenue Growth Forecast: 22.5% p.a.

King Slide Works is seeing significant growth, with earnings projected to increase 32.13% annually, surpassing the Taiwan market's 16.9%. Revenue is also expected to grow at a robust 22.5% per year. Despite recent quarterly sales rising to TWD 4.23 billion from TWD 2.52 billion, net income fell to TWD 614.1 million from TWD 1.46 billion year-on-year due to increased costs or other factors impacting profitability in the short term.

- Click here to discover the nuances of King Slide Works with our detailed analytical future growth report.

- The valuation report we've compiled suggests that King Slide Works' current price could be inflated.

Summing It All Up

- Get an in-depth perspective on all 619 Fast Growing Asian Companies With High Insider Ownership by using our screener here.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301600

Flaircomm Microelectronics

Develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.